3 min read

The Fundamentals of NGL & LPG Hedging Part II - Options

This post, which explores hedging NGLs with options, is the second post in a series of several where explaining some of the most common NGL hedging...

As the NGL (natural gas liquids) & LPG (liquefied petroleum gas) markets around the world continue to grow – and will do so for years to come - many companies, from consumers to producers, are starting to implement or upgrade their hedging and price risk management strategies. As such we thought it would be prudent to explore the various strategies that companies can utilize to hedge their NGL & LPG (propane, butane, ethane and natural gasoline) price exposure. This post is the first in a series where we'll explain the various NGL & LPG hedging strategies available to market participants.

The most common NGL & LPG hedging strategy is a strategy known as a fixed price swap. In short, a swap allows market participants to exchange a floating (index or market) price for a fixed price or vice versa. In addition to NGLs and other energy commodities, swaps are also utilized for hedging numerous other assets classes such as agriculture commodities, interest rates and foreign exchange. Swaps are called such as the buyers and sellers of swaps are exchanging or “swapping” cash flows.

Oil and gas producers often utilize swaps to “lock in” their NGL revenues and/or cash flow. Many midstream energy companies employ swaps to lock in their NGL profit margins. Similarly, many NGL traders and marketers (both wholesale and retail) utilize swaps to hedge their supply costs, inventories and fixed price sales. And last but certainly not least, many NGL consumers use swaps to fix their costs.

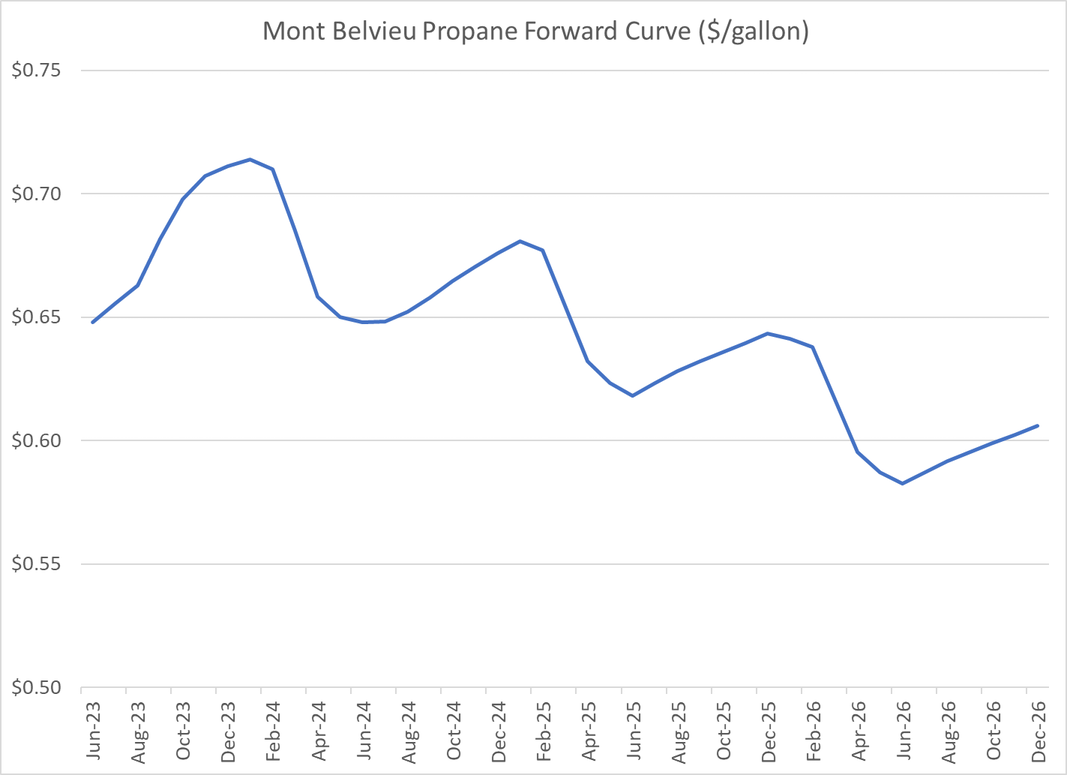

As an example, let’s explore how a commercial or industrial consumer can utilize a swap to hedge its anticipated propane consumption. Let's assume that you're a US company with operations in Texas looking to hedge 42,000 gallons - which is equivalent to 1,000 barrels and is the standard trading volume of propane and other NGLs in the US - of propane that you will consume in January. To hedge accomplish this, you could purchase a January Mont Belvieu (the industry benchmark for US Gulf Coast propane prices) propane swap from one of your counterparties. If you had purchased the swap at the close of business yesterday, the price would have been approximately $0.71375/gallon.

