4 min read

The Fundamentals of Oil & Gas Hedging - Put Options

This post is the third in a series where we are exploring how oil and gas producers can hedge their exposure to crude oil, natural gas and NGL...

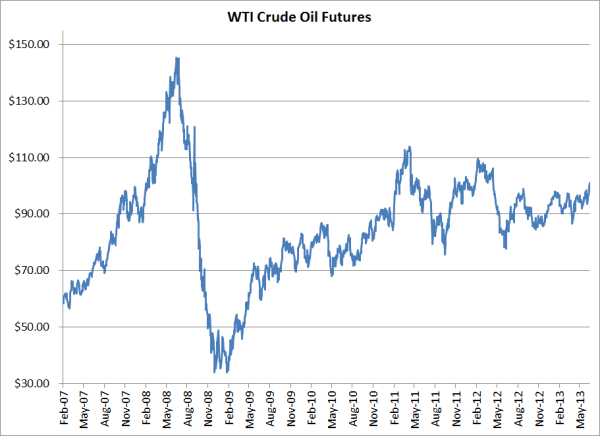

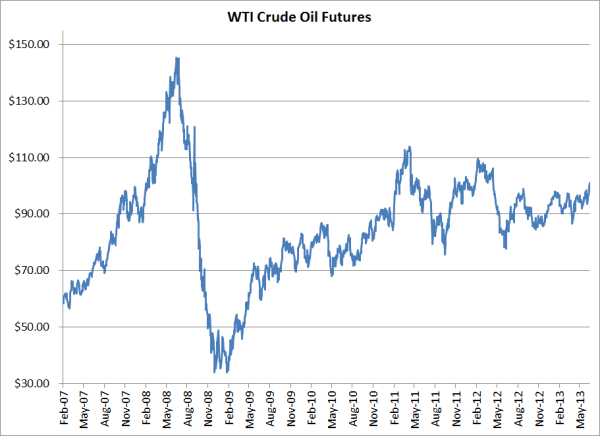

After trading as low as $92.67 only two weeks ago, WTI Crude oil prices have risen significantly since then, trading above $100/BBL for the only the second time in the past year on concerns that the situation in Egypt will lead to supply issues. Why Egypt? Approximately 2.25MM barrels of crude oil flow though the Suez Canal and the Suez-Mediterranean Pipeline on a daily basis. While the majority of the crude that flows through Egypt is linked to Brent crude oil prices, rather than WTI, the combination of the uncertainty of the situation, an expected decline in US crude oil stocks when the EIA releases their latest report later this morning and a shortened holiday week in the US, are proving to be enough for the market to forget its concerns about weak oil demand.

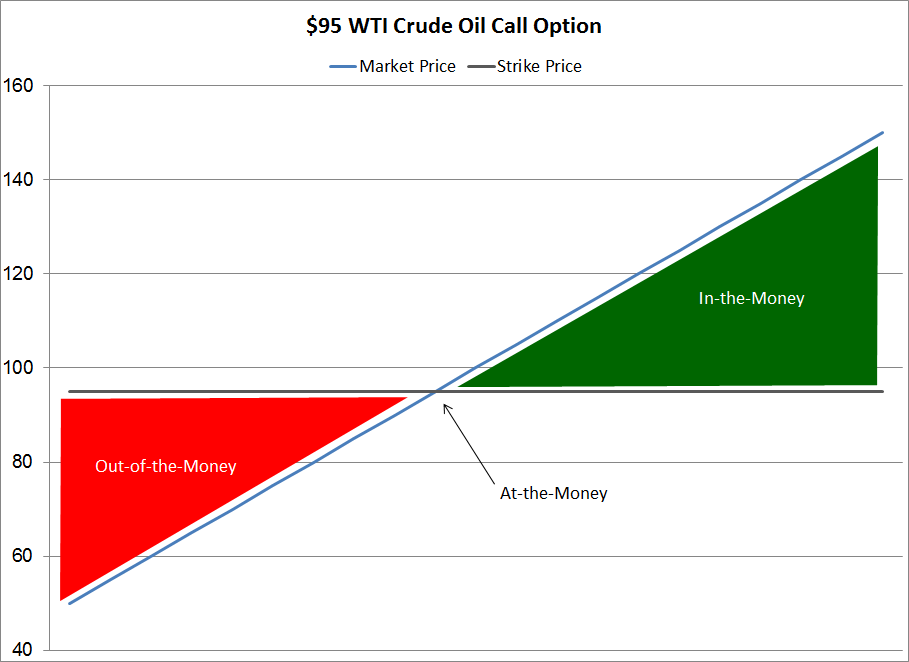

So what are both oil consumers and producers to do at this point in time? Keep calm and carry on. Perhaps better said, carry on hedging as dictated by your hedging policy and risk tolerance. While the move towards $150/BBL in late 2008 was a surprise to many, the subsequent collapse that followed was an even greater surprise to most. In extremely "noisy" markets such as the current environment, buying options should be the hedging strategy of choice for most companies. While options are never free, even more so when volatility is high, when you hedge by purchasing options (or by purchasing spreads on options in the form of a bull call spread), you position yourself to have your cake and eat it too as your worst case scenario is known at the time the trade is executed.

For companies with a limited risk tolerance, low cost, conservative option hedging strategies do exist and are arguably very well suited for an environment such as the current one. It all comes down to determining your risk tolerance and how much capital you are willing to allocate to your hedging strategy. At the risk of stating the obvious, an explosive, short-term price spike is a much greater risk to fuel consumers than a steady, gradual increase. The reason being, the latter scenario is one in which consumers can, at least to an extent, pass on the higher costs their customers. Clearly that isn't the case in the former situation as very few companies have the ability to pass on 100% of a rapid and steed increase in fuel prices.

If you're a fuel consumer interested in learning more about conservative, option-based hedging strategies see the following posts:

A Beginners Guide to Fuel Hedging With Call Options

Fuel Hedging In Volatile Markets With Call Option Spreads

Similarly, when oil prices spike, producers who engage in hedging can find themselves in an equally unpleasant situation as well. How? The majority of oil producers hedge with fixed price swaps and/or costless collars, which do provide them with a hedge against lower prices but also expose them to higher prices. While it's safe to say that producer hedging losses are offset by higher revenues, due to the fact that hedging losses are often realized sooner than increasing revenues, oil prices which increase significantly over a short period often result in oil producers experiencing short term cash flow issues.

If you're an oil producer interested in learning more about conservative, option-based hedging strategies see the following posts:

The Fundamentals of Oil & Gas Hedging With Put Options

A Low Cost Natural Gas Hedging Strategy For E&P Companies

In summary, in a environment filled with geopolitical and economic uncertainty, conservative, option-based hedging strategies will tend to be the most palatable strategies for many companies as they provide not only "insurance" against adverse price moves but also cash flow certainty and peace of mind.

4 min read

This post is the third in a series where we are exploring how oil and gas producers can hedge their exposure to crude oil, natural gas and NGL...

4 min read

How Do Sovereign Energy Companies Influence Commodity Markets and Expectations? Petróleos Mexicanos (Pemex) makes headlines about once per year...

2 min read

We're often asked to explain what determines the price of crude oil (as well as bunker fuel, diesel fuel, gasoil, gasoline and jet fuel) options....