1 min read

Sell Crude Oil - Buy Natural Gas - Hedge or Widowmaker?

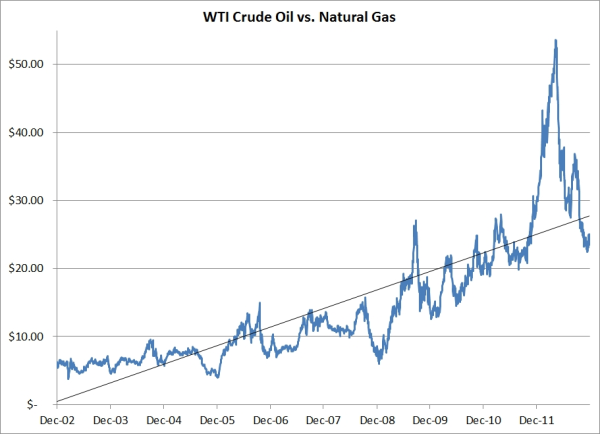

In June of 2011, in a post titled Energy Hedging Myths Demystified - Part I, we took addressed the age old theory that crude oil and natural gas...

One of the questions we quite often from both current and prospective clients is, "Is now a good time to be hedging natural gas"?

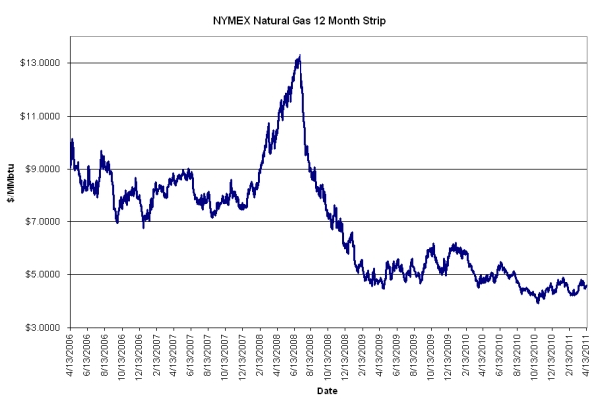

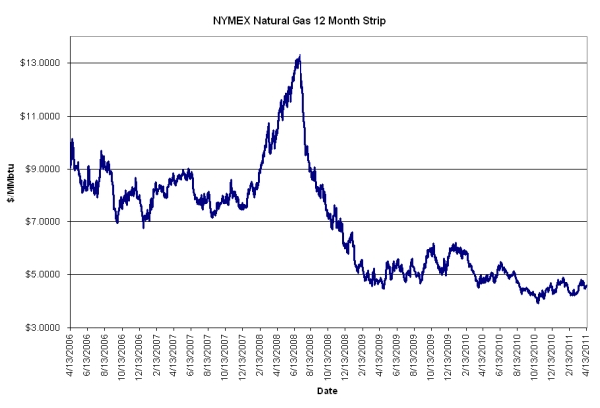

For starters, the answer depends on numerous variable. As of this moment, the NYMEX natural gas 12 month strip (one year forward curve) is at $4.60/MMbtu. As the chart below indicates, the one year forward curve traded over $13 in the summer of 2008 and as low as $3.93 last October.

If you're a consumer who isn't currently, comfortably hedged, you might be wondering whether your opportunity to buy at the bottom of the cycle.

If you're a producer who isn't currently, comfortably hedged, you're probably kicking yourself for not hedging significant future production volumes when the entire forward curve was trading at twice the price of where the one year forward curve is trading today.

Both situations beg the question, is now a good time to be hedging natural gas? As we have advocated more than a handful of times, the price of the forward curve shouldn't be the main determinant of when, how and/or if you hedge. You hedging decisions and strategies need to be based on your budgetary needs, risk tolerance, etc. and only then should consider the price of the forward curve.

To expand, if you're a consumer, where does a $4.60 swap or even a $5.00 call option put you in terms of your budget needs for the next year? What if natural gas prices continue to decline and the forward curve trades down to $4.00 or conversely increase to $5.50 before you execute a hedge? Can a $0.60/MMbtu difference give you a significant competitive advantage in your market or is knowing that you have hedged at a historically low price level which happens to be well below your budget numbers well worth the opportunity cost of prices declining further from here?

If you're a producer, where would a $4.60 swap put you in terms of having adequate working capital, being able to service your debt, or perhaps, to drill a new well (an oil well of course)? What about a $4.00 put option (floor)? If the forward curve were to jump up to $5.25 would you be kicking yourself for hedging or would you simply chalk it up as a cost of ensuring that you would survive if we're still in the early stages of a long cycle of low natural gas prices?

In summary, while we can analyze the fundamentals, technicals and even the geopolitics of the energy markets to death, trying to predict where natural gas prices will be three months from now, let alone a year, is a fool's game. Determining if, how and/or when to hedge needs to begin with your hedging/risk management goals and objectives, not your opinion on the forward price curve.

As our blog has recently celebrated it's fifteenth birthday (months, not years) we wanted to take a moment to ask you, our faithful readers, what you would like us to address, answer or explain in the coming weeks and months? Whether it's hedging, marketing, risk management, supply, trading or something else entirely, let us know and we'll do our best to address it. Regardless of who you are or where you're from, we're interested in hearing your opinion. You're welcome to comment below or send us an email via the form on our contact page.

1 min read

In June of 2011, in a post titled Energy Hedging Myths Demystified - Part I, we took addressed the age old theory that crude oil and natural gas...

2 min read

Natural gas basis rarely receives the attention it deserves, but can make or break a commercial hedging, marketing or supply strategy. In West Texas,...

2 min read

Given the significant volatility which is currently wreaking havoc on many energy market participants, especially natural gas producers, we thought...