3 min read

Passive vs. Active Energy Hedging Strategies - Part I

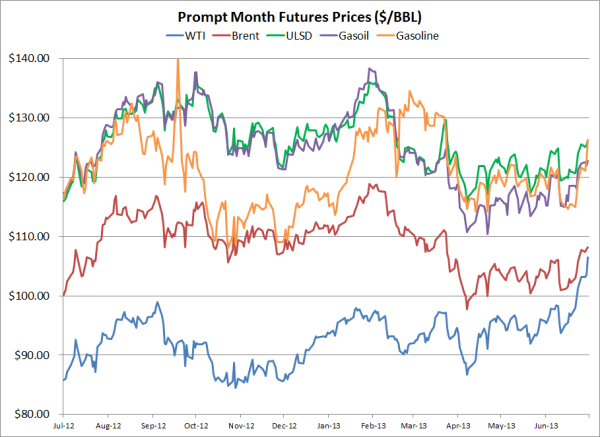

As all large fuel consuming companies know all too well, fuel prices have increased significantly over the past few months. After posting 2013 lows...

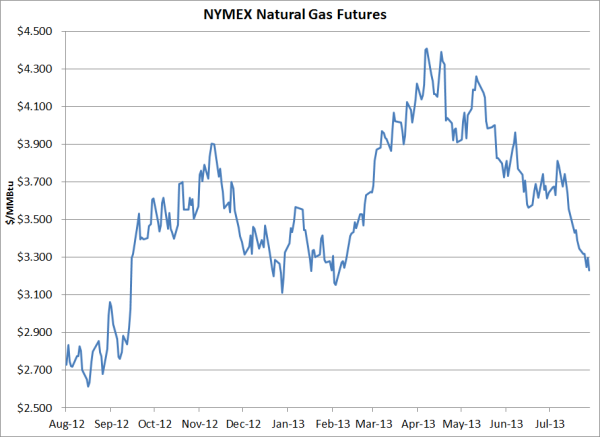

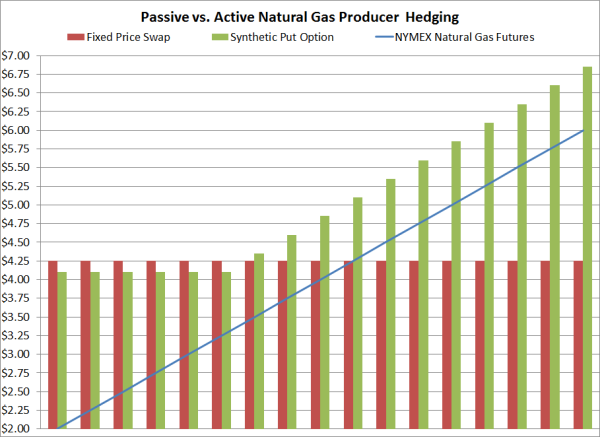

After trading as low as $3.125/MMBtu in mid February and as high as $4.444/MMBtu in early May, NYMEX natural gas futures have recently given up nearly all of the spring/summer gains with the prompt month futures closing at $3.23/MMBtu on Friday. Given the large moves both up and down, we want to address how natural gas producers can optimize any existing fixed price swaps, which might be in-the-money, while maintaining the ability to participate in higher prices, should natural gas prices increase in the coming months.

While it's possible for natural gas producers to optimize in-the-money fixed price swaps by selling their swap, "pocketing" the gains, and buying put options or even put option spreads, many gas producers will benefit by pursuing an alternative strategy, a synthetic put option. A synthetic put option is the combination of a fixed price swap and a call option, which when combined, creates a position which acts as a put option or floor.

As an example, let's assume that Big Green Exploration & Production (a fictitious company) has hedged their October 2013 production by selling an October NYMEX natural gas swap at a price of $4.25/MMBtu. Given the recent decline in natural gas prices, Big Green's $4.25 swap is currently trading for approximately $3.25/MMBtu, meaning their swap is currently in-the-money by $1.00/MMBtu. If Big Green were to buy back their swap and capture the gain of $1.00/MMBtu, they could then purchase a $3.25 October NYMEX natural gas put option for approximately $0.15/MMBtu. The $3.25 put option would provide them with a hedge against prices falling below $3.25 while retaining the benefits of higher prices as well.

