2 min read

Has Your Gas Hedging Program Failed Because of Your Optimism?

Behavioral finance and economics researchers consistently confirm the consequences of personal bias in all forms of trading. Many firms make these...

2 min read

Mercatus Energy : Updated on March 30, 2017

As energy hedging advisors, natural gas consumers, producers and marketers regularly ask us for advice regarding hedging their natural gas price risk. As such, many companies want to know how they can determine the best time to hedge their natural gas price risk. In short, there is rarely a "best" time to hedging natural gas prices. A successful natural gas hedging program doesn't require an ability to forecast where natural gas will be trading a week, month or year from now. In fact, most companies who believe they have the ability to accurately forecast commodity prices often have less than desirable hedging results. Why? When their price forecasts are incorrect, they simply aren't prepared to deal with reality. The vast majority of the time, hedging success isn't the result of accurate price forecasting, rather it's more often than not the result of proper analysis, planning, execution and optimization.

As of the close of business yesterday, the NYMEX natural gas one year forward curve settled at $4.148/MMBtu. If a natural gas producer decided to hedge the vast majority of their production for the next year at $4.148 and prices average $5.00 over the next year, would we be able to say, in hindsight, that the company made a poor hedging decision? It all depends on what they were trying to accomplish when they executed the hedge at $4.148. If they were simply speculating that natural gas prices were going to decline over the next year, yes, it probably was a poor decision. On the other hand, what if hedge at $4.148 allowed the company to exceed their budget projections? Would we be able to say that hedging at $4.148 was a good decision? Most likely yes, as the hedge provided them with the ability to mitigate their exposure to potentially lower prices while also ensuring that they would exceed their budget projections.

What about a natural gas consumer who decided to hedge their natural gas price exposure for the next 12 months at $4.148/MMBtu? If prices decline over the course of the next year and average $3.00, in hindsight, would we be able to say that they made a poor hedging decision? What if locking in a price of $4.418 allowed them to ensure a larger than targeted profit margin? On the other hand, what if they hadn't hedged and natural gas prices increased to $5.00 or even higher? In many energy intensive industries, a lack of hedging could result in a significantly lower profit margin, or even a loss. While it may seem farfetched, in industries whose profit margins are highly dependent on the price of natural gas, an increase of $0.50/MMBtu can easily turn profits into losses.

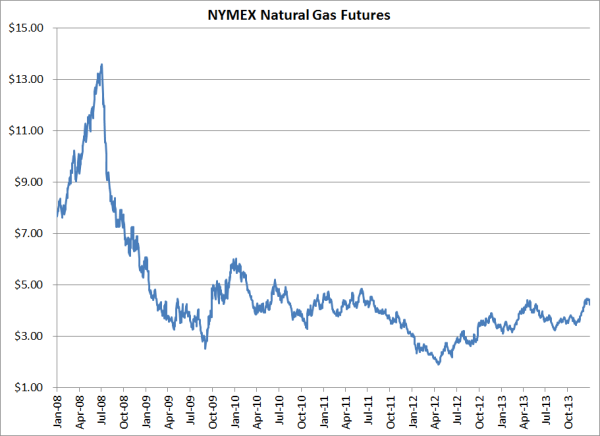

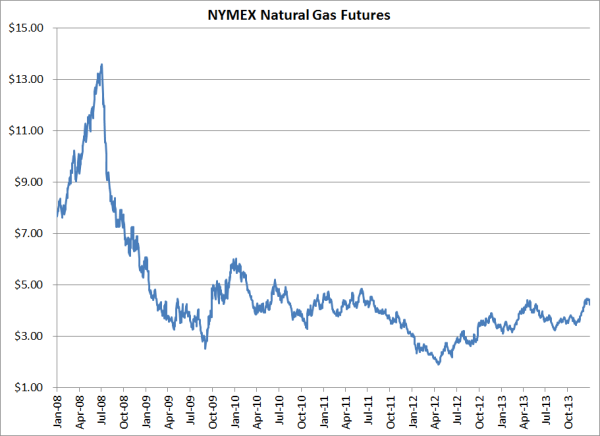

While natural gas futures have traded in a relatively narrow range in recent years, the past few months are a perfect example of how fast prices can change in a rather short period of time. As the chart above indicates, prompt month futures have increased more than a dollar since trading as low as $3.129 in August.

So, when is a good time to hedge your natural gas price risk? It's impossible to say without knowing the specifics of your situation but if you spend the time to do the necessary analysis, develop and implement a sound strategy(s) that is in line with your risk tolerance and look for opportunities to optimize your positions, our experience shows that your natural gas hedging program should, at the very least, produce results that meet your expectations.

2 min read

Behavioral finance and economics researchers consistently confirm the consequences of personal bias in all forms of trading. Many firms make these...

2 min read

Managing an energy budget can be a difficult task to say the least. Natural gas, fuel and electricity markets are complex and volatile. Not to...

1 min read

On Friday the EIA released their 2010 Natural Gas Year In Review, the agency's annual report on the natural gas market. A few of the highlights: ...