4 min read

Energy Hedging 101 - Options

This post is the third of several in a series covering the basics of energy hedging. Here are the links to the first and second posts, which covered

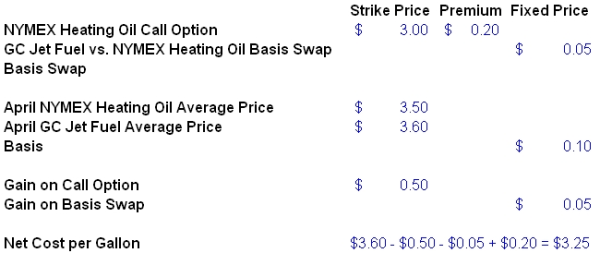

In our previous post in this series, we explored how energy consumers and producers can utilize swaps to hedge their energy commodity price risk. This post will build upon the foundation covered in the previous post, which you can access via this link. In future posts, we will explore how you can utilize options, basis swaps, collars and spreads on options, among many others, to hedge energy price risk.

A swap is an agreement whereby a floating (or market) price is exchanged for a fixed price, over a specified period(s) of time. In addition to energy commodities, swaps can also be used to hedge a variety of market prices – from agricultural commodities to foreign exchange rates to interest rate swaps. Swaps are referred to as such because the buyers and sellers of swaps are “swapping” cash flows with one another, as we will explore though a practical, real-world example.

Energy consumers often hedge with swaps to fix or lock in their energy costs, while energy producers often utilize swaps to lock in or fix their revenues and/or cash flow. Likewise various market participants, such as processors, refiners, traders, marketers and merchants often use swaps to hedge their profit margins and inventories (stocks) as well.

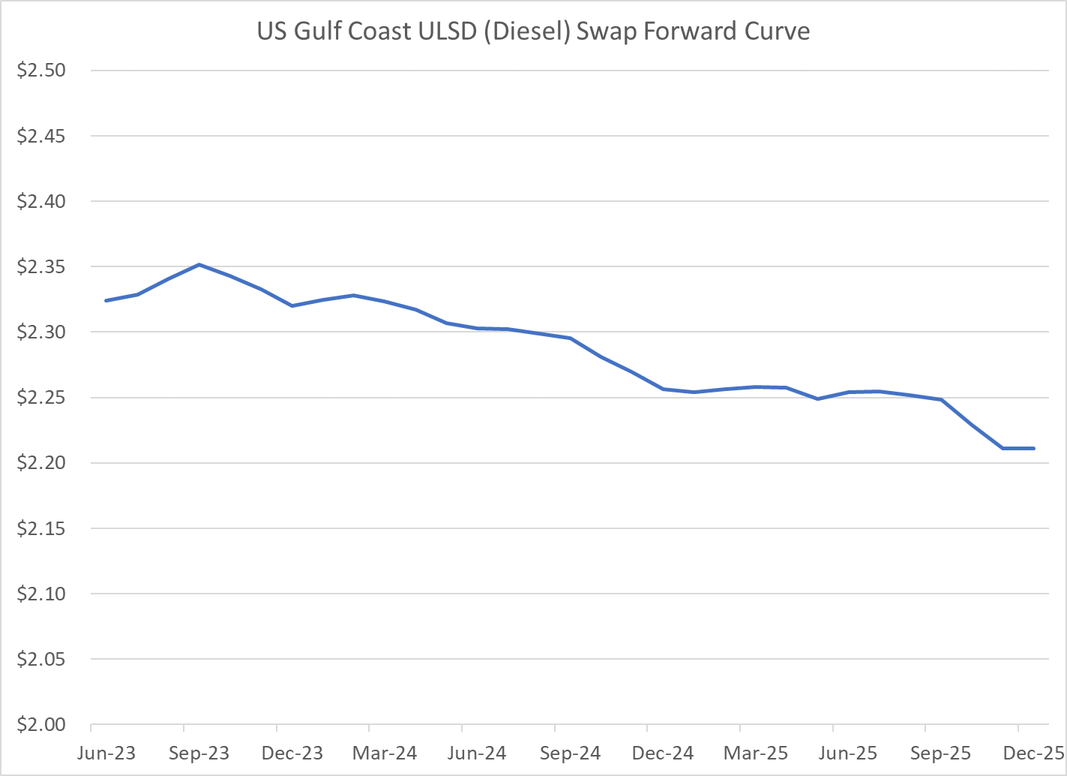

As an example of how one can utilize an energy swap, let's assume that you're a large fuel consuming company in the Houston-New Orleans geographical area, who wants to fix or lock in the price of your anticipated ultra-low sulfur diesel fuel (ULSD) cost for a specific month. For sake of simplicity, let's assume that you are looking to hedge 80% of your anticipated December USLD fuel consumption, which equates to 100,000 gallons. To accomplish this, you could purchase a December US Gulf Coast ULSD swap from one of your counterparties, often a financial institution or commodity trading firm. If you had purchased this swap yesterday at the prevailing market price, the price would have been (approximately) $ 2.3198/gallon which is the equivalent of $97.4316/BBL as there are 42 gallons in one barrel.

