3 min read

Passive vs. Active Energy Hedging Strategies - Part II

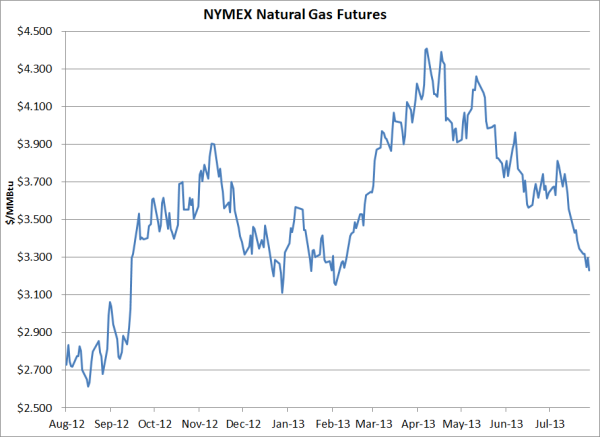

After trading as low as $3.125/MMBtu in mid February and as high as $4.444/MMBtu in early May, NYMEX natural gas futures have recently given up...

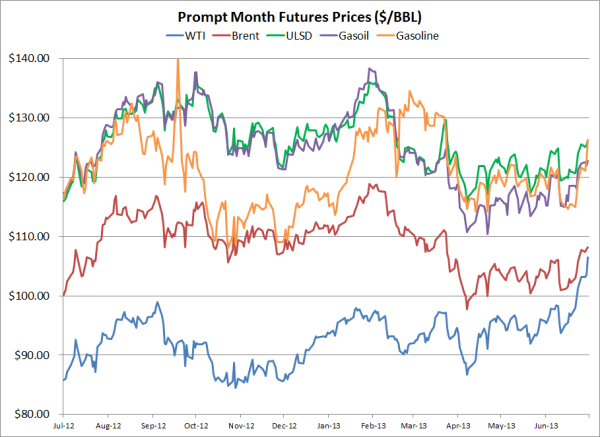

As all large fuel consuming companies know all too well, fuel prices have increased significantly over the past few months. After posting 2013 lows in mid April, prompt month WTI, Brent, ULSD, gasoil and gasoline futures have increased by 18.63%, 9.68%, 9%, 9.81% and 9.61%, respectively.

Given such significant price moves over such a short period of time, we thought it would be beneficial to explain how fuel consumers can optimize their fixed price swaps, many of which are likely to be in-the-money, while maintaining a sound hedge against prices rises higher from here.

Note: All prices in the chart above have been converted to $/BBL, gasoline and ULSD at a rate of 42 gallons per barrel and gasoil at a rate of 7.45 barrels per metric ton.

While it's certainly possible to optimize fixed price swaps by selling the swaps, "pocketing" the gains, and buying call options, generally speaking most comanies will benefit by pursuing an alternative strategy. In trading jargon, it's referred to as a synthetic call option. In practice, it is the combination of a fixed price swap and a put option, which when combined, creates a position which is esentially a call option, also called a price cap.

