4 min read

The Fundamentals of Oil & Gas Hedging - Put Options

This post is the third in a series where we are exploring how oil and gas producers can hedge their exposure to crude oil, natural gas and NGL...

In the previous post in this series, The Fundamentals of Oil & Gas Hedging with Futures, we explored how an oil and gas producer can hedge their exposure to commodity price uncertainty and volatility by buying or selling futures contacts. In this post, we are going to explain how oil and gas producers can utilize swaps for hedging purposes. Also, in subsequent posts in this series, we will explore how oil and gas producers can hedge with options and more complex strategies.

A swap is an agreement whereby a floating (or market) price is exchanged for a fixed price, or a fixed price is exchanged for a floating price, over a specified period(s) of time, most often one month. The instrument is referred to as a swap because the transaction involves buyers and sellers “swapping” cash flows with one another.

Swaps are arguably the most popular - because swaps can be customized to meet the needs of various market participants, something which cannot be done with futures contracts - hedging instrument used by oil and gas producers to hedge their exposure to commodity prices as hedging with swaps allows them to lock in or fix the price they receive for their oil and gas production. In addition to companies seeking to hedge their exposure to energy commodity prices, swaps are also utilized by companies seeking to hedge their exposure to agriculture commodities, metals, foreign exchange rates and interest rates, among others.

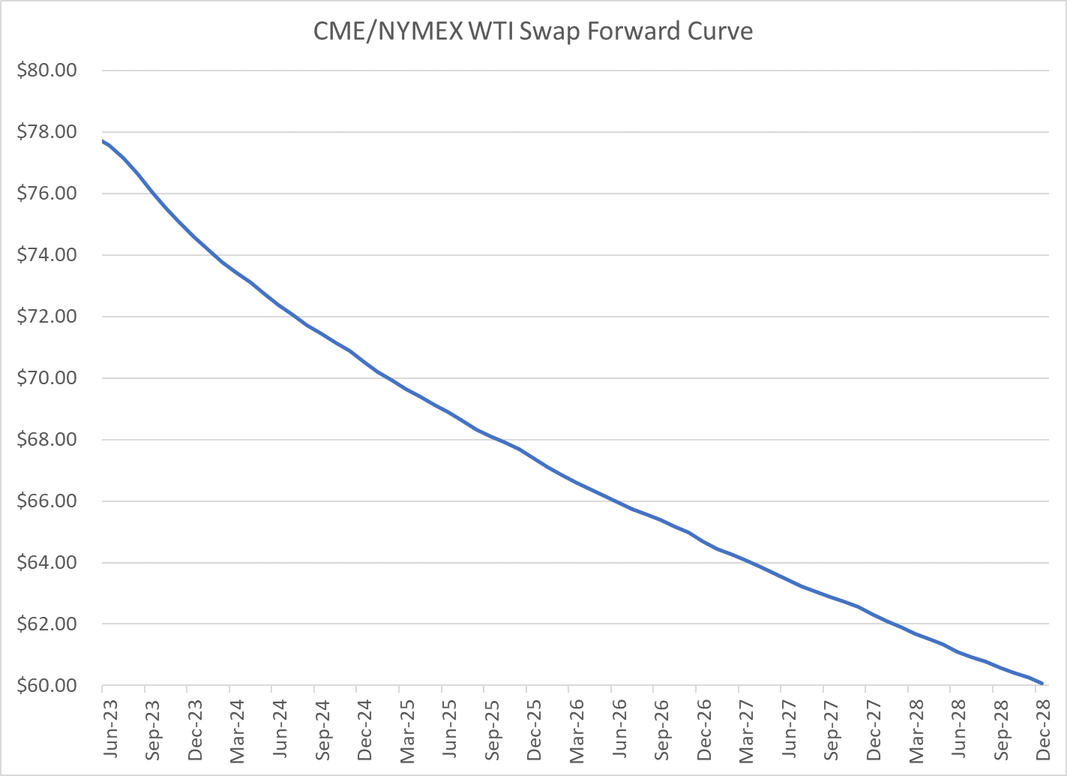

As an example of how an oil and gas producer can utilize a swap to hedge its crude oil production, let's assume that you're an oil producer who needs to hedge your December crude oil production to ensure that your December revenue meets or exceeds your budget forecast estimate of $60.00/BBL. If you had sold a December WTI crude oil swap at the close of business Friday, the price would have been approximately $74.60/BBL.

