2 min read

The Top Eight: Keys to Energy Hedging Success

As energy trading and risk management advisors, we're often asked: What are the "big picture" keys to success as it relates to energy hedging and...

1 min read

Mercatus Energy : Aug 31,2011

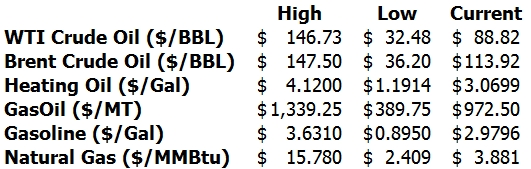

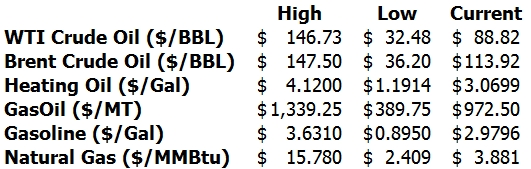

The argument for developing an effective energy hedging program has never been more compelling. As the following data shows (NYMEX and ICE futures), energy prices have been incredibly volatile over the past few years, with highs and lows varying by as much as a factor of six and a half in the case of natural gas.

This volatility necessitates that companies with significant energy price exposure develop a disciplined energy hedging program. The penalty for executed hedging decisions can be painful or worse. In recent years we have observed numerous companies fail or suffer significant losses as a direct result of the misapplication of energy hedging instruments as part of an ill-conceived hedging program (i.e. Semgroup).

Equally worrisome is the decision by some companies to abandon their hedging programs all together (i.e. US Airways). There's no questions that developing and managing an energy hedging program can be challenging, especially given the recent and current state of the financial markets and regulatory uncertainty, but it can't be debated that a sound hedging program protects companies from excessive exposure to energy price volatility. An effective energy hedging program can provide several key, strategic objectives:

Reduces the risk of unexpected losses:

Provides budget certainty:

Allows management to focus on core business:

The ability to hedge is a key tool available to management of energy producing and consuming companies. By following a disciplined risk management framework and sticking to strategies that management understands and is able to clearly communicate to key stakeholders, hedging does not have to be a source of confusion or uncertainty, quite the opposite in fact.

2 min read

As energy trading and risk management advisors, we're often asked: What are the "big picture" keys to success as it relates to energy hedging and...

2 min read

Since the NYMEX introduced the heating oil futures contract in 1978, energy consumers, producers, marketers, refiners and processors have had the...

1 min read

If you haven't perused our website recently, you may have missed the following: May 23rd & 25th Mike Corley will be delivering presentations on base...