3 min read

Oil & Gas Hedging Without Futures, Swaps & Options

Financial derivatives do not always provide satisfactory risk mitigation. Your risk profile may be more deeply exposed to risks beyond commodity...

This post is the first in a series where we explore the most common strategies utilized by market participants – in these examples we will focus on producers and consumers – in the oil and gas markets. While the series focuses on crude oil and natural gas, the same or similar methodologies apply to most energy commodity markets, except for electricity markets, which are structured quite differently due to the unique nature of electricity markets.

In the energy markets there are six primary energy futures contracts, four of which are traded on the CME Group’s New York Mercatus Exchange (NYMEX): WTI crude oil, Henry Hub natural gas, NY Harbor ultra-low sulfur diesel (formerly heating oil) and RBOB gasoline and two of which are traded on the IntercontinentalExchange (ICE): Brent crude oil and gasoil.

A futures contract gives the buyer of the contract the right and obligation, to buy the underlying commodity at the price at which he buys the futures contract. Conversely, a futures contract gives the seller of the contract, the right and obligation, to sell the underlying commodity at the price at which he sells the futures contract. However, in practice, very few commodity futures contracts result in delivery, most are utilized for hedging or speculation and are sold or bought back – the latter occurs when the initial transaction is a sale rather than a purchase - prior to expiration.

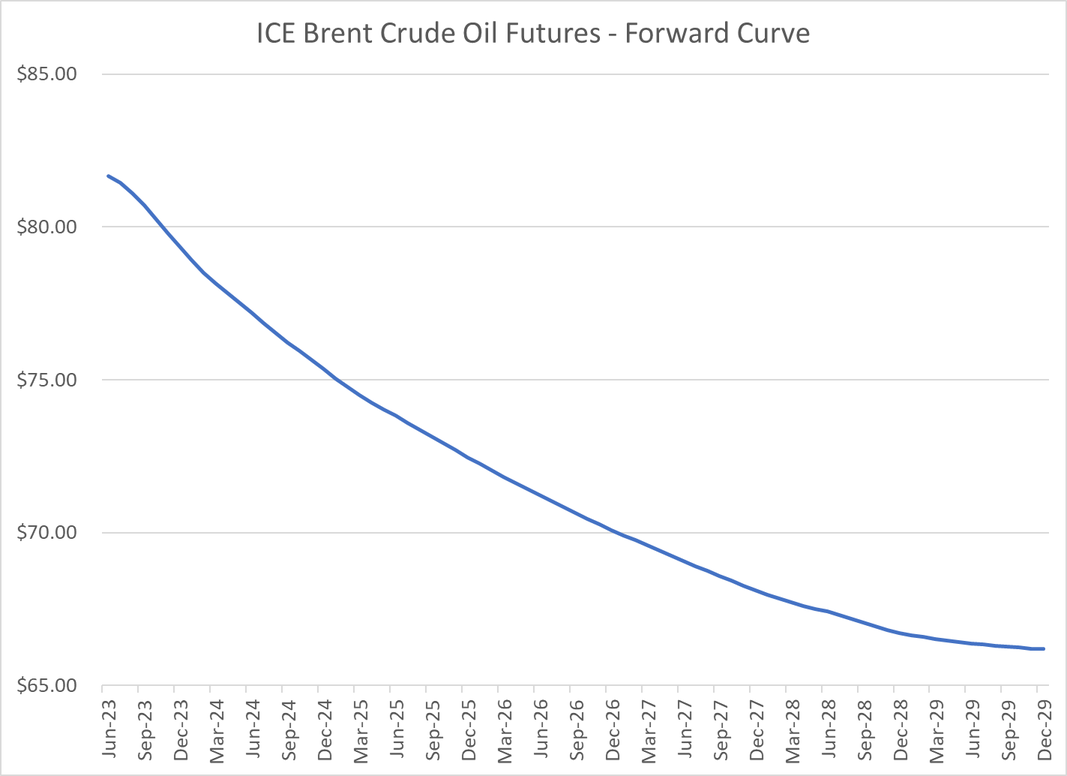

So how can an oil and gas producer utilize futures contracts to hedge their exposure to volatile oil and gas prices? As an example, let's assume that you are a crude oil producer who wants to hedge the price of your future crude oil production. For sake of simplicity, let's assume that you are looking to hedge (by "fixing" or "locking" in the price) your July crude oil production. To hedge this production with futures, you could sell (short) a September ICE Brent crude oil futures contract. We are using ICE Brent futures in this example as ICE Brent is the global benchmark for crude oil however, most producers in the Americas would be likely be inclined to utilize NYMEX WTI futures rather than ICE Brent futures.

Furthermore, you would sell the September, rather than the July or August, futures contract because the September futures contract expires at the end of the July production month. Per the contract specifications for ICE Brent crude oil, "Trading shall cease at the end of the designated settlement period on the last Business Day of the second month preceding the relevant contract month (e.g. the September contract month will expire on the last Business Day of July)". The fact that the futures contract expires on the last business day of the month, rather than being based on a monthly average price as would be ideal given that oil and gas are produced and consumed daily, is the reason many oil and gas producers hedge with swaps or their exchange cleared look-a-likes offer by exchanges such as ICE and NYMEX. We’ll also address the calendar mismatches, known as calendar basis risk in trading jargon, in more depth in another post in the not-too-distant future.

