3 min read

A Beginners Guide to Fuel Hedging - Swaps

This post is the second in a series where we are explaining the most common fuel hedging strategies utilized by commercial and industrial fuel...

This post is the third in a series where are addressing the fuel hedging strategies most utilized by commercial and industrial fuel consumers. The previous posts in the series explained fuel hedging with futures (Part I: A Beginners Guide to Fuel Hedging - Futures and swaps (Part II: A Beginners Guide to Fuel Hedging - Swaps.

Now we are going to examine how fuel consumers can hedge with a strategy known as a call option. An option is contract which provides the buyer of the contract the right, but not the obligation, to purchase or sell a particular amount of a specific commodity (or the financial equivalent thereof) on or before a specific date or period of time.

There are two primary types of options, call options (also referred to as a caps or ceilings) and put options (also referred to as floors). A call option provides the buyer of a call option with a hedge against rising prices. Conversely, a put option provides the buyer of the put option with a hedge against declining prices.

As an example of how a fuel consumer (also referred to in the industry as an “end-user”) can utilize call options to hedge their exposure to fuel prices, let's assume that you're a service company with a large fleet of vehicles, whose primary fuel is ultra-low sulfur diesel. Let's further assume that your company has determined (ideally via a formal hedging policy) hedging strategy you can employ is purchasing options as doing so ensures that your company will never be subject to hedging losses. For sake of simplicity, let's also assume that you are looking to hedge diesel fuel which you will consume September. Lastly, let’s assume that you budget allows you to spend up to $0.0750/gallon on option premiums.

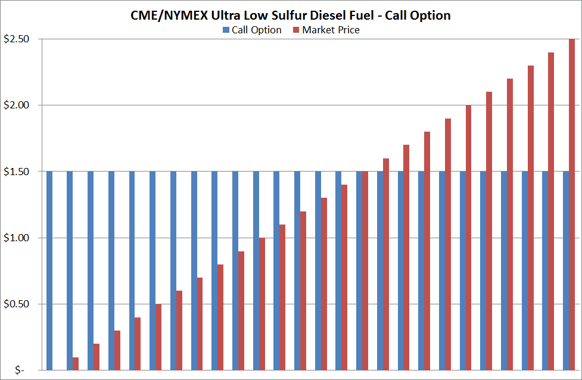

In order to do accomplish the previously mentioned goals, your ideal hedging strategy would be to purchase a September CME/NYMEX ULSD average price call option (also called an APO or Asian call option) from one of your counter-parties. Given that your budget provides you with up to $0.0750/gallon to spend on option premiums, you decide to purchase a September CME/NYMEX ULSD APO call option at a strike of $1.50/gallon and a premium cost of $0.0625/gallon. For reference, the currently underlying price for a September CME/NYMEX ULSD swap is approximately $1.46/gallon, as such the $1.50 call option is $0.04/gallon out-of-the-money ($1.50-$1.46=$0.04).

Now let's look at how this call option would impact your fuel costs if CME/NYMEX ULSD prices during September average both higher and lower than your strike price of $1.50/gallon.

In the first case, let's assume that CME/NYMEX ULSD prices for each business day in September average $1.85/gallon. In this case, your ULSD call option would provide you with a hedging gain $0.75/gallon ($1.85-$1.50= $0.35). However, given that you paid $0.0625/gallon for the option premium, your net benefit from the option would be $0.2875/gallon ($0.35-$0.0625=$0.2875).

In the second case, let's assume that CME/NYMEX ULSD prices for each business day in September average $1.25/gallon. In this scenario, your call option would be "out-of-the-money" by $0.25 as your strike price is $1.50. As a result, you would not have a hedging gain on the option, nor would you incur a loss, which is the primary benefit of hedging with options. Furthermore, because ULSD prices are lower than your strike price, your actual fuel cost during the month of September (i.e. $1.25) plus the $0625/gallon you paid for the option, for a net cost of $1.3125.

As an aside, in a perfect world you will have a physical fuel supply contract which states that your fuel cost (independent of hedging) is based on the monthly average price of the CME/NYMEX ULSD futures during the month. As such, there would be a perfect correlation between your hedges and your fuel costs. If this indeed the case, when ULSD futures increase or decrease, your actual fuel cost would increase or decrease by the same amount. If this is not the case, you will need to address your basis risk.

The graph shown above indicates the "profile" of the $1.50 CME/NYMEX ULSD call option described in the example. As the graph shows, when CME/NYMEX ULSD prices average above $1.50, the buyer of the option incurs a hedging gain. On the contrary, when the CME/NYMEX ULSD futures average less than $1.50, the buyer of the option does not incur a hedging loss, the key benefit of hedging with options. Furthermore, regardless of whether the option settles in or out-of-the-money, the buyer needs to account for the option premium of $0.0625/gallon in their net cost, which is not reflected in the graph.

While many fuel consumers tend to hedge with futures or swaps, rather call options, due to upfront premium expense of purchasing options, it can't be denied that purchasing call options is often the most advantageous hedging strategy for fuel consumers as call options provide fuel consumers a hedge against higher prices while also providing the opportunity to benefit from lower prices, should prices settle below the strike price of the option. In summary, hedging with call options allows fuel consumers to have the best of both worlds – a hedge when prices are higher, market prices when prices are lower.

This post is the second in the series titled A Beginners Guide to Fuel Hedging. The other posts in the series can be found via the following links:

Part I: A Beginners Guide to Fuel Hedging - Futures

Part II: A Beginners Guide to Fuel Hedging - Swaps

Editor’s Note: The post was originally published in September 2012 and has recently been updated to reflect current market conditions.

3 min read

This post is the second in a series where we are explaining the most common fuel hedging strategies utilized by commercial and industrial fuel...

3 min read

As crude oil and refined products prices once again seem to be on an upward trend, we've received several requests for more information on the basics...

2 min read

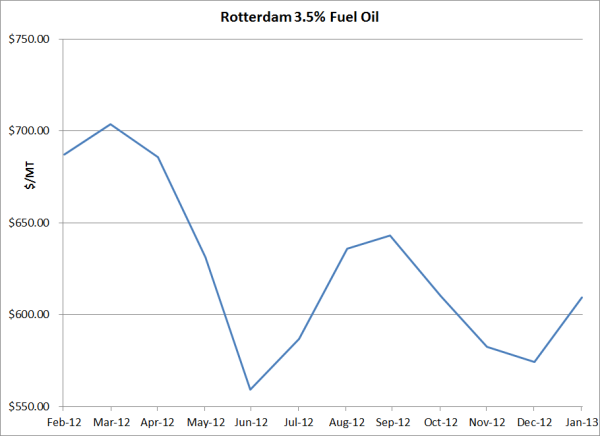

This post is the fourth in a series on hedging bunker fuel price risk. The first post in the series, An Introduction to Bunker Fuel Hedging,...