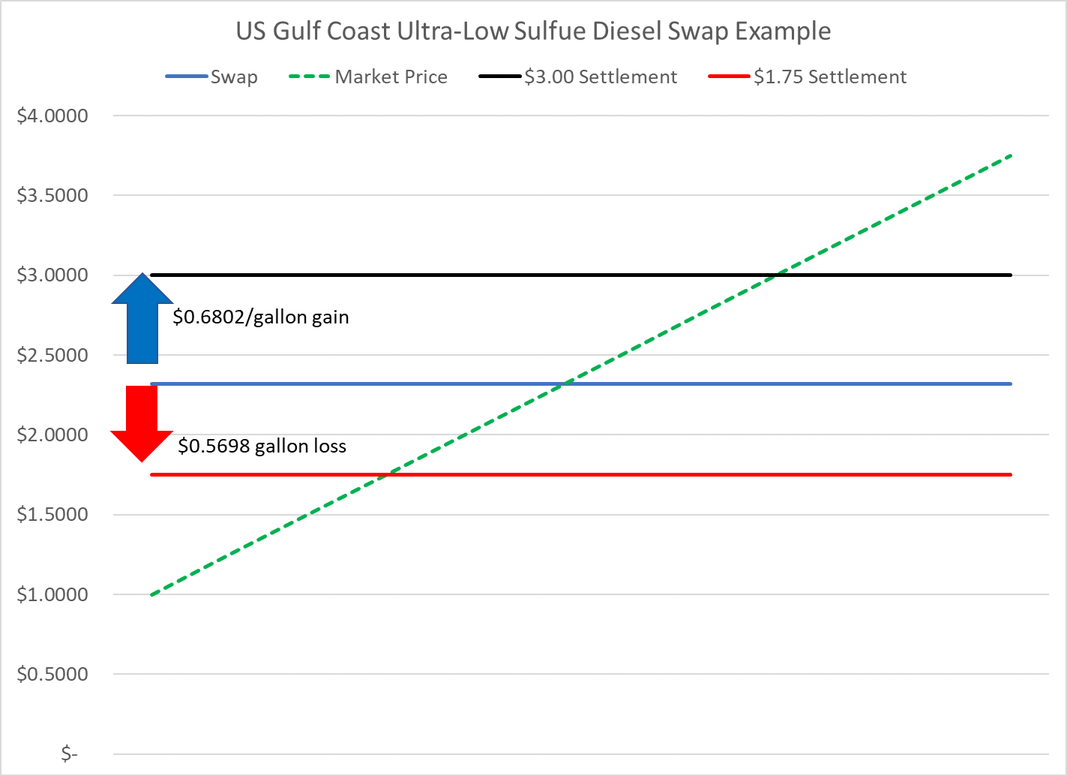

Now let’s examine the results of this swap if Gulf Coast ULSD prices settle both higher and lower than the $2.3198 that you paid for the swap.

In the first case, let's assume that fuel prices increase and that the average price for Gulf Coast ULSD, (as published by Argus, Platts, OPIS or the relevant price reporting agency which your contract references) for each business day in December is $3.00/gallon. In this case, your swap would produce a hedging gain of $0.6802/gallon ($3.00 - $2.3198 = $0.6802) or $28,568.40 (42,000 gallons multiplied by $6802/gallon). As a result, you would receive a payment of $ $28,568.40 from your counterparty, which you would utilize to offset the increase in your gross fuel cost of $3.00/gallon. A gross cost of $3.00/gallon assumes you can buy fuel direct from a Gulf Coast refiner or to negotiate a contract to purchase physical fuel from your supplier at the Gulf Coast average price). Your net fuel cost would likely be closer to $4.00/gallon to account for taxes, local transportation fees from the fuel terminal, etc.

On the other hand, let's assume that fuel prices decrease and that the average price for Gulf Coast ULSD, for each business day in December, is $1.75/gallon. In this case, the swap would result in a hedging loss of $0.5698/gallon ($2.3198 - $1.75 = $0.5698) or $23,931.60. As a result, you would have to make a payment of $23,931.60 to your counterparty, which would add to your gross fuel cost of $1.75/gallon. Like the example when prices increase, we are assuming that both the swap and gross physical price are both based on the Gulf Coast average price as published by the relevant price reporting agency. Your net fuel cost would likely be closer to $2.75/gallon, again to account for taxes, local transportation fees from the fuel terminal, etc.

As the results of both outcomes indicate, by purchasing a Gulf Coast ULSD swap for $2.3198/gallon, your net fuel cost (again assuming that both the swap and gross physical price are both priced on the same index) will be $2.3198 regardless of whether Gulf Coast ULSD prices settle higher or lower than $2.3198. If Gulf Coast ULSD prices settle higher than $2.3198 you will have a gain on the swap which offsets the increase in your gross physical fuel price. On the other hand, if Gulf Coast ULSD prices settle lower than $2.3198, you will have a loss on the swap which must be accounted for when calculating your net fuel cost.

While this example examined how a fuel consumer can use swaps to hedge ultra-low sulfur diesel fuel price risk, similar methodologies can also be used to hedge exposure to other energy commodities such as electricity, gasoline, jet fuel, natural gas, propane, etc. In addition, as previously mentioned, energy producers, refiners, traders and marketers can also utilize swaps to hedge their energy price risk. For example, if you are a crude oil producer looking to hedge your oil production, you could do so by selling crude oil swaps, the opposite of what the consumer in our example did to hedge their fuel price risk.

This post is the second in an introductory series on energy hedging. The additional posts in the series can be accessed via the following links:

4 min read

This post is the third of several in a series covering the basics of energy hedging. Here are the links to the first and second posts, which covered

2 min read

In what has become a monthly feature of our blog, here is the November energy hedging Q&A. As always, if you would like us to provide a more in...

3 min read

This post is the fourth, in an ongoing series, covering the basics of energy hedging. The first three posts in the series explored energy hedging...