2 min read

A Beginner's Guide to Crude Oil Options - Part III - Volatility

As we discussed A Beginner's Guide to Crude Oil Options - Part I & Part II, there are four primary factors that determine the price of crude oil, as...

2 min read

Mercatus Energy : Apr 17,2013

Are oil prices poised to collapse again, as they did in 2008? We don't claim to know the answer to such a question as doing so would require us to have the ability to accurately predict global, macroeconomic events, which is beyond difficult to do in a normal environment, let alone in the current environment. That being said, we do think it's a question that deserves serious consideration given the fragility of the global economy as well as recent decline in not only oil but other asset classes (i.e. gold, which has declined approximately 15% in less than one week) as well.

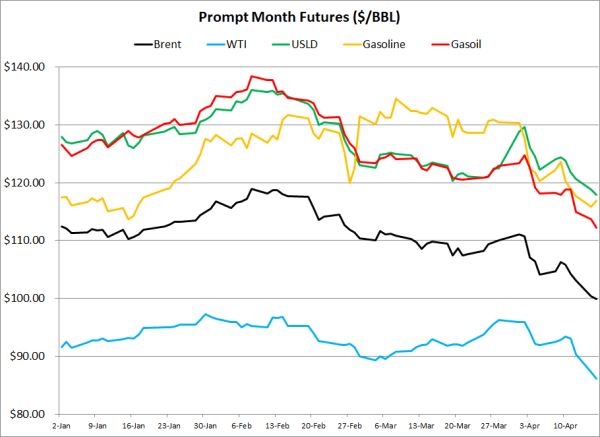

For those of you who haven't paid close attention to crude oil and refined product prices in recent months, Brent crude oil, WTI crude oil, ultra low sulfur diesel (formerly heating oil), gasoline and gasoil futures have all declined more than 10% from their year-to-date highs. Since peaking in late January to early February (with the exception of gasoline which peaked in early March) Brent, WTI, ULSD, gasoline and gasoil futures have declined 15.97%, 11.57%, 13.34%, 15.51% and 18.92%, respectively.

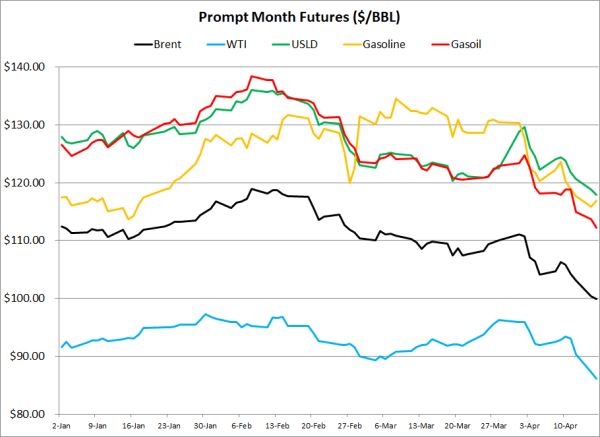

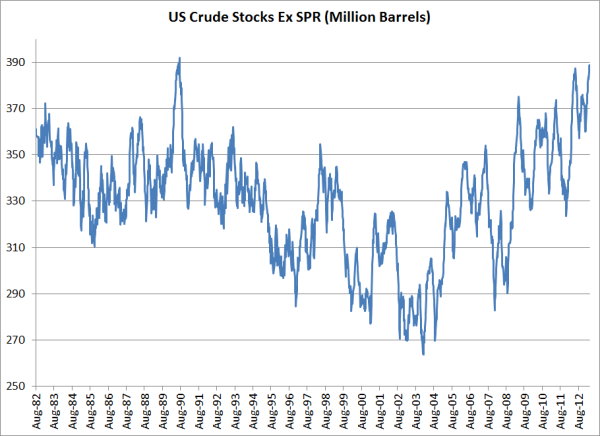

So what's driving prices lower? In short, rising crude oil stocks. Year-over-year, as of April 5th, crude oil stocks are up 6.49%. On the products side, gasoline stocks are up 2.17% while distillate stocks are down 14.46%. On the demand side of the equation, (also as of April 5) gasoline demand is down 2.35% while distillate demand is up 2.03%. In addition, since the beginning of the year, gasoline demand is up 5.37% while distillate demand has been quite strong, up 21.58%. Clearly the market appears to be quite focused on the ever growing crude oil stocks, despite increasing demand for both distillates and gasoline. At 388.774MM BBLs, crude oil stocks are at their highest level in nearly 23 years and third highest level since the inception of the EIA's data, which dates back to August 20, 1982.

So back to the question at hand, can your hedging strategies tolerate significantly lower oil prices? How can you know? For starters, we would suggest that you stress test your portfolio (which is something that should be done on a regular basis regardless of the current price environment) to determine how a significant price decline would impact your positions, as well as your credit lines and bottom line. This is especially important for companies that employ hedging strategies which could potentially subject them to significant downside price risk i.e. swaps and collars in the case of consumers, three-way collars in the case of producers, etc. While we aren't forecasting a steep decline in oil prices, such an occurrence shouldn't be ruled out given the fragile state of the global economy, even more so with crude oil stocks at their highest level since 1990.

In summary, most, if not all, companies will be very well served to take a closer look at their hedging strategies to determine how such strategies will perform if/when we experience a period of significantly lower oil prices, or worse, a repeat of anything remotely similar to 2008.

2 min read

As we discussed A Beginner's Guide to Crude Oil Options - Part I & Part II, there are four primary factors that determine the price of crude oil, as...

3 min read

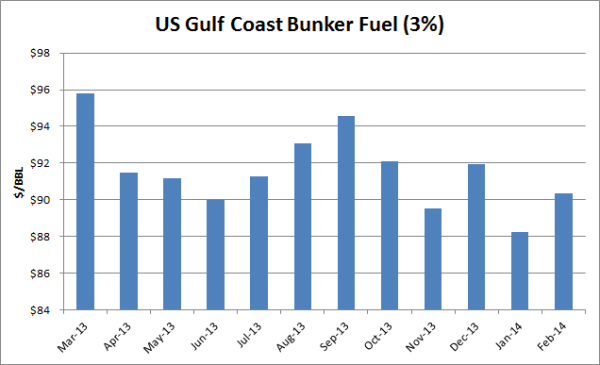

As many participants in the bunker fuel market are constantly seeking better strategies to hedge their exposure to fuel price risk, we wanted to...

3 min read

The prompt month NYMEX WTI contract settled at $107.26/bbl on June 20, 2014. That day would prove to be a major inflection point in the market. The...