2 min read

Significant Changes Coming to Global Fuel & Oil Markets

As the energy markets continue to evolve, NYMEX and ICE continue to introduce new contracts to accommodate the changing marketplace. As such, we...

On September 16th, Platts announced that is going to "Amend the date range reflected in the Dated Brent assessment to 10-25 days forward, instead of the current 10-21 days forward. The change will take effect on January 6, 2012. At the same time, Platts will only consider in its assessment of cash Brent those crudes where the cargoes are nominated 25 days in advance of loading, instead of the current 21 days." The official announcement from Platts is available via this link.

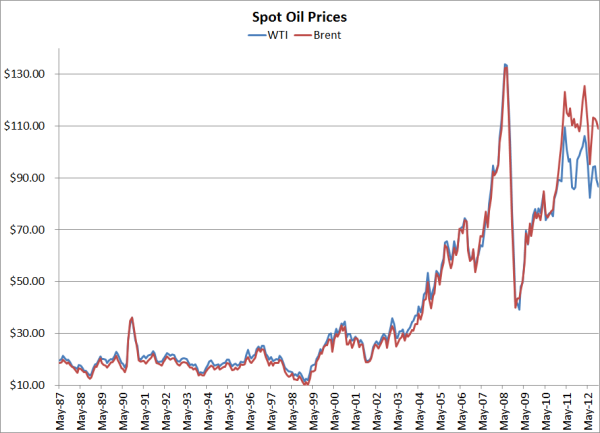

To provide a layman's explanation as to why Platts is making this change, the major "Brent" oil fields (Brent, Forties, Ekofisk and Oseberg) have experienced significant declines in production in recent years, from 1.6 million barrels per day in 2006 to approximately 875,000 barrels per day in August. As a result, there is concern that the "cash" Brent market, based on Platts' current pricing methodology, could be vulnerable to price spikes, short squeezes, etc. Many will argue that simply changing the data range isn't enough and we agree. In fact, we would argue that in addition to changing the date range, Platts should increase the number of "grades" which are deliverable as "Brent," the combination of which would increase liquidity.

Clearly, Platts' new pricing methodology is going to cause problems for some market participants with respect to hedging and many are none too pleased with the short transition timeline. As Shell, the "custodian" of the SUKO90 contract which dictates trades in physical "Brent" crude oil, stated shortly after the announcement from Platts, "We maintain the January 2012 timing announced by Platts today is likely to cause issues with the futures market and its derivatives such as swaps and options transactions which could have been avoided if a 2013 implementation date were adopted. Nonetheless, we believe the Brent market will continue to function and will find ways to overcome this short term difficulty."

According to several sources, one short term "solution" being considered by ICE is the listing of a new Brent futures contract which would reflect Platts' new methodology and would trade in parallel to the current Brent futures contract. The new contract would allow traders to accurately hedge their exposure to the physical market while the market transitions from the "current" Brent futures contract to the new Brent futures contract.

On the surface it might appear that such a transition to a new futures contract, if it does indeed occur, would only have a significant impact on market participants who have exposure to physical Brent crude oil but, that isn't necessarily the case. If and when the market is required to transition from the current Brent futures contract to a new Brent futures contract, the transition will have an impact on liquidity and as a result, is likely to increase volatility, at least in the short term.

Given that the announcement from Platts only occurred a few days ago and ICE is only in the preliminary stages of determining if and when they will launch a new Brent futures contract, it will likely be at least several weeks, if not longer, before we have a better understanding of how both the transition, or transitions as it may be, will impact the market as it relates to crude oil hedging with Brent futures, swaps and options. Stay tuned...

2 min read

As the energy markets continue to evolve, NYMEX and ICE continue to introduce new contracts to accommodate the changing marketplace. As such, we...

2 min read

Given the decline in oil prices we've recently received several inquiries asking who is well hedged and who is not, particularly among the various...

2 min read

In early December the EIA announced that beginning with its 2013 Annual Energy Outlook, which will be published in the spring, the agency is going to...