For sake of this example, let's assume that to hedge your July production that you simply sold one September ICE Brent crude oil futures contract. If you had done so Friday, based on the closing price of September ICE Brent crude oil futures, you would have hedged your July production at approximately $80.70/BBL.

Let's now assume that it is July 31, the expiration date of the September ICE Brent crude oil futures contract. Because you do not want to make delivery of the futures contract, you buy back the September futures contract at the prevailing market price to close out your position.

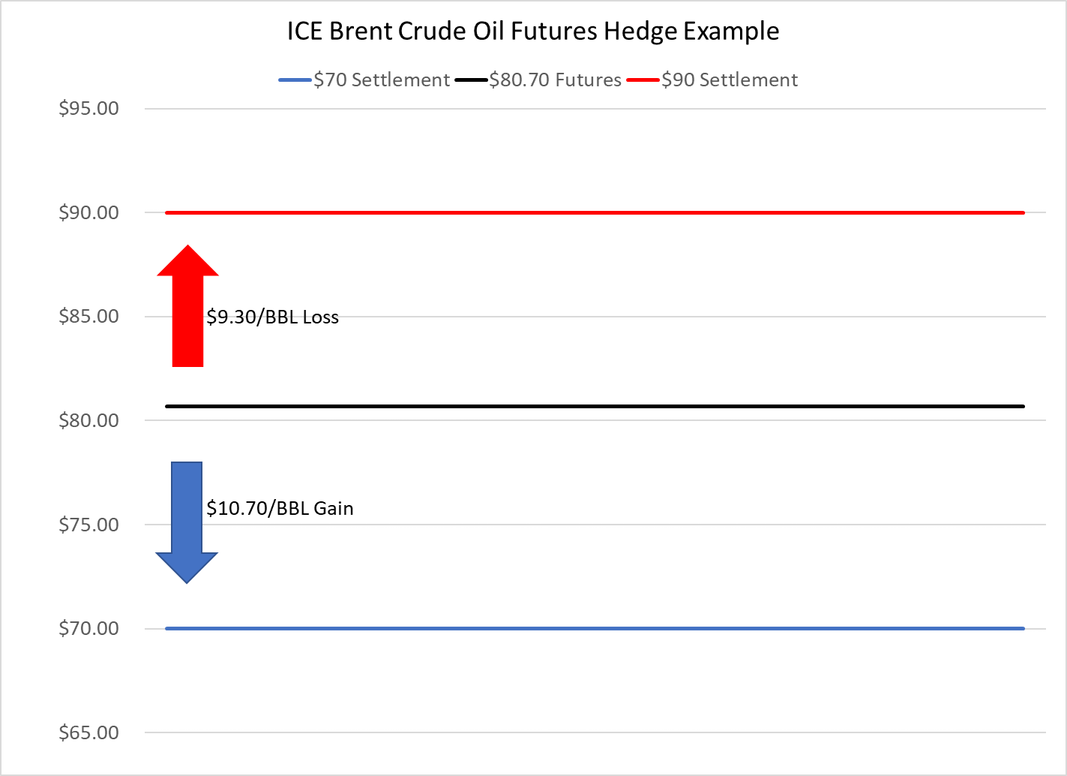

To compare how your strategy will work if the September crude oil futures contract settles at prices both above and below your price of $80.70, let's examine the following two scenarios.

In the first scenario, let's assume that the prevailing market price, at which you buy back the September Brent crude oil futures contract, is $90/BBL, which is $9.30/BBL higher than the price at which you sold the futures contract. In this scenario, you would receive approximately $90/BBL for your July crude oil production. However, your net revenue would be $80.70, the price at which you originally sold the futures contract, excluding the locational and quality basis differentials, if applicable, as well as gathering and transportation fees, etc. This is because you would incur a loss of $9.30/BBL ($90.00 - $80.70 = $9.30) on the futures contract.

In the second scenario, let's assume that the prevailing market price, at which you buy back the September Brent crude oil futures contract, is $70/BBL, which is $10.70/BBL lower than the price at which you sold the futures contract. In this scenario, you would receive approximately $70/BBL for your July crude oil production. However, your net revenue would be approximately $80.70/BBL, again excluding the basis differentials, gathering and transportation fees, etc. This is because you would incur a gain of $10.70/BBL ($80.70- $70.00 = $10.70) on the futures contract.

While there are numerous variables that must be considered before you hedge your crude oil or natural gas or NGL production with futures, the basic methodology is rather simple: if you are an oil and gas producer and need or want to hedge your exposure to crude oil, natural gas or NGL prices, you can do so by selling (short) a futures contract. On the other hand, if you are an oil and gas consumer and need or want to hedge your exposure to oil and gas commodity prices, you can do so by buying (long) a futures contract.

Finally, while this example addressed how a crude oil producer can hedge with futures, one can employ similar methodologies to hedge the production of other commodities as well.

This post is the first in a series on hedging crude oil, natural gas and natural gas liquids production. The subsequent posts can be viewed via the following links:

The Fundamentals of Oil & Gas Hedging - Swaps

3 min read

Financial derivatives do not always provide satisfactory risk mitigation. Your risk profile may be more deeply exposed to risks beyond commodity...

3 min read

In the previous post in this series, The Fundamentals of Oil & Gas Hedging with Futures, we explored how an oil and gas producer can hedge their...

3 min read

This post is the fourth in a series where we are exploring (no pun intended) how oil and gas producers can hedge their exposure to crude oil,...