1 min read

Creative Producer Hedging Strategies In A $3.00 Natural Gas Market

As natural gas prices remain depressed, despite the recent bounce, we are receiving numerous inquiries from natural gas producers asking for hedging...

2 min read

Mercatus Energy : Feb 23,2021

This post is the sixth in a series where we are exploring many of the hedging strategies which are available to commercial and industrial natural gas consumers. The first five posts can be found via the following links:

While futures, swaps, call options and costless collars are definitely the hedging strategies most often utilized by natural gas consumers, many companies are seeking a hedging strategy which will provide them with a relatively low cost, somewhat short-term hedge against potentially rising natural gas prices. If your company is searching for such a strategy, you might want to consider a long call option spread, also known as a bull call spread.

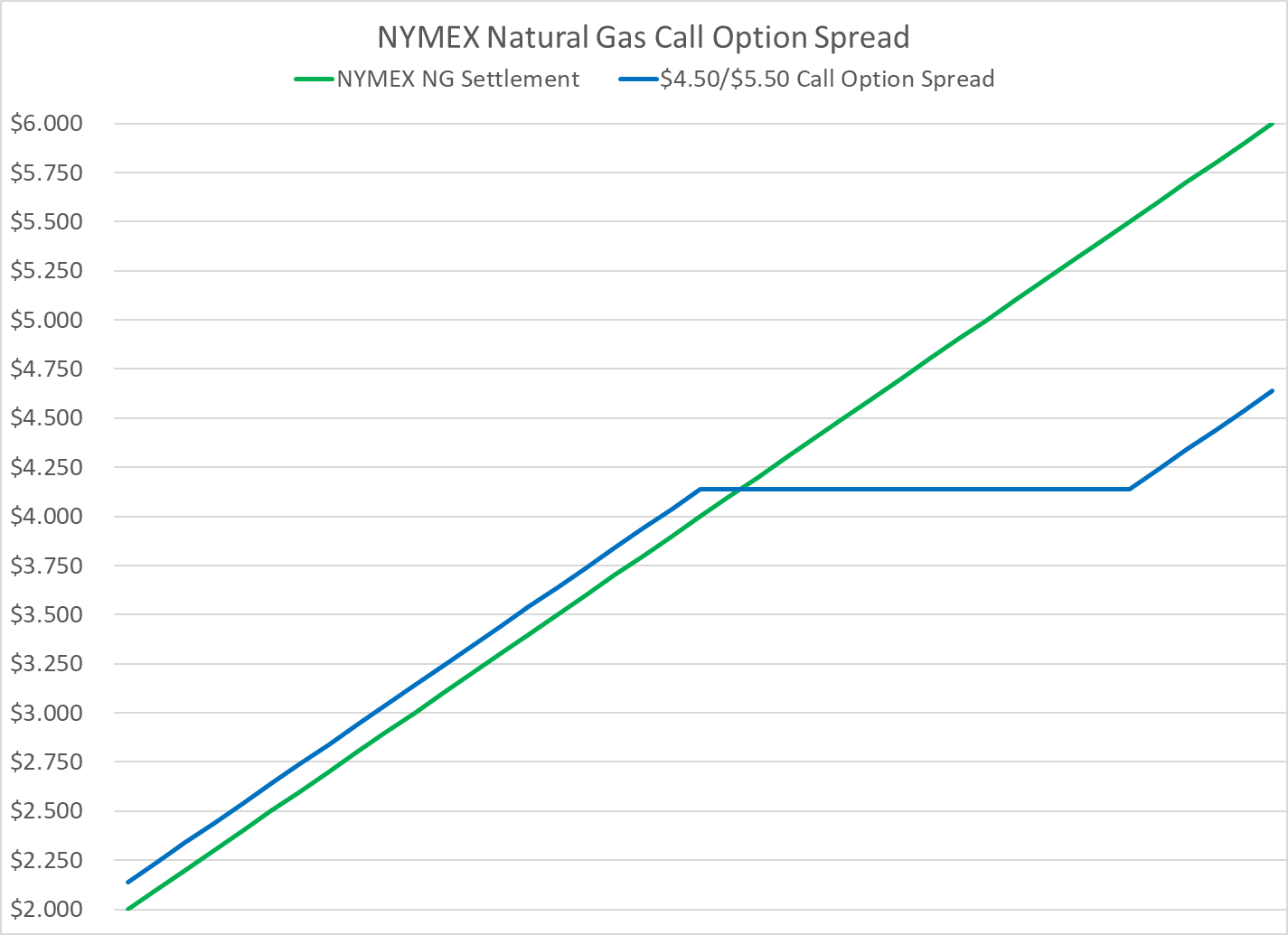

A long call option spread is simply the combination of purchasing a call option with a "lower" strike price and selling an additional call option with a strike price which is higher than that of the "lower" strike price option.