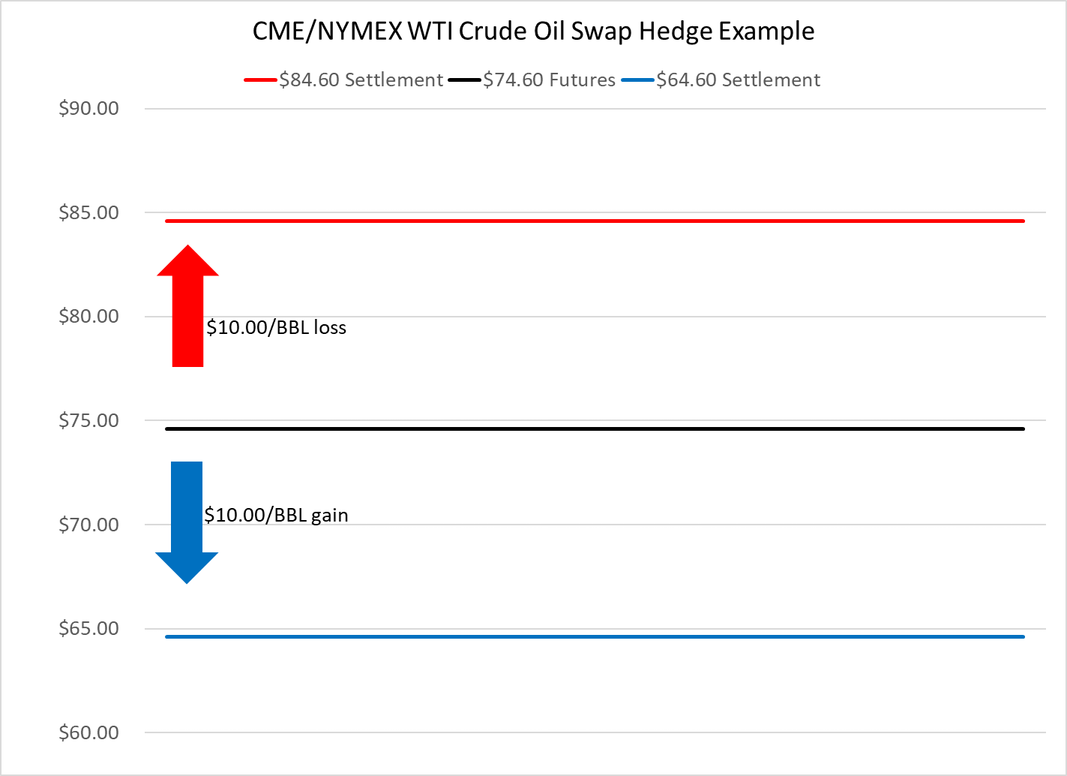

Now let's explore how hedging with the December WTI crude oil swap would impact your revenue - and in turn your cash flow - if the December WTI crude oil swap settles $10 higher and $10 lower than $74.60, the price at which you sold the swap to your counterparty.

In the first scenario, let's assume that prices at the end of December are lower than the price at which you hedged with the swap and that the settlement price for the December NYMEX WTI crude oil swap is $64.60/BBL. In this case, the price you receive for your December crude oil production would be approximately $64.60/BBL, excluding basis, gathering and transportation fees. However, because you hedged with the $74.60 swap, you would have a hedging gain of $10.00/BBL which equates to net revenue of $74.60/BBL. In this scenario, the hedge performed as designed and allowed you to lock in a price which provided you with a net price that allowed you to exceed your budget target of $60.00/BBL.

In the second scenario, let's assume that settlement price for the December NYMEX WTI crude oil swap is $84.60/BBL, $10 above your swap price of $74.60/BBL. In this case, the price you receive for your December crude oil production would be approximately $84.60/BBL. However, due to your $74.60 swap, you would incur a hedging loss of $10.00/BBL which, like the first scenario, still provides you with a net revenue of approximately $74.60/BBL. In this scenario, while you did experience a hedging loss, the hedge still performed as designed and allowed you to lock in a price which was well above your budgeted price of $60.00/BBL.

As this example indicates, oil and gas producers can mitigate their exposure to volatile crude oil prices by hedging with swaps. If the price of crude oil during the respective month averages less than the price at which the producer hedges with the swap, the gain on the swap offsets the decrease in revenue. On the contrary, if the price of crude oil during the respective month averages more than the price at which the producer hedges with the swap, the loss on the swap is offset by the increase in revenue.

While this example addresses how oil and gas producers can utilize swaps to hedge their crude oil price risk, a similar methodology can be used to hedge natural gas and NGLs as well. In addition, consumers, marketers and refiners can also utilize swaps to manage their exposure to energy commodity prices as well.

While the theory of hedging crude oil production with swaps may appear simple on the surface, the devil is always in the details. As such, before you decide to hedge with swaps or any other hedging tool, it is imperative that you conduct the proper analysis to determine if hedging with swaps, or any other instrument, is appropriate for your specific needs, objectives and risk tolerance.

This post is the second in a series on hedging crude oil and natural gas production. The previous and subsequent posts can be accessed via the following links:

The Fundamentals of Oil & Gas Hedging with Futures

4 min read

This post is the third in a series where we are exploring how oil and gas producers can hedge their exposure to crude oil, natural gas and NGL...

3 min read

This post is the fourth in a series where we are exploring (no pun intended) how oil and gas producers can hedge their exposure to crude oil,...

1 min read

While the basic fundamentals of energy hedging and risk management don't change very often, the prices at which one can hedge clearly do. As such,...