1 min read

Constructing a Hedging Matrix for Oil & Gas Producers

When meeting with potential clients one of the topics we always discuss is their risk tolerance as it relates to their risk profile, hedging goals...

Crude oil prices once again traded above $100 today which has many asking, how high will it go, while others wondering if we may see prices collapse, as they did in 2008. Depending on the flavor of the day, it's not all that difficult to make a strong case for both scenarios, both independent of one another or in succession.

The combination of rising geopolitical tensions across the globe, strong demand in emerging economies (e.g. China announced yesterday that MoM and YoY crude imports both increased by ~7%), inflationary economic policies and a host of other variables can be combined to create a decent case for higher oil prices. On the other hand, poor economic conditions, energy conservation, increasing crude oil production) and a host of other bearish issues all point towards oil trading at well below $100/BBL. Eventually the market will decide the winner but, in the meantime it's anyone's guess.

So what are both consumers and producers to do at this point in time? Hedge, but don't ignore market history. While the move to $150/BBL was a surprise to many, the quick and dirty collapse that followed shocked all but a handful. In extremely "noisy" markets such as the current one, buying options will be the hedging strategy of choice for most. Sure, options require a premium payment but, when you buy options (or spreads on options), your risk and worst case scenario are well defined.

Buy aren't options expensive? They certainly can be but there are low cost, conservative option hedging strategies can be catered to meet the needs of most market participants. It all comes down to what exposure you are trying to hedge. An explosive, short-term price spike is a much greater risk to consumers, such as airlines, than a steady, gradual increase. The reason being, the latter scenario is one in which the airlines can, at least to an extent, pass on to their customers. Clearly that isn't the case with the former.

On the contrary, while it might be painful, most oil producers can handle a short term price decline. However, if oil prices were to experience a significant pull back, most producers would find themselves in a very difficult situation, or worse. Not only would their revenues and cash flows decline, their access to capital would be reduced as well.

In summary, in a economic environment filled with noise and uncertainty, conservative, option-based hedging strategies will tend to be the solution for many as they provide not only price "insurance" but peace of mind as well.

1 min read

When meeting with potential clients one of the topics we always discuss is their risk tolerance as it relates to their risk profile, hedging goals...

3 min read

In a recent Bloomberg article, “In a Risky World, Oil Traders Bet on $100 a Barrel” the author explored how, “Some oil traders have started to gear...

2 min read

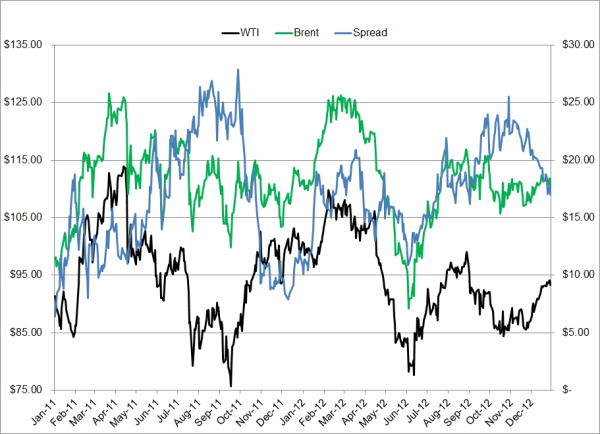

In recent weeks the Brent-WTI spread has collapsed once again, settling yesterday at just above $17/BBL after trading as high as $25.53 in mid...