4 min read

A Beginners Guide to Fuel Hedging with Futures

As companies begin to plan for the second half of the year, we’ve been fielding numerous inquiries from companies who are interested in developing a...

As we noted in our May energy hedging Q&A, the NYMEX (CME) has been working on the transition process whereby the benchmark distillate (disel fuel, jet fuel, kerosene, etc.) fuel hedging and trading product will be transitioning away heating oil to an ultra low sulfur product, specifically New York Harbor ultra low sulfur diesel (USLD). As of last Wednesday, one of the final boxes appears to have been ticked as the exchange announced that the last month the heating oil contract will be listed is April 2013. It was previously January 2013 but after hearing from numerous market participants (our shop being one of the more vocal participants) that forcing the transition during the middle of winter was not a good idea, the reason being that distillate futures, swaps and options (including heating oil futures) often trade in seasonal (winter, summer, etc.) strips. So what does this mean as it relates to fuel hedging and trading? Essentially, if you are looking to take a position beyond the April 2013 contract month (and probably several months earlier as liquidity in the final months is likely to be low), you'll need to consider that New York Harbor ultra-low sulfur diesel (ULSD) futures are going to be the new benchmark and act accordingly. Here is the link to the official NYMEX announcement (Special Executive Report 5854).

In somewhat related news, the NYMEX announced Friday (Special Executive Report 5857) that it is rolling out Micro WTI and Brent crude oil futures contracts. So what's a micro contract? One barrel. Yes, one barrel, as opposed to the normal contract volume of 1,000 barrels. We can think of several reasons the exchange would want to roll out a one barrel contract but there are two that make the most sense and happen to be related...

While these are the only "micro" contracts that have been annouced thus far, we expect that there will be more to come should these prove successful and/or should the CME/NYMEX see this as an opportunity to gain market share via Dodd-Frank.

4 min read

As companies begin to plan for the second half of the year, we’ve been fielding numerous inquiries from companies who are interested in developing a...

3 min read

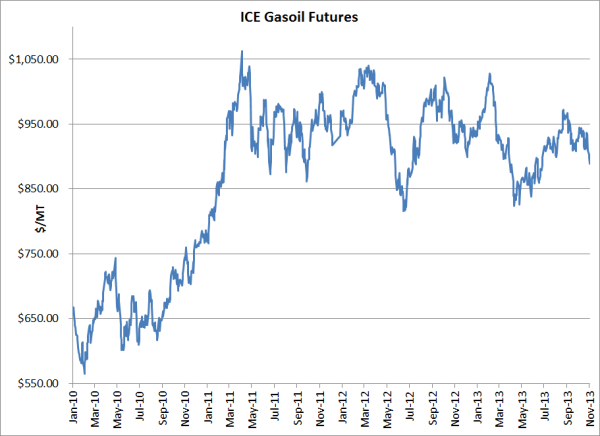

As many companies are beginning to plan for 2014, we have received quite a few inquiries from companies who are looking into hedging their gasoil...

2 min read

As the energy markets continue to evolve, NYMEX and ICE continue to introduce new contracts to accommodate the changing marketplace. As such, we...