4 min read

Energy Hedging 101 - Options

This post is the third of several in a series covering the basics of energy hedging. Here are the links to the first and second posts, which covered

This post is the fifth, in a series, covering the basics of energy hedging. The first four posts in the series explained futures, swaps, options and basis swaps.

When we refer to complex energy hedging strategies, they need not be complex, they are simply more advanced than the basic hedging strategies we've addressed in recent weeks.

Having said that, there are times where energy producers, marketers and consumers feel the need to think outside of the box with respect to hedging. For large fuel consumers it could be an environment like the current environment where hedging is more important than ever yet option premiums can be prohibitively expensive. For crude oil producers, it could be also be an environment like the current environment, where the producers desires to hedge against potentially declining prices while retaining some ability to profit from potentially rising prices. In both situations, one hedging strategy that could be considered is known as a collar.

While it may sound complex, a consumer collar is simply the combination of buying a call option and selling a put option thus creating both a ceiling and a floor. Conversely, a producer collar is the combination of buying a put option and selling a call option. Often times, the options are structured in such a way that the premium of the purchased option is completely offset by the premium of the sold option, a structure known as a costless collar.

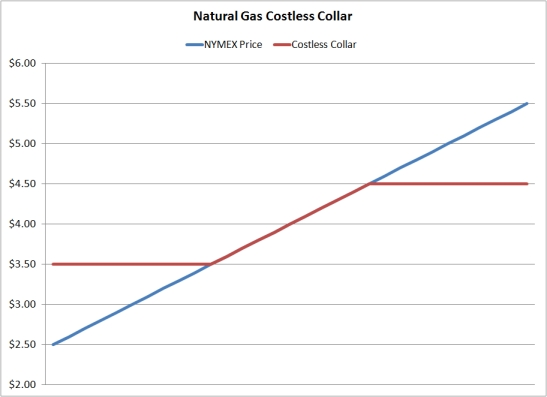

As an example, let's consider a NYMEX natural gas costless collar with a $4.50 ceiling (call option) and a $3.50 floor (put option). For a natural gas producer is protected against prices declining below $3.50 while there upside would be limited to $4.50. In between $3.50 and $4.50 the producer would be selling his production at the current market price. Conversely, a natural gas consumer would face the opposite situation, they would be protected against prices rising above $4.50 while their downside would be limited to $3.50. Likewise, in between $3.50 and $4.50, the consumer would be paying the current market price.

Clearly, collars can be an effective hedging structure but their benefits are limited due to fact that one "leg" of the collar involves selling options and selling options limits opportunity costs. Generally speaking, collars are most advantageous to energy producers during "high" price environments while being most advantageous to energy consumers during "low" price environments.

UPDATE: This post is the third post in a series of five on the basics of energy hedging. The previous and subsequent posts can be found via the following links:

Energy Hedging 101 - Basis Swaps

If you'd like to learn more about energy hedging with collars please to contact us, we would be glad to discuss your specific situation.

4 min read

This post is the third of several in a series covering the basics of energy hedging. Here are the links to the first and second posts, which covered

3 min read

In our previous post in this series, we explored how energy consumers and producers can utilize swaps to hedge their energy commodity price risk....

3 min read

This post is the fourth, in an ongoing series, covering the basics of energy hedging. The first three posts in the series explored energy hedging...