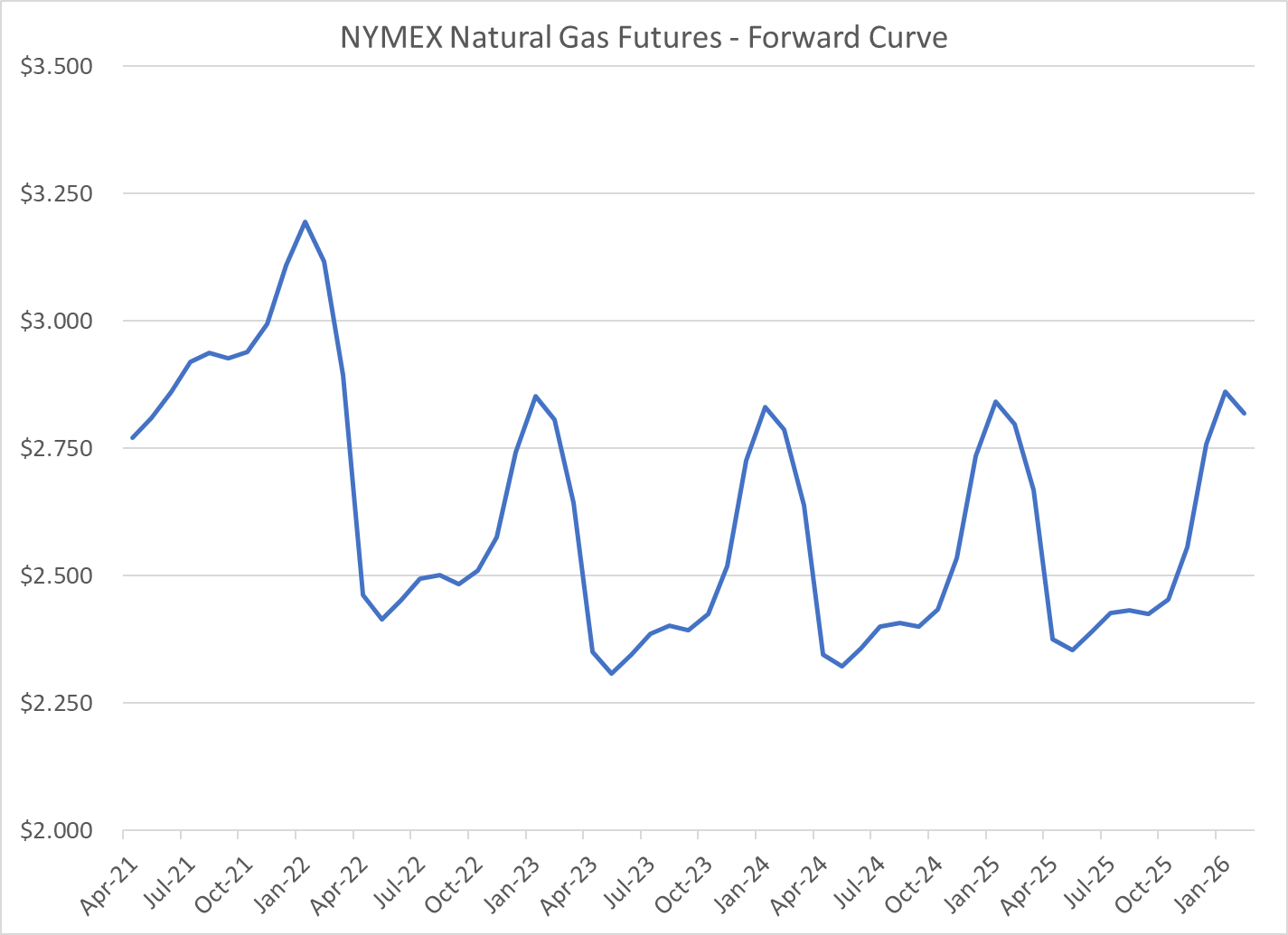

As an example, let's assume that your company has determined that you need to hedge your January natural gas price risk. In looking at the NYMEX natural gas forward curve, you see that the January futures are currently trading at approximately $3.195/MMBtu. In addition, you have determined that you would like to be hedged against NYMEX natural gas prices rising above $4.00/MMBtu. Lastly, you have determined that the most you can spend on an option premium is $0.15/MMBtu. Given these requirements, what call option spread strategy might be a good fit for you?

One potential strategy is to purchase a $4.00 January NYMEX natural gas call option which is trading for $0.2406/MMBtu and, to simultaneously sell a $5.50 January call option which is trading for $0.1023/MMBtu. The combination of these two options will provide you with a $4.00/$5.50 bull call spread for a net premium cost of $0.1383/MMBTU.

If you were to implement this strategy, you will have hedged yourself against January NYMEX natural gas prices rising above $4.00 to a maximum of $5.50 or $1.50/MMBtu. In addition, if the January NYMEX natural gas contract settles below $4.00/MMBtu, your physical cost of January natural gas will be the settlement price plus your net premium cost of $0.1383/MMBtu.

The risk, or limitation, of this strategy is that if January NYMEX natural gas prices rise above $5.50, the maximum gain on your hedge is limited to $1.50/MMBtu or $1.3617/MMBtu when accounting for your premium cost of $0.1383/MMBtu.

While bull call spreads (call option spreads) are a viable hedging strategy for companies seeking a relatively low cost natural gas hedging strategy, as previously noted, call option spreads only provide a limited hedge against rising natural gas prices, in the case of this example a maximum of $1.50/MMBtu. If, in this scenario, you will need to remain hedged above $5.50/MMBtu, you would likely want to consider hedging with futures, swaps or call options rather than the call option spread described in this post.

1 min read

As natural gas prices remain depressed, despite the recent bounce, we are receiving numerous inquiries from natural gas producers asking for hedging...

2 min read

Natural gas basis rarely receives the attention it deserves, but can make or break a commercial hedging, marketing or supply strategy. In West Texas,...

2 min read

According to an article published by Reuters on Friday, Dow Chemical is, "Considering a hedging program for the first time in a decade to lock in...