2 min read

How to Reduce Basis Risk by Hedging with Options - Part II

A few weeks ago, in a post titled How to Reduce Basis Risk by Hedging with Options - Part I, we looked at how a large fuel consumer, such as an...

This post is the fourth, in an ongoing series, covering the basics of energy hedging. The first three posts in the series explored energy hedging with futures, energy hedging with swaps and energy hedging with options.

In subsequent posts in this series, we will also be exploring more "complex" energy hedging structures such as collars, participating swaps and option spreads.

Basis risk is the difference in price difference between a forward (futures) market and a cash (spot) market. In the energy markets there are three primary types of basis risk:

A basis swap is contract which provides the buyer or seller of the swap to hedge their exposure to basis risk.

So who is potentially exposed to basis risk? Nearly every energy consumer and producer: fuel end-users, fuel marketers, natural gas end-users, oil & gas producers, utility companies, etc.

As an example of basis risk and how it can be hedged, assume that you are a large airline whose contract with your jet fuel supplier states that they price you will pay for jet fuel is the average, between the low and the high price, of the U.S. Gulf Jet 54 Fuel pipeline price as published in Platts' Oilgram Price Report.

In addition, let's also assume that you want to hedge your July '11 - December '11 exposure to jet fuel prices by buying call options. In order to hedge this risk, you will need to purchase both NYMEX heating oil call options as well as Gulf Coast jet fuel vs. NYMEX heating oil jet fuel swap as the market for Gulf Coast jet fuel options isn't very liquid.

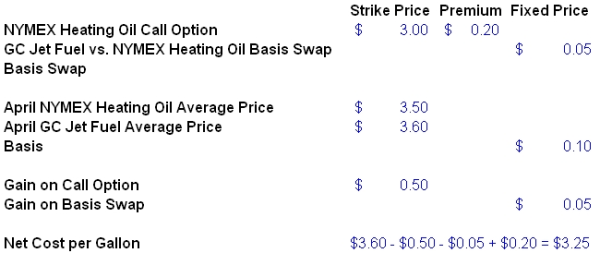

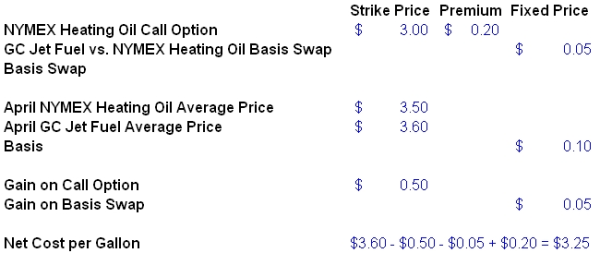

In order to explain the mechanics of structuring this hedge, assume that on March 31st you purchase a April '11 - December '11 NYMEX heating oil average price call option with a strike price of $3.00/gallon and a premium of $0.20/gallon for 10,000 (420,000 gallons) barrels each month, April through December. By purchasing this option, if the NYMEX heating oil prices average more than $3.00/gallon during any month, Apr-Dec, you will receive a return on this option. However, because the option is based on NYMEX heating oil and not Gulf Coast jet fuel you are now exposed to the basis risk between NYMEX heating oil futures and Gulf Coast jet fuel prices.

You can hedge your basis risk by purchasing a Gulf Coast jet fuel vs. NYMEX heating oil basis swap. Assume that on March 31st you also purchase the April - December basis swap at a price of $0.05/gallon. As such, you have locked in the basis between the U.S. Gulf Jet 54 Fuel pipeline price and the NYMEX heating oil futures at $0.05/gallon.

By purchase the NYMEX heating oil option and the Gulf Coast jet fuel vs. NYMEX heating oil basis swap you have now capped your April - December jet fuel price at $3.05/gallon or a net of $3.25/gallon including the $0.20 premium for the option.

To complete the example, let's assume that the front month NYMEX heating oil futures during the month of April average $3.50/gallon. If this is the case, you will receive a return on the option of $210,000 ($0.50/gallon X 420,000 gallons).

Let's also assume that the average, between the low and the high price, of the U.S. Gulf Jet 54 Fuel pipeline price as published in Platts' Oilgram Price Report, during the month of April is $3.60/gallon. Therefore, the basis for the month of April settles at $0.10/gallon ($3.60 - $3.50) and you receive a return on the basis swap of $0.05/gallon ($0.10 - $0.05).

In conclusion, due to the returns on the option and the swap of $0.50.gallon and $0.05/gallon, respectively, plus the upfront premium for the option of $0.20/gallon, your net cost for jet fuel purchased in April is $3.25/gallon.

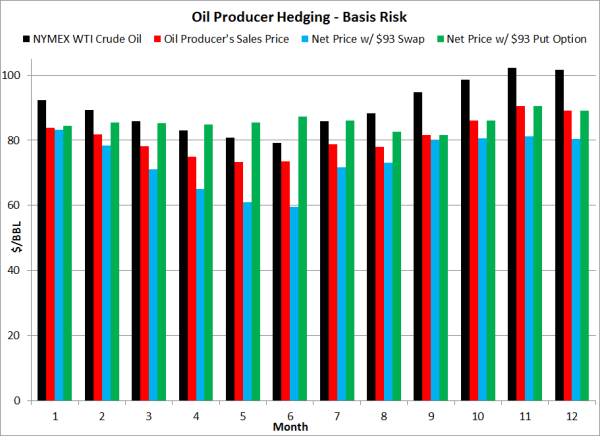

While this example focused on hedging jet fuel basis risk, the same methodology would apply to end-user basis risk hedging for nearly every energy commodity i.e. diesel fuel, natural gas, etc. If you would like to learn more about hedging basis risk, check out our previous posts, The Basics of Basis and Basis Risk and Revisiting Energy Basis Risk which includes several additional examples. And if that post still isn't informative enough for you to be able to determine how to analyze and hedge your basis risk, you are to contact us or leave a comment below.

UPDATE: This post is the third post in a series of five on the basics of energy hedging. The previous and subsequent posts can be found via the following links:

2 min read

A few weeks ago, in a post titled How to Reduce Basis Risk by Hedging with Options - Part I, we looked at how a large fuel consumer, such as an...

2 min read

The following are our answers to your April energy hedging questions. If you're interested in reading our previous energy hedging questions and...

1 min read

Through numerous emails that we've received from our subscribers, we're hearing that you need and want more information on the various aspects of...