2 min read

April Energy Hedging Q&A - Costless Collars, Dodd-Frank & Basis Swaps

The following are our answers to your April energy hedging questions. If you're interested in reading our previous energy hedging questions and...

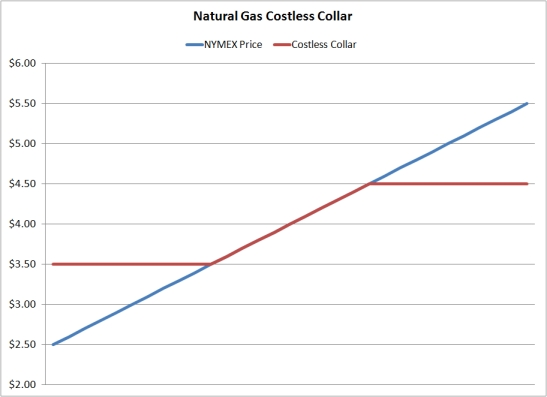

As has been the case many times in the past and certainly will be many times in the future, the debate regarding the advantages and disadvantages of hedging with costless collars is once again front and center.

If you've followed are blog for any period of time, you're well aware that we are of the opinion that costless collars can be a sound hedging strategy, when they are fully understood and utilized with caution and sound analysis. Why? It's really quite simple, costless collars are one of the leading causes of "unanticipated" hedging losses. Yes, you read that correctly. While costless collars are certainly viable hedging instruments, the potential negative implications (mark-to-market losses, negative cash flow, etc.) of being short an in-the-money- put option (in the case of a consumer) or call option (in the case of a producer) are often much greater than they are perceived to be at the time of execution.

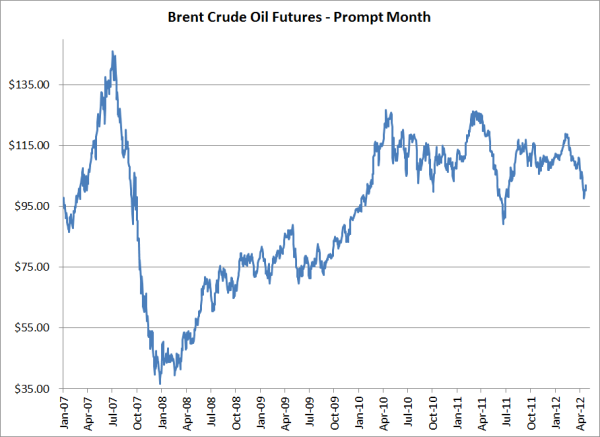

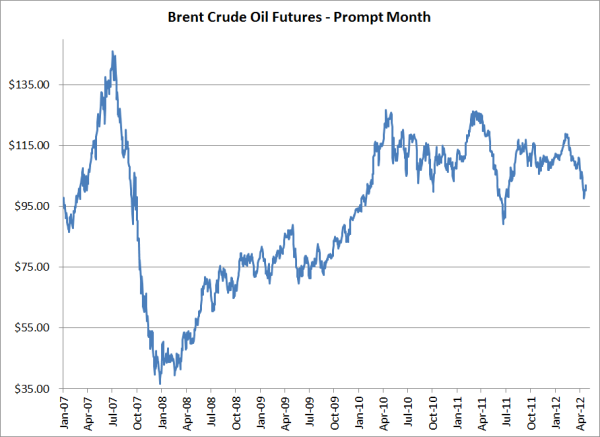

Consider the case of an oil (fuel) consumer who entered into a $130/$100 (long a $130 call option, short a $110 put option) Brent crude oil costless collar in early February. At the time, crude oil prices appeared rather strong having traded as low as $106.66/BBL in early December. As such, a $130/$110 costless collar may have appeared to be an attractive strategy to some oil consumers. However, from a statistical perspective, this shouldn't have been the case. While crude oil prices did indeed appear to be quite strong as they approached $120 in early February, proper analysis at the time would have shown that Brent hadn't traded at such a level since May 2012 and had traded in a rather narrow range for the previous five months. In addition, Brent has shown a rather strong mean reverting tendency for the better part of the past few years.

On the contrary, due to their being in the opposite situation, early February may have been an attractive opportunity for an oil producer to consider the opposite strategy, buying a $110 put option and selling a $130 call option.

So why do so many companies hedge with costless collars? For many it's the attraction of "free" optionality. But optionality is very rarely free, in fact it's often quite expensive. As a result, what most consider to be costless collars aren't truly costless, they are just structured such that the premium paid for the long option is offset by the premium received for the short option.

Further to this point, unless you request that they do so, many derivative marketers quote costless collars without mentioning the premium cost associated with each leg of the collar. If you do decide to hedge with costless collars, it's imperative that you know the true value of both options as doing so is the only proper way to determine if the prices (both the strike prices as well as the premiums) being quoted are competitive, let alone whether the option is indeed "costless".

Costless collars can certainly be a viable hedging strategy but given that they require one to sell an option, before you decide to hedge with costless collars, you need to obtain a solid understanding of what it means to be short an option (and to assume the risk of being short an option). Otherwise, you risk coming face to face with the previously mentioned, "unanticipated" losses which have surprised far too many companies.

2 min read

The following are our answers to your April energy hedging questions. If you're interested in reading our previous energy hedging questions and...

2 min read

Yesterday, CME Group (NYMEX) announced that it is increasing margin requirements for numerous energy products including crude oil, refined products...

2 min read

This post is the fifth, in a series, covering the basics of energy hedging. The first four posts in the series explained futures, swaps, options and...