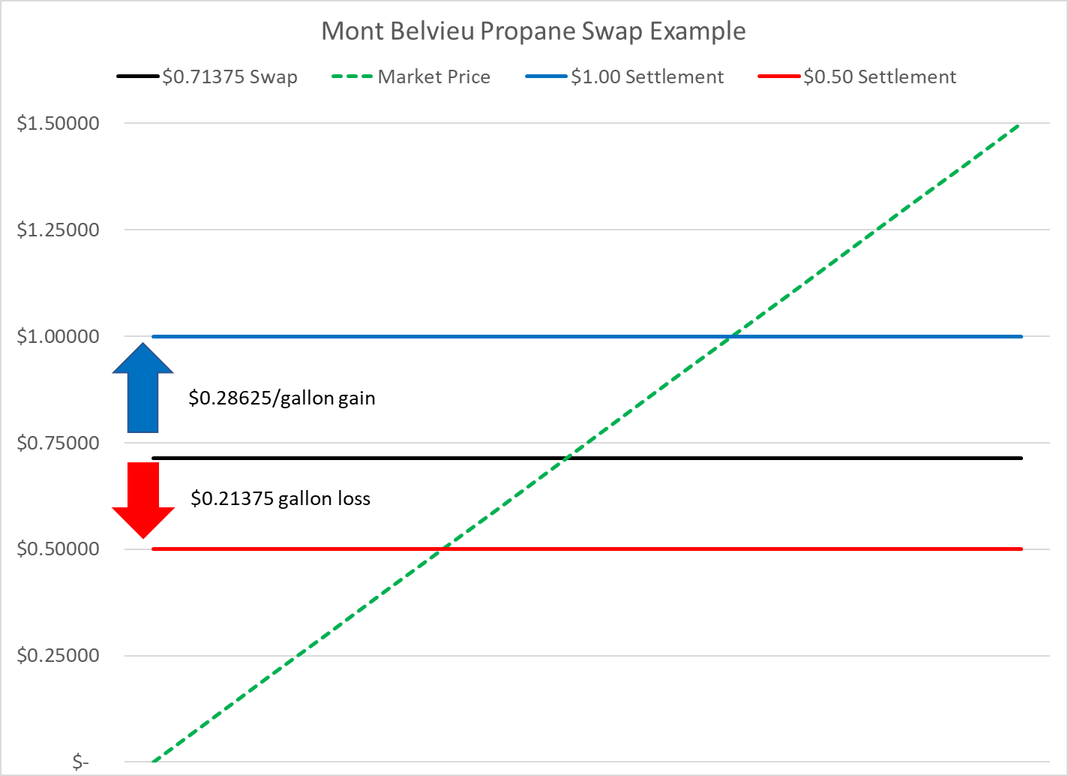

Now let's examine how your $0.71375/gallon propane swap would impact your January propane costs if January Mont Belvieu propane prices average both higher and lower than $0.71375/gallon.

In scenario A, let's assume that the average price for Mont Belvieu propane (as published by OPIS or another respective price reporting agency) each business day in January is $0.50/gallon. In this scenario, your swap would result in a hedging "loss" of $0.21375/gallon ($0.71375-$0.50) or $8.977.50 (42,000 gallons multiplied by $0.21375/gallon). As a result, you would owe your counterparty $8,977.50, which would offset the lower cost ($0.50/gallon) you would pay your supplier for the physical propane that you consume in January. The net cost you would pay your supplier would also include the fees they charge for transportation and distribution as well as their profit margin. If we assume that your transportation, distribution and profit margins add up to a sum of $0.75/gallon, your net cost in this scenario would be $1.46375/gallon ($0.50 gross cost + $0.21375 hedge loss + $0.75 supplier fees).

In scenario B, let's assume that the average price for Mont Belvieu propane (as published by OPIS or another respective price reporting agency) each business day in January is $1.00/gallon.

In this scenario, your swap would result in a hedging "gain" of $0.28625/gallon ($1.00 - 0.71375) or $12,022.50 (42,000 gallons multiplied by $0.28625/gallon). As a result, your counterparty would owe you $12,022.50, which would offset the higher cost ($1.00/gallon) you would pay your supplier for the physical propane that you consume in January. Again, the net cost you would pay your supplier would also include the fees they charge for transportation and distribution as well as their profit margin. Again, if we assume that your supplier charges you $0.75/gallon for their fees and margins, your net cost in this scenario would be $1.46375/gallon ($1.00 gross cost - $0.28625 hedge gain + $0.75 supplier fees).

As you can see, by purchasing the swap, you fixed your January propane cost at $0.71375/gallon gross or $1.46375/gallon net (which includes your supplier’s transportation and distribution fees as well as their profit margin which we the sum of the three to be $0.75/gallon), which allows you to know that your propane cost in January would be $1.46375/gallon (assuming you have negotiated a fixed margin with your supplier) regardless of whether propane prices increase or decrease between the time you by the swap and the end of January.

If the price of propane declines relative to the price of the swap, the loss on the swap offsets the lower gross cost you pay to your supplier. On the other hand, if the price of propane increases relative to the price of the swap, the gain on the swap is offset by the higher gross cost you pay to your supplier. While this example focuses on how a commercial or industrial propane consumer can utilize swaps to hedge their propane price risk, the same methodology can also be used to hedge other NGLs and LPGs such as ethane, butane and natural gasoline.

While this example explores hedging propane from the perspective of a consumer, the opposite methodology - selling rather than buying a swap - is regularly used by oil and gas producers, as well as other market participants such as traders, to hedge their exposure to propane and other NGL/LPG prices.

This article is the first in a series on NGL & LPG hedging. The subsequent articles can be found via the following links:

3 min read

This post, which explores hedging NGLs with options, is the second post in a series of several where explaining some of the most common NGL hedging...

3 min read

This article is the third in a series covering the most common hedging strategies utilized by market participants in the NGL (propane, butane, ethane...

2 min read

Once again, it's time for the monthly energy hedging Q&A. If you would like to pose a question for next month's Q&A, please contact us or leave a...