1 min read

Upcoming Energy Risk Management Events & Recent Articles

If you haven't perused our website recently, you may have missed the following: May 23rd & 25th Mike Corley will be delivering presentations on base...

This post in the first of a new series where we'll be demystifying various myths related to energy hedging, myths which we hear repeated all too often...

The 6:1 Crude Oil to Natural Gas Ratio

Historically, the Btu (British thermal unit) ratio between crude oil and natural gas has been "accepted" by the industry as 6:1. The reasoning behind this is that once upon a time the IRS defined a BOE (barrel equivalent of oil), "As fuel that has a BTU (British Thermal Unit) content of 5.8 million. A cubic foot of gas contains about 1000 BTU, thus, 5.8 thousand cubic feet (MCF) of natural gas has nearly the same number of BTU’s as one BOE." And because it's makes the mathematics easier, the industry has rounded 5.8 to 6.

In layman's terms, if you burn a barrel of oil, it produces about 6 million BTUs. If you burn an MCF of gas, it produces about one million BTUs. So the assumption is that 6 MCF of gas is equivalent to one barrel of oil, which is more or less true, on an energy equivalent basis.

As a result, many decided that they could translate the energy equivalent into a value (or dollar) equivalent, whereby 6 MCF of natural gas should be about the same price as one barrel of oil. Furthermore, many argue that if oil is cheaper than natural gas (on a Btu basis), people will use oil; and if natural gas is cheaper oil (again, on a Btu basis), companies will burn gas.

The problem with this methodology, especially in the U.S., is that very few end-users (less than 10%) have the ability to switch between oil (diesel fuel, heating oil, etc.) and natural gas. So while it all sounds nice and rosy, it's not practical in the real world. Perhaps it will be in the future (if natural gas becomes a widely used transportation fuel), but not today. As an aside, many power plants used to have the ability to switch between oil and natural gas, based on economics, but as the domestic power generation fleet has become more modernized, very few plants still have the ability to switch between oil and natural gas.

So what does this have to do with energy hedging? We've recently heard that a reputable (at least that's the perception) energy derivative marketer is pitching various "hedging" structures based on a combination of the 6:1 ratio and mean reversion. The basic idea, as we understand it, is that they are arguing that on a BOE basis, natural gas is undervalued and/or crude oil (and refined products) is overvalued, and, in due time, prices should "mean revert" towards the 6:1 ratio and as such, the "hedges" they are recommending will only "work" if the reversion towards the mean occurs, quite a stretch in the current environment. Based on current NYMEX prices, let's call it $47/BBL and $2.75/MMBtu, we're looking at an oil to gas ratio of approximately 23:1. Yes, 23:1.

While one could have made a semi-decent argument for entering into trades based on the ratio in the 1994-2009 timeframe, it’s simply a crazy strategy – if one can even call it a strategy - in the current and foreseeable price environment. Perhaps a few years down the road natural gas (LNG) will become a relatively liquid, global market, as and the fundamentals will bring the ratio back into the 1994-2009 range but until that happens “hedging” based on the 6:1 myth is likely to be more dangerous than sitting on the sideline.

If you're a gambler with an incredible pain tolerance and believe that prices will indeed revert towards the 6:1 ratio then, by all means, feel free to buy natural gas, sell crude oil and pray for the best. However, if you're a legitimate hedger seeking to mitigate your exposure to volatile energy prices, you'll be best served by ignoring the 6:1 ratio and developing an energy hedging strategy based on your business objectives, risk tolerance and sound, quantitative analysis.

UPDATE: This article is one of a two-part series. Part II can be found via the following link:

1 min read

If you haven't perused our website recently, you may have missed the following: May 23rd & 25th Mike Corley will be delivering presentations on base...

2 min read

This post is the second in our series covering energy hedging myths. The first post, Energy Hedging Myths Demystified - Part I, is available via this

2 min read

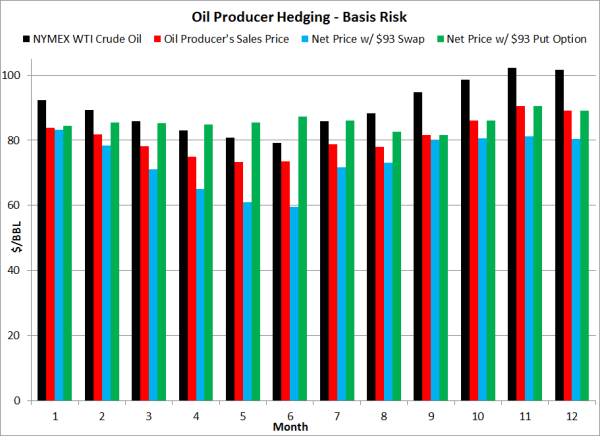

A few weeks ago, in a post titled How to Reduce Basis Risk by Hedging with Options - Part I, we looked at how a large fuel consumer, such as an...