3 min read

Bunker Fuel Hedging & Price Risk Management - Three-Way Collars

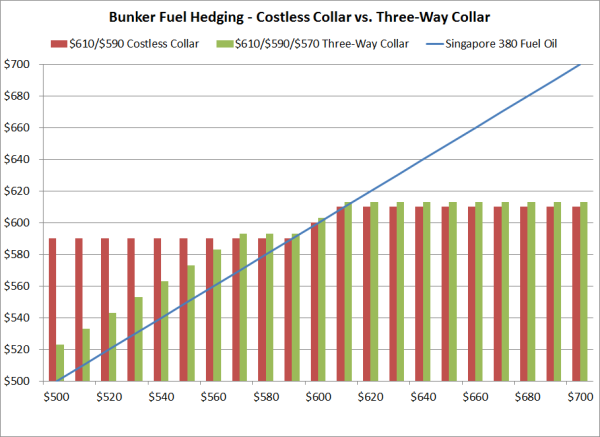

In recent weeks, we've spoken with many bunker fuel consumers (cruise lines, shipping companies, etc.) who are seeking "more creative" hedging...

2 min read

Mercatus Energy : Jan 24,2013

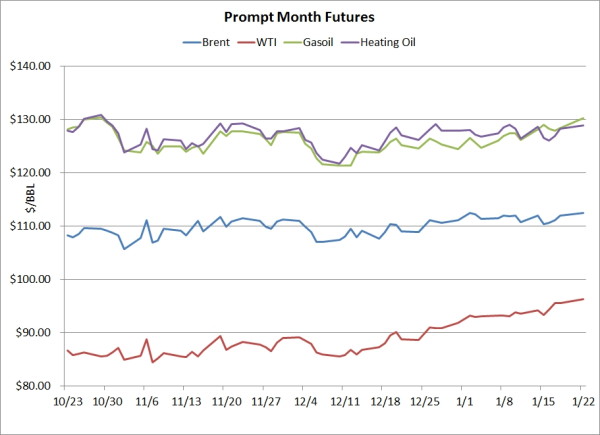

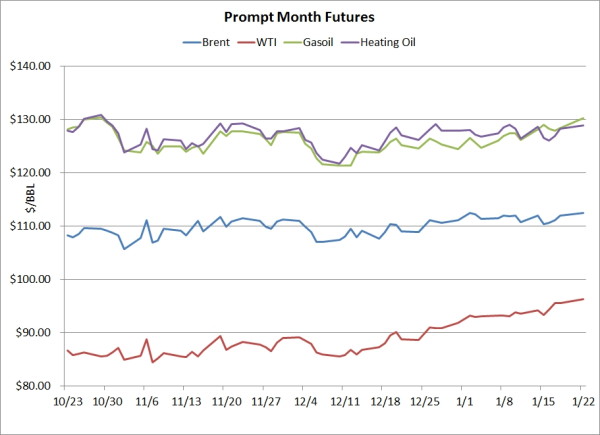

Over the course of the past three months, the prompt month Brent, WTI, gasoil and heating oil futures have averaged daily changes of $1.02/BBL, $0.86/BBL, $7.31/MT and $0.03/Gal, respectively. As is often the case when companies are feeling the impact of short-term fuel price volatility, we've recently received several inquires from companies looking for cheap, low risk fuel hedging strategies.

So what strategies are available to companies looking for cheap, low risk hedging strategies against rising fuel prices? One such strategy is a bull call spread. A bull call spread is simply the combination of buying one call option, with a "low" strike price, and selling another call option, with a higher strike price.

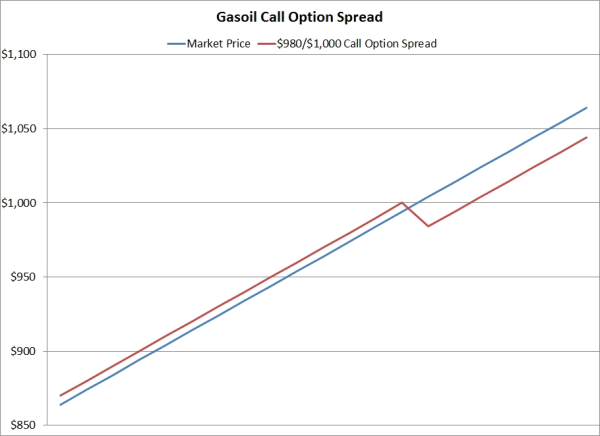

As an example, let's say you're looking to hedge your February 2013 fuel consumption in Western Europe. If we look at the forward market for February gasoil (the benchmark for European diesel and jet fuel) swaps, we see that they are currently trading in the $964/MT range. In addition, let's assume that your analysis indicates that you need to be protected against gasoil prices rising above $980/MT. Furthermore, as previously mentioned, you've determined that your strategy needs to be cheap and entail minimal risk.

One potential strategy to consider given your requirements is a February $980/$1,000 average price, bull call spread on gasoil, which would entail the combination of purchasing a $980 gasoil call option and selling a $1,000 gasoil call option. The net cost would be approximately $6/MT as the current prices for the $980 and $1,000 February, average price, gasoil call options are approximately $12/MT and $6/MT, respectively.

As the chart above shows, by hedging with a $980/$1,000 bull call spread, you are hedged against prices rising above $980/MT up to $1,000/MT, at which point your maximum gain on the position would be $20/MT. In addition, this position is a low risk hedging strategy as the position would not expose you to losses should gasoil prices decline. In fact, by hedging with a bull call spread, you would be well positioned to benefit from lower prices such that your net cost would simply be the monthly average price plus the $6/MT premium paid for the call option spread.

The "downside" to hedging with spreads on options is that your maximum potential gains are limited. As mentioned above, in this example, if gasoil prices during February average more than $1,000/MT your gain would be limited to $20/MT.

In summary, for companies seeking a cheap, low risk hedging strategy against rising prices, bull call spreads are one strategy to consider. In addition, this strategy is not limited to gasoil. Call option spreads are available on bunker fuel, crude oil, diesel fuel, gasoline, jet fuel, natural gas and natural gas liquids as well. Similarly, for companies seeking a cheap, low risk hedging strategy against declining prices, you may want to consider a bear put spread, a strategy we highlighted last November in a post titled A Low Cost Natural Gas Hedging Strategy For E&P Companies.

3 min read

In recent weeks, we've spoken with many bunker fuel consumers (cruise lines, shipping companies, etc.) who are seeking "more creative" hedging...

2 min read

As the energy markets continue to evolve, NYMEX and ICE continue to introduce new contracts to accommodate the changing marketplace. As such, we...

3 min read

While many consumers and politicians are hopeful that "anti-speculation" regulations (e.g. Dodd-Frank) will ultimately lead to lower gasoline prices...