2 min read

A Layman's Guide To Energy Hedging Disclosures & Transparency

Many companies today are faced with an unprecedented combination of economic, political and regulatory uncertainty. Exposure to energy price...

The concept of portfolio diversification is nothing new to anyone who has ever owned a stock, bond or mutual fund. One only has to "Google" the term and you'll receive about 1.5MM websites that discuss it in some shape or form. As most financial markets have shown in recent weeks, portfolio diversification is the key to doing well, relatively speaking at least, during periods of uncertainty. As most investors now realize, even a "conservative" portfolio, can be decimated when there is a complete lack of confidence in the financial markets.

While we often think of portfolio diversification as a strategy for managing stocks and bonds, diversification is a sound strategy when it comes to hedging energy price risk as well. By building a hedge portfolio that includes fixed priced instruments such as swaps, forwards or futures as well as options and index based price, price stability can be obtained while still exposure to potentially advantageous market prices. The aim of a diversified energy hedging portfolio, then, is to determine the optimal mix and application of hedging instruments to support the objectives of the hedger, be it a producer, end-user or marketer.

A portfolio that is 100% index based (meaning all sales or purchases are made at the prevailing market price) would ensure exposure to current market prices, but provide no means of protecting against increasing volatility. The other side of the coin—100% fixed price contracts, would ensure price stability, but provide no opportunity to benefit should prices become advantageous (increasing in the case of a producer, decreasing in the case of a consumer). The question then becomes: What is the right mix? Most energy producers and consumers should opt for a diversified portfolio that falls somewhere between the two extremes, while still providing price stability.

The first step in developing a diversified hedge portfolio is outlining your overall hedging objectives. An industrial energy consumer may be budget-driven, choosing to protect the budget by entering into long-term fixed-price contracts. A fuel marketer may rely more on index pricing because of competitive concerns. An oil and gas producer may choose to buy put options which provide them with price certainty should prices decline while still allowing advantageous participation should prices rise.

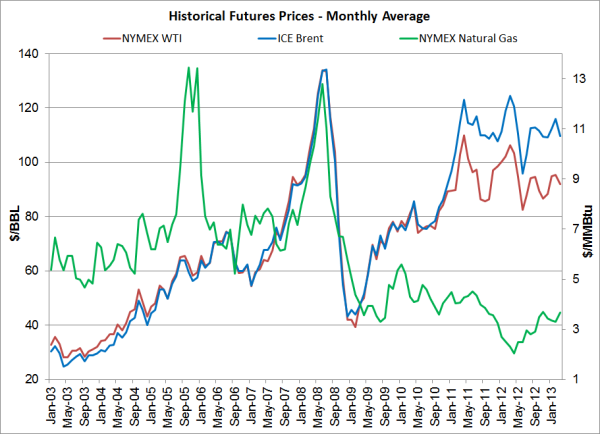

The second step is understanding that volatility has become a pervasive characteristic of the energy markets and that locking in good "value" (often defined as outperforming a historical benchmark or budget number) continues to be a difficult task. For an energy consumer, a higher-priced environment could dictate a greater reliance on options (hedging instruments that provide upside protection and allow for some participation if prices decline). Similarly, Low prices in the forward price curve would encourage an oil and gas producer to lean more heavily towards options than they might in a high prices environment.

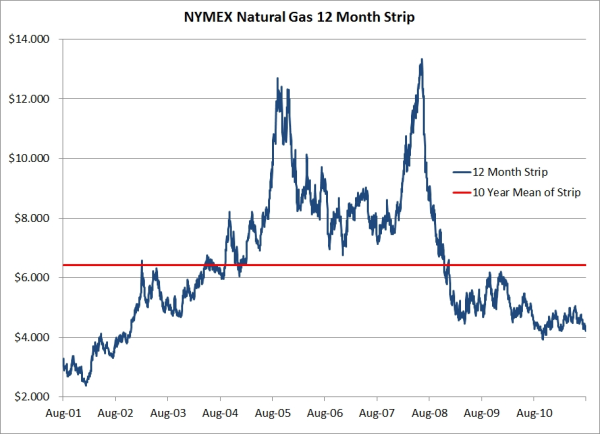

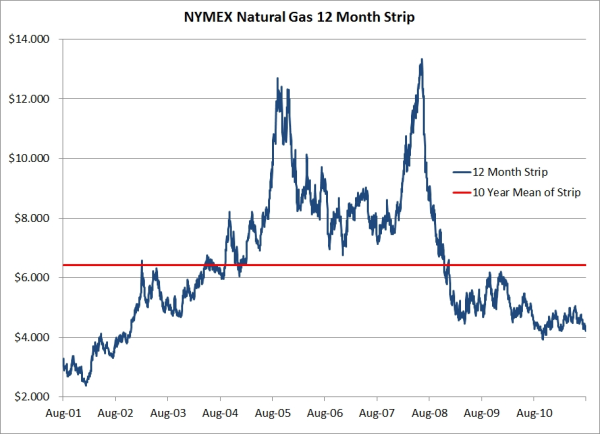

If we look at it from the perspective of a large natural gas consumer, in the current price environment, portfolio diversification would dictate a higher percentage of fixed coverage as natural gas prices are at the lower end of historic price distribution ($4.215 for the next twelve months is under the historic mean of $6.418 by ~34% percent and represents "good value"). If that same twelve-month strip price was above say, $8.00, a lower percentage of fixed coverage would be desirable, with option positions making up the majority of the overall hedge portfolio. Some exposure to index buying could be maintained as well. This higher percentage of option and index positions would allow for downside participation in the event of lower prices (as the $8 price is significantly higher than the historic average of $6.418, a decline would be a strong probability at some point in time). By implementing price targets based on historic "value" or set budget/rates, a natural gas end-user can employ portfolio diversification to stabilize costs and reduce volatility.

If we look at it from the opposite view, that of a natural gas producer, in the current price environment, portfolio diversification would lead the producer towards a hedge portfolio with a higher percentage of options coverage ($4.215 for the next twelve months is well under the historic mean of $6.418 by ~34% percent and does NOT represent "good value" to the producer). If that same twelve-month strip price was above say, $8.00, the producer would want to obtain a larger percentage of fixed price coverage. Some exposure to put options, costless collars or index prices could be maintained as well. The higher percentage of option positions will provide the gas producer with side participation, in the event that natural gas prices increase at some point in the future. By implementing price targets based on historic "value" or budget targets, a natural gas producer can also employ portfolio diversification to stabilize revenues and reduce exposure to volatility.

The final piece in portfolio diversification is the timing of the application of when "value" buying or selling may be possible. Structuring a price-time matrix that allows for hedging targets from the current year through a number of years out allows for pricing opportunities to be executed in favorable markets, yet calls for a measure of coverage when prices are not attractive. In short, the latter, forces you to "cry uncle" and obtain at least some level of protection rather than riding out the storm and hoping for the best.

With the unprecedented volatility in energy markets, although much less so in natural gas, portfolio diversification has become a necessity for energy consumers and producers attempting to obtain price stability. Diversification of energy hedging instruments between fixed prices, options and index pricing is a practice that is gaining acceptance with senior management, investors and lenders. The key to successfully hedging with a diversified portfolio is the structure of the program and the discipline to follow the plan, even during times of high volatility and uncertainty.

2 min read

Many companies today are faced with an unprecedented combination of economic, political and regulatory uncertainty. Exposure to energy price...

2 min read

As energy trading and risk management advisors, we're often asked: What are the most common, "big picture" mistakes we see companies make when it...

3 min read

In our role as energy hedging advisors, we regularly receive inquires from companies who have had a difficult time, if not worse, in producing...