2 min read

Six Tips to Better Manage Your Energy Budget: Hedging & Procurement

Managing an energy budget can be a difficult task to say the least. Natural gas, fuel and electricity markets are complex and volatile. Not to...

2 min read

Mercatus Energy : May 19,2014

Behavioral finance and economics researchers consistently confirm the consequences of personal bias in all forms of trading. Many firms make these mistakes without even realizing that their hedging programs are unintentionally complicated or are actually a form of speculation rather than hedging. In addition, these errors commonly cause hedging programs to underperform, or worse, fail.

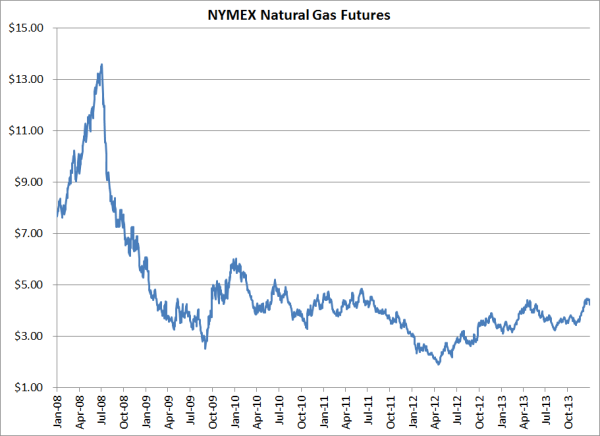

Managers tend to be overly optimistic. This is understandable. A reasonable person is unlikely commit to a capital project or strategy if he or she expects to fail. The risk associated with doing nothing, however, can be catastrophic. Some even consider doing nothing equivalent to taking a speculative position on the market. In this post, we consider the natural gas market’s two extremes over the last approximately ten years – low of the lows and high of the highs – and common market responses to prices that were arguably speculative.

Low of the Lows – “Prices Can’t Get Any Lower”

The prompt Henry Hub natural gas contract’s average close between January 3, 2012 and March 30, 2012 was $2.503/MMBtu. Many natural gas producers resisted hedging their near term production because they “didn’t want to lock in low prices.” This implies that they believed prices could not fall further. Just one month later, however, prompt natural gas recorded its lowest daily closing price in more than a decade, $1.907 (April 19, 2012).

Should producers have sold swaps to lock in $2.50 during 2012? Or even $1.907 on April 19, 2012? Of course not. These prices are sub-economic for many producers. Furthermore, to natural gas producers’ relief, natural gas prices have steadily risen from those lows to average around $4.70 during 2014. Doing nothing, however, left the natural gas producer unnecessarily exposed.

High of the Highs – “Prices Will Only Go Up"

Managerial optimism is not reserved for the “prices can’t get any lower” scenario. Behavioral research concludes there is a disproportionately optimistic bias when things are going well. Empirical analysis has shown this to result in a managerial tendency to overreact to positive news and underreact to negative news. For risk managers this can lead to a variety of risky behaviors. The most common of which is failing to prepare for cyclical downturns.

It may be a distant memory for many natural gas producers, but there was a time when natural gas prices consistently settled above $7.00/MMBtu. There was even a time when natural gas prices reached $15.00. Unbelievably, many producers refused to hedge during those times, just as they have during recent low-price environments. I remember advising producers who were afraid. They feared missing out on higher prices. They feared selling calls with strikes as high as $25.00/MMBtu because they were convinced natural gas prices would rise above $25.00 and they would have their gas called away.

Natural gas prices fell shortly thereafter for a variety of reasons (shale revolution, recession, weather) and as a result, many producer missed the opportunity to lock in double-digit natural gas prices. The fear of a missed opportunity crippled many risk managers and now they dream about a time when they had the opportunity to lock in $7.00 gas. It is easy to say that fear was misplaced in hindsight. It could have been just as easy to protect the company from falling prices without worrying about opportunity cost.

Overcoming Market Distractions and Avoiding Mistakes of Emotional Bias

We view these two scenarios as nearly identical failures in energy price risk management.

What, then, are we suggesting natural gas producers should have done? Most of our clients find the answer to be surprisingly simple: create a decision framework based on your company’s unique risk exposure and tolerance, budget requirements, and revenue goals. Then decide which tool(s) or instrument(s) is most appropriate for your firm’s specific circumstance, using prevailing market conditions as secondary inputs. A successful hedge program neither avoids nor pursues activity based solely on market conditions.

Hedging should not be a binary decision – to hedge or not to hedge. At regular intervals, companies should consider the market environment and have a specific set of rules that guide decisions based on company risk tolerance and corporate strategy. This is the best way to remove emotion and bias, as well as prevent speculative behavior that allows said emotion and bias to influence hedging decisions.

2 min read

Managing an energy budget can be a difficult task to say the least. Natural gas, fuel and electricity markets are complex and volatile. Not to...

2 min read

As energy hedging advisors, natural gas consumers, producers and marketers regularly ask us for advice regarding hedging their natural gas price...

3 min read

This post, which explores hedging NGLs with options, is the second post in a series of several where explaining some of the most common NGL hedging...