3 min read

An Introduction to End-User Natural Gas Hedging - Part II - Fixed Price Swaps

This post is the second in a series where we are exploring the various hedging strategies which are available to commercial and industrial natural...

On Friday the EIA released their 2010 Natural Gas Year In Review, the agency's annual report on the natural gas market. A few of the highlights:

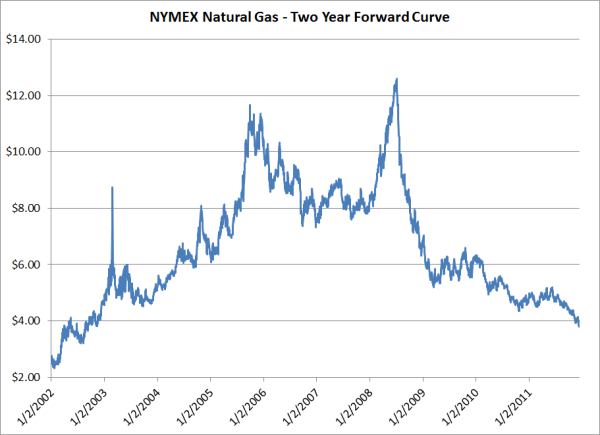

Given that the report is backward looking by nearly a year, here's our fifteen second summary of the current state of the domestic gas market as it relates to prices and hedging.

For those of you interested in perusing the EIA's entire report, you can access it via this link.

New to our blog? Check out the three most popular articles:

The Basics of Basis and Basis Risk

Hedging Oil & Gas With Three Way Collars

Fuel Hedging: A Competitive Analysis

3 min read

This post is the second in a series where we are exploring the various hedging strategies which are available to commercial and industrial natural...

3 min read

This article is the first in a series of several where we are exploring the various hedging strategies which are available to commercial and...

2 min read

As we discussed yesterday in The Layman's Guide to Natural Gas Options - Part II, there are four primary variables that affect the premium or price...