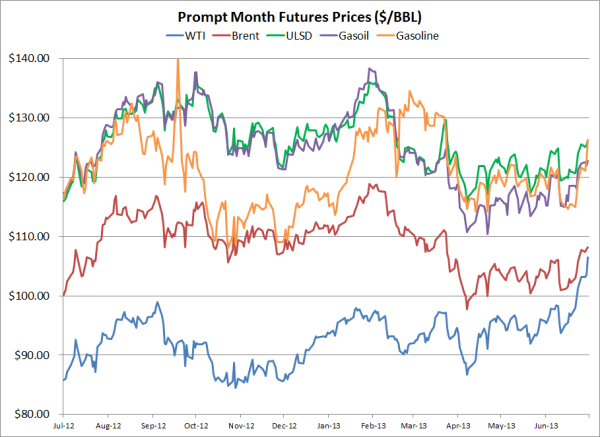

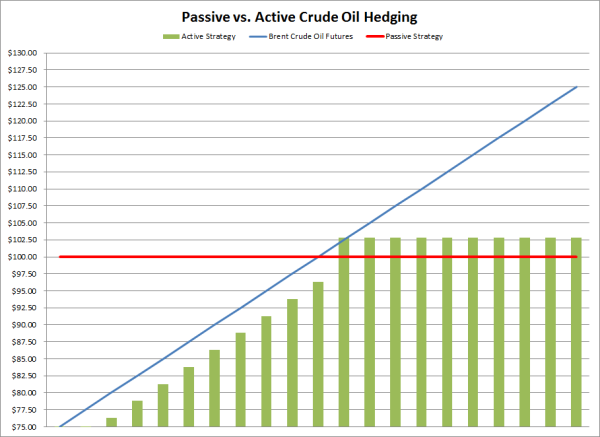

As an example, let's assume that Red Transportation (a fictitious company) hedged their September 2013 fuel consumption by purchasing a September Brent crude oil calendar swap at a price of $100/BBL. Given the recent increase in Brent prices, Red's swap is currently trading for approximately $106.50/BBL, meaning their swap is currently in-the-money by 6.50/BBL. If Red were to sell the swap and capture the gain of $6.50/BBL, they could then purchase a $106.50 September Brent crude oil call option (average price) call for approximately $4.10/BBL. However, as previously mentioned, this isn't the most advantageous way to optimize their swap as they would have to execute two transactions (sell the swap and then purchase the call option), which would subject them to the "bid/ask spread" on both the swap and the call option. In layman's terms, this means that they would have to compensate their counter-party (via the counter-party's profit margin on each transaction) on both the sale of the swap and the purchase of the call option, which would mitigate the benefit of optimizing the swap.

As an alternative, Red could achieve a more advantagous, optimized postion by continuing to hold the swap and purchasing a September $106.50 Brent crude oil put option (average price) for a premium of approximately $3.80/BBL. By retaining their existing swap and purchasing the $106.50 put option, Red only has to enter into one new transaction, which means that they are only subjected to the bid/ask spread on one transaction. In addition, due to call skew in September Brent options, Red will save $0.30/BBL by purchasing the $106.50 put option rather than the selling the $100.00 swap and subsequently purchasing the $106.50 call option.

To put this example into a numerical context, if Brent prices decline and average $100.00/BBL during September, Red will gain $6.50/BBL on the $106.50 put option while they will realize neither a gain nor a loss on the $100 swap. After factoring in the $3.80 premium cost for the $106.50 put option, Red's net gain would be $2.70/BBL. On the other hand, if Brent prices continue to increase and average $120/BBL in September, Red will realize a gain of $20/BBL on the $100 swap and the $106.50 put option will expire worthless (as it is out-of-the-money) for a net gain of $16.20/BBL (including the put option premium of $3.80/BBL).

While many would argue that optimizing an existing hedge is a form of speculation, we would disagree, so long as the optimized strategy reduces risk(s), as is clearly the case in this example. To clarify, by optimizing their original position, Red will benefit in the following ways:

While many companies approach hedging with a "set it and forget it" mentality, this example shows how an actively managed fuel hedging program can not only reduce risk, but also improve the bottom line. In a future post we will explore how producers can similarly benefit from an actively managed hedging program.

This post is the first in a series on passive vs. active energy hedging strategies. The second post in the series can be accessed via the following link: Passive vs. Active Energy Hedging Strategies - Part II.

3 min read

After trading as low as $3.125/MMBtu in mid February and as high as $4.444/MMBtu in early May, NYMEX natural gas futures have recently given up...

2 min read

This post is the second in our series covering energy hedging myths. The first post, Energy Hedging Myths Demystified - Part I, is available via this

4 min read

This post is the third of several in a series covering the basics of energy hedging. Here are the links to the first and second posts, which covered