2 min read

An Introduction to End-User Natural Gas Hedging - Part VI - Call Option Spreads

This post is the sixth in a series where we are exploring many of the hedging strategies which are available to commercial and industrial natural...

1 min read

Mercatus Energy : Jan 30,2012

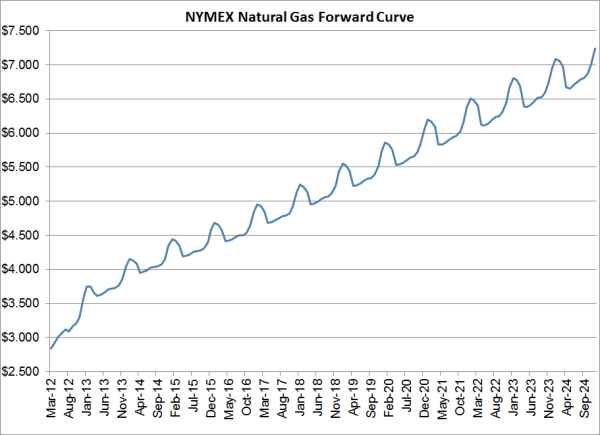

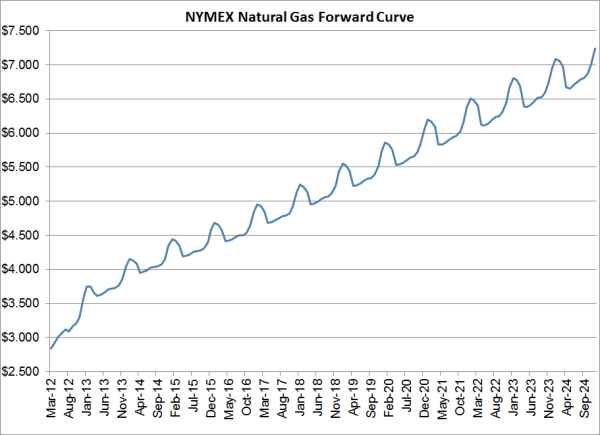

As natural gas prices remain depressed, despite the recent bounce, we are receiving numerous inquiries from natural gas producers asking for hedging advice given the current state of the market. Unfortunately, we don't have any magical hedging strategies that will result in $5.00 natural gas anytime soon (as the chart below shows, July 2018 is the first month that natural gas futures are trading above $5.00) but, there are some "creative" hedging options (no pun intended), that might be worth considering for some producers.

In our recent post titled A "Zero Cost" Gasoline Hedging Strategy For End-Users, we addressed how fuel consumers can utilize participating swaps as a "no cost" hedging strategy. Natural gas producers can also hedge via a similar strategy with participating swaps. Essentially, a producer participating swap works the exact opposite of a consumer participating swap, whereby the producer would be fully protected if natural gas prices settle below the price of the swap but, if natural gas prices settle higher than the price of the swap, they would participate in X% of the upside, as dictated by the participating percentage of the swap.

Another strategy that some producers may want to consider are bear put spreads, which we highlighted in the post titled A Low Cost Natural Gas Hedging Strategy For E&P Companies. In a nutshell, a bear put spread involves buying one put option (i.e. $3.25/MMbtu) and then selling another put option with a lower strike price (i.e. $3.00/MMbtu), which would provide the producer with a hedge from $3.25 to $3.00. However, if prices settle below $3.00, the producer's maximum gain on the hedge will be $0.25/MMbtu.

As we discussed in the post titled Hedging Crude Oil Via Deferred Cost Floors, deferred premium put options are another hedging strategy that some natural gas producers may want to consider, especially those who are "cash poor". Deferred premium put options are simply put options whose premium is financed, until expiration, by the seller of the option. So rather than paying the market price for the option, you would pay a slightly high price, which compensates the option seller for "lending" you the capital to purchase the put option.

Clearly there are numerous ways to get creative when it comes to hedging natural gas in a low price environment, but none of the above mentioned strategies are the perfect solution for all producers. If you'd like to discuss how we can assist you to develop an "outside the box" natural gas hedging strategy, give us a call.

2 min read

This post is the sixth in a series where we are exploring many of the hedging strategies which are available to commercial and industrial natural...

2 min read

Natural gas basis rarely receives the attention it deserves, but can make or break a commercial hedging, marketing or supply strategy. In West Texas,...

3 min read

This post was originally written many years ago but has been updated many times since as it is regularly referenced by various publications and...