1 min read

Energy Hedging Case Studies & Mutil-Client Studies

We just launced a new section on our website where we will be highlighting the results that we produce for our clients. This section is "under...

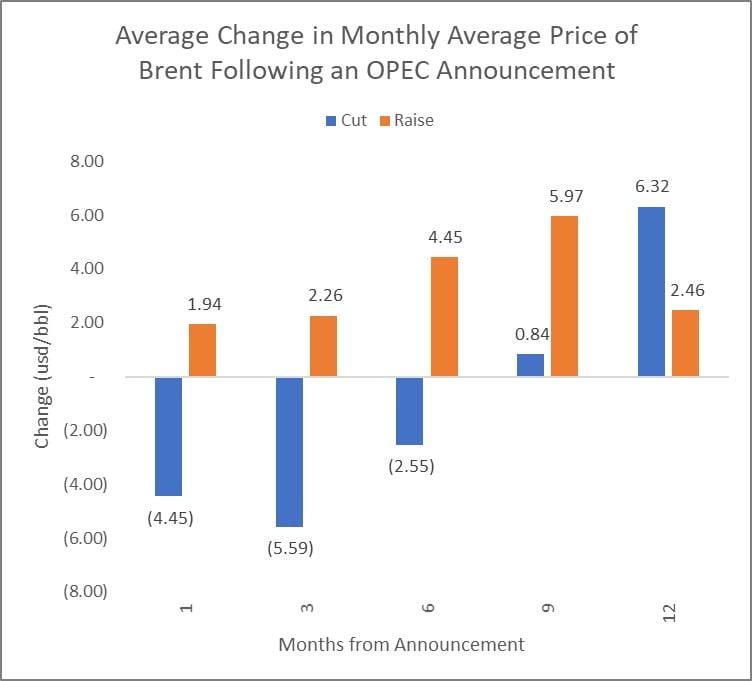

The Organization of Petroleum Exporting Countries (OPEC) is reportedly considering another production cut in response to the recent weakness in oil prices. But how effective are these cuts in supporting prices? We did a quick look back at OPEC announcements since April 1998 and Brent oil prices over the roughly 21 years since. We compared the average price of the benchmark in the month preceding the OPEC announcement to the month after the announcement, as well as three, six, nine, and twelve months after the announcement.

Since April 1998, OPEC has announced 17 production cuts. About 40% of the time, prices fell in the month that followed. Nearly half of the time prices were lower in both the third and sixth month following an announcement. On average the average Brent price in the month following the announcement was $4.45/bbl lower than the month preceding the announcement, $5.59 lower in the third month following the announcement, and $2.55 lower in the sixth month following the announcement.

It appears to take, on average, 9-12 months for oil prices to rise after an announcement that the Cartel intends to cut production. At that length, though, it’s hard to conclude that the change in price was directly tied to OPEC’s decision.

A deeper analysis would consider OPEC’s operations leading up to the cut and compliance with its targets, as well as the broader fundamentals surrounding each case, but this first look at prices suggests that OPEC’s cuts fail to meet their stated goal of supporting prices in the months following an announcement.

1 min read

We just launced a new section on our website where we will be highlighting the results that we produce for our clients. This section is "under...

3 min read

For the first time since 2008, OPEC (Organization of the Petroleum Exporting Countries) has agreed to reduce its aggregate output by 700,000-800,000...

1 min read

Crude oil prices once again traded above $100 today which has many asking, how high will it go, while others wondering if we may see prices collapse,...