4 min read

A Beginners Guide to Fuel Hedging with Futures

As companies begin to plan for the second half of the year, we’ve been fielding numerous inquiries from companies who are interested in developing a...

As the energy markets continue to evolve, NYMEX and ICE continue to introduce new contracts to accommodate the changing marketplace. As such, we thought it would be beneficial to provide an overview of the new contracts, as they will certainly change the way market participants hedge their energy price risk.

On the fuel side, due to regulations which require, or will require, distillate fuels to contain lower levels of sulfur, NYMEX has introduced the following contracts:

NY Harbor Ultra Low Sulfur Diesel Futures (Symbol LH)

NY ULSD (Platts) Swap Futures (Symbol YS)

NY ULSD (Argus) Swap Futures (Symbol 5Y)

Gulf Coast ULSD (Platts) Swap Futures (Symbol LY)

Gulf Coast ULSD (Argus) Calendar Swap Futures (Symbol AJ)

Gulf Coast Ultra Low Sulfur Diesel (ULSD) Futures (Symbol LU)

Group Three ULSD (Platts) Swap Futures (Symbol A7)

Chicago ULSD (Platts) Swap Futures (Symbol 4C)

ULSD 10ppm (Platts) Cargoes CIF NWE Swap Futures (Symbol TY)

ULSD 10ppm (Platts) Cargoes CIF MED Swap Futures (Symbol Z6)

ULSD 10ppm (Platts) CIF MED BALMO Swap Futures (Symbol X7)

ULSD 10ppm (Platts) Cargoes CIF NWE BALMO Swap Futures (Symbol B1)

As we noted a few weeks ago, NYMEX has also announced that it intends to delist the heating oil futures contract, the last listed month being April 2013. For the market historians out there, the NYMEX heating oil futures contract was the first energy futures contract listed in the United States, which occurred in 1978.

In addition, NYMEX has also listed numerous ultra low sulfur swaps which allow market participants to hedge basis risk and crack spread risk. The list, as well as the details, of these contracts can be found on the CME Group website.

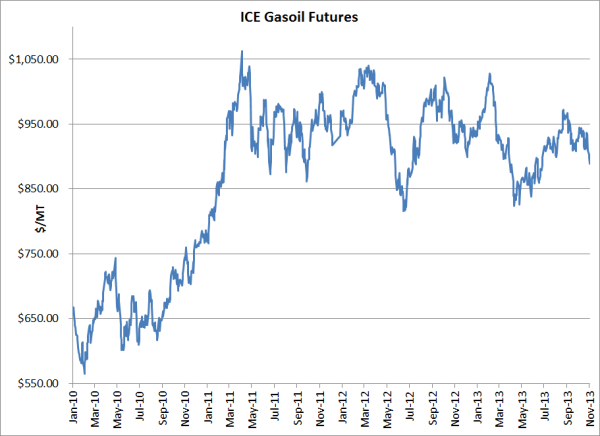

On the other side of the pond, last week ICE introduced ultra low sulfur gasoil futures and options as well as numerous ultra low sulfur spread swaps. Similar to the delisting of the NYMEX heating oil futures, ICE has also announced that it plans to delist the "high sulfur" gasoil futures and options, the last listed month being January 2015. More information on the ultra low sulfur gasoil contracts can be found on the ICE website.

So what does all of this mean with respect to fuel hedging? In essence, market participants, which have long hedged their distillate fuel risk with heating oil and gasoil futures and options, will have to decide which of the new contracts will best meet their hedging needs. On this note, while NYMEX has yet to list options on any of the ultra low sulfur contracts, we expect that they will in the coming months, as heating oil options are the most actively traded refined products listed on NYMEX, behind heating oil and gasoline futures, respectively.

Last but not least, as we noted last week in our post titled New Platts' Brent Formula Will Impact Oil Hedging, Platts has decided to "Amend the date range reflected in the Dated Brent assessment to 10-25 days forward, instead of the current 10-21 days forward..." As a result, ICE is considering a new Brent crude oil futures contract which would reflect the date range change made by Platts but, as of today, the exchange has yet to release any details regarding a new Brent contract.

In a nutshell, the energy markets are the early stages of a significant transition, a transition which will ultimately change the way companies hedge their energy risk. As always, please don't hesitate to contact us if we can be of assistance.

4 min read

As companies begin to plan for the second half of the year, we’ve been fielding numerous inquiries from companies who are interested in developing a...

2 min read

As we noted in our May energy hedging Q&A, the NYMEX (CME) has been working on the transition process whereby the benchmark distillate (disel fuel,...

3 min read

As many companies are beginning to plan for 2014, we have received quite a few inquiries from companies who are looking into hedging their gasoil...