2 min read

NYMEX Hedging Updates & New Micro Futures

As we noted in our May energy hedging Q&A, the NYMEX (CME) has been working on the transition process whereby the benchmark distillate (disel fuel,...

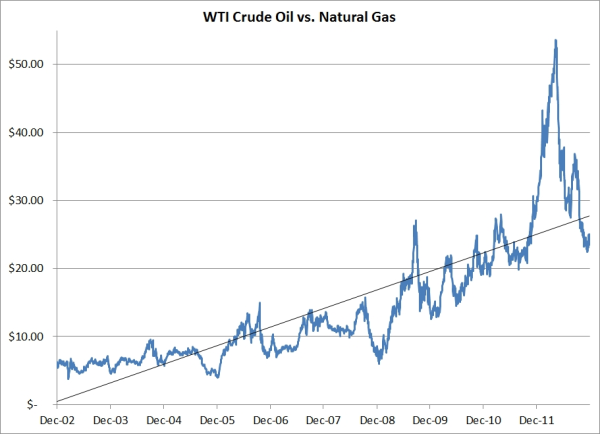

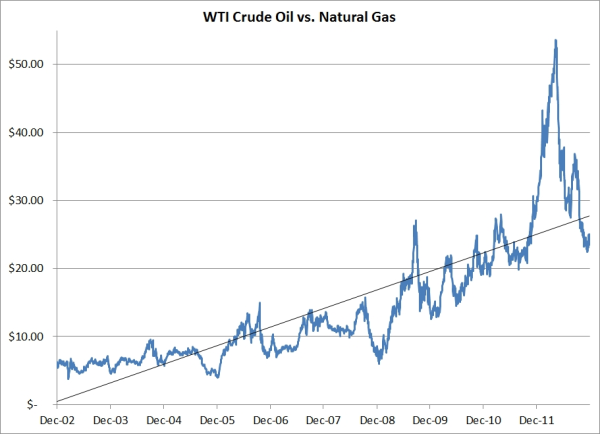

In June of 2011, in a post titled Energy Hedging Myths Demystified - Part I, we took addressed the age old theory that crude oil and natural gas should trade at a 6 to 1 ratio based on the BOE (barrel of oil equivalent) or BTU (British thermal unit) theory. At that time, the ratio on the prompt month futures was approximately $22, as the prompt month WTI crude oil futures contract was trading near $95.41/BBL and the prompt month natural gas futures contract was trading near $4.32/MMbtu.

As of the the close of business on Friday, the ratio on the prompt month futures settled at $24.20 with prompt month WTI crude oil futures settling at $85.93/BBL and prompt month natural gas futures contracts settling at $3.55/MMbtu.

So what does this have to do with hedging either crude oil or natural gas? Well, there's an age old, industry myth that, over the long run, the ratio should trade in the 6 to 1 range. Clearly, as the chart below indicates, while the ratio has declined significantly since peaking at $53.41 on April 17, at $24.20 it's no where near $6 nor will it be anytime in the near future. In fact, excluding December 24, 2008 (when the ratio hit $5.98 due to the collapse in WTI to $35.35), one has to travel back to January 3, 2006 to witness the ratio at below $6, at which time WTI was trading in the low $60's and natural gas was still trading above $10.

As was the case in June of 2011, we bring this myth to the surface once more as we are hearing that it is once again is being promoted in the market as a good idea for a 2013 hedging program. While the recent, relative strength in natural gas (having increased about $0.75 in the past few months) and the relative weakness in WTI crude oil (having decreased about $6 over the same time) could very well be the beginning of a trend, it would be virtually impossible to make a case for speculating with such a trade as part of a sound hedging program. There's a reason that such trades are often referred to as "widowmakers." And as the chart above indicates, this trade has definitely earned the right to be referred to as such many times in recent years.

2 min read

As we noted in our May energy hedging Q&A, the NYMEX (CME) has been working on the transition process whereby the benchmark distillate (disel fuel,...

4 min read

This post is the third in a series where we are exploring how oil and gas producers can hedge their exposure to crude oil, natural gas and NGL...

3 min read

This post was originally written many years ago but has been updated many times since as it is regularly referenced by various publications and...