However, as previously mentioned, this likely isn't the most advantageous strategy for Big Green to optimize their $4.25 swap as they would have to execute two transactions (buy back the swap and then purchase the put option), which would subject them to the "bid/ask spread" (their counterparty's profit margin) on both the swap and the put option. Ultimately this means that they would have to compensate their counter-party on both transactions, which would be expensive if the volume is significant.

As an alternative, Big Green could achieve a more advantageous, optimized strategy by continuing to hold the $4.25 swap and purchasing a $3.25 October NYMEX natural gas call option for a premium of approximately $0.15/MMBtu. By retaining their existing swap and purchasing a $3.25 call option, Big Green only has to enter into one new transaction, which means that they are only subjected to the bid/ask spread on one transaction.

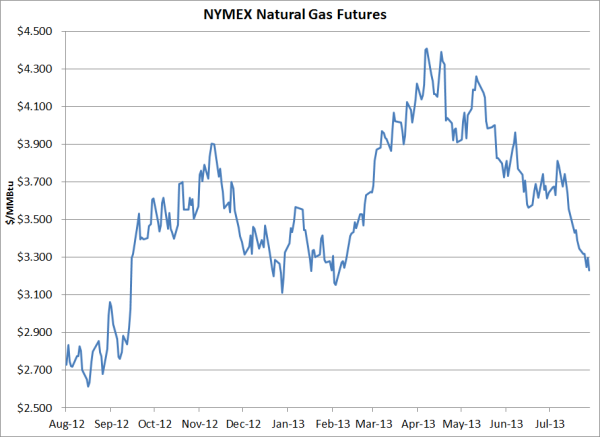

Now let's fast forward and look at how the original $4.25 swap and the new, $3.25 synthetic put option would perform if October NYMEX natural gas prices expire at both $2.50 and $5.00.

If October NYMEX natural gas prices decline further and expire at $2.50, Big Green will gain $1.75/MMBtu on the $4.25 swap while they will realize neither a gain nor a loss on the $3.25 call option. At a settlement price of $2.50/MMBtu, Big Green's net gain, including the call option premium of $0.15/MMBtu, would be $1.60/MMBtu, which would equate to a realized production price of $4.10/MMBtu, excluding basis and transportation.

Conversely, if natural gas prices rebound and the October NYMEX natural gas futures expire at $5.00/MMBtu, Big Green will realize a gain of $1.75/MMBtu on the $3.25 call option and a loss of $0.75/MMBtu on the $4.25 swap for a net gain of $0.85/MMBtu, including the call option cost of $0.15/MMBtu, excluding basis and transportation.

As opposed to the passive hedging practices utilized by many producers, an active hedging program can provide producers with an opportunity to reduce risk and lock in hedging gains, while retaining the ability to prosper in both low and high price environments, often at a very low cost.

As can be seen in the above graph, by choosing to actively manage their hedging program by transforming their $4.25 fixed price swap into a $3.25 synthetic put option, Big Green will benefit in the following ways:

While many exploration and production companies hedge their production with a "set it and forget it" mentality, this example identifies how an active hedging strategy can potentially provide producers with an opportunity to reduce their risk as well as lock in gains on in-the-money positions.

This post is the second in a series on passive vs. active energy hedging strategies. The first post in the series can be accessed via the following link: Passive vs. Active Energy Hedging Strategies -Part I.

3 min read

As all large fuel consuming companies know all too well, fuel prices have increased significantly over the past few months. After posting 2013 lows...

2 min read

This post is the second in our series covering energy hedging myths. The first post, Energy Hedging Myths Demystified - Part I, is available via this

4 min read

This post is the third of several in a series covering the basics of energy hedging. Here are the links to the first and second posts, which covered