3 min read

Energy Hedging 101 - Basis Swaps

This post is the fourth, in an ongoing series, covering the basics of energy hedging. The first three posts in the series explored energy hedging...

This post is the second in our series covering energy hedging myths. The first post, Energy Hedging Myths Demystified - Part I, is available via this link.

Energy Hedging is Risky

This is probably our most favorite myth of all. We hear it all the time and it couldn't be any less true. Uninformed hedging is risky. Uneducated hedging is risky. Hedging without well defined goals and objectives is risky. Hedging without a hedging policy is risky. We could go on and on but the point is quite simple, hedging isn't risky, it's only "risky" if you don't know what (as well as how, when, where, why and with whom) you're doing before you execute a trade.

So how do you hedge your exposure to volatile energy prices without it being/becoming a risky endeavor?

1. If you don't have the in-house expertise to properly develop, implement and manage a hedging program, reach out to experts that can help you. The cost of engaging a hedging expert(s) is far less than the potential cost (losses) of a poorly executed hedging program. This isn't merely a shameless sales plug. Think about it for a minute...If you don't have in-house expertise in any other, significant busienss function (legal, engineering, tax, etc.) you generally engage a third-party expert, correct? Why would you not do the same when it comes to managing commodity price risk?

2. Develop and implement a risk management and/or hedging policy. See Our Thoughts on Developing an Energy Hedging Policy for more on developing a hedging policy. A proper hedging policy, which includes pre-approved hedging strategies, addresses basis, counterparty and credit risk, states whom is responsible for what and when as well as numerous, other common sense measures, will mitigate/eliminate most issues which can potentially make energy hedging a "risky" endeavor.

3. Thoroughly explain the items mentioned in number two to your board of directors, management team, lenders, shareholders, etc. and anyone else who needs to know and was not involved in the process. Are you and they comfortable with the policy, procedures and your ability to manage a proper hedging program given the various front, middle and back offfice requirements?

4. Develop analytical models which you can use to run pre-trade stress tests on your portfolio to determine the potential impacts of said trades in various market environments. Run the stress test and share the results with your key stakeholders as well. Are you and they comfortable with the results? If not, go back to drawing table until you determine which stategies, volumes and tenors will allow you and your colleagues to know you are well hedged in various market environments.

In summary, energy hedging isn't a risky endeavor, it's hedging when you don't know what you're doing that's risky.

3 min read

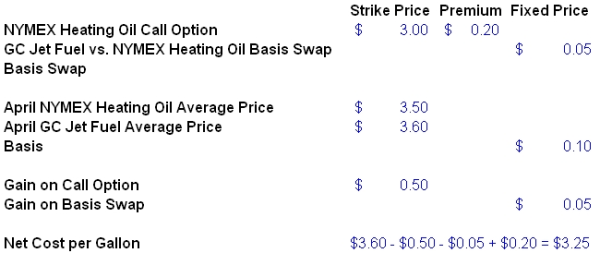

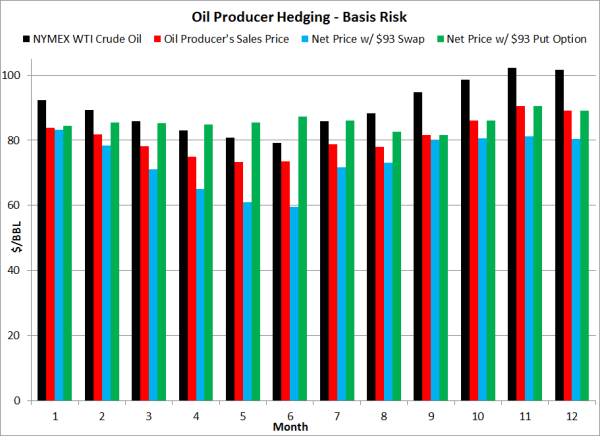

This post is the fourth, in an ongoing series, covering the basics of energy hedging. The first three posts in the series explored energy hedging...

4 min read

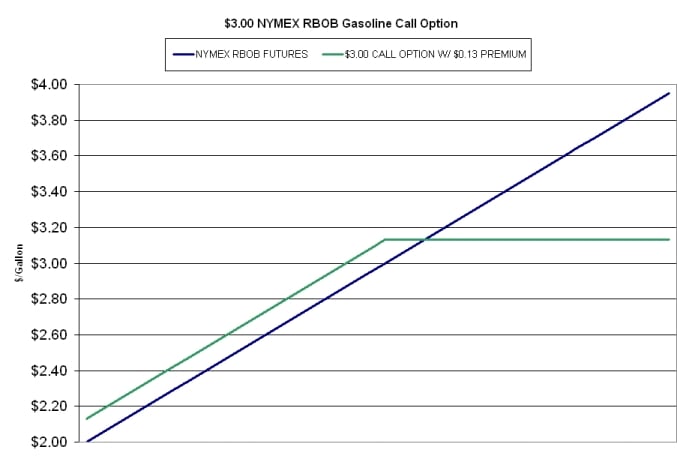

This post is the third of several in a series covering the basics of energy hedging. Here are the links to the first and second posts, which covered

2 min read

A few weeks ago, in a post titled How to Reduce Basis Risk by Hedging with Options - Part I, we looked at how a large fuel consumer, such as an...