3 min read

Hedging Oil & Gas - Costless Collars vs Three-Way Collars

This post was originally written many years ago but has been updated many times since as it is regularly referenced by various publications and...

2 min read

Mercatus Energy : May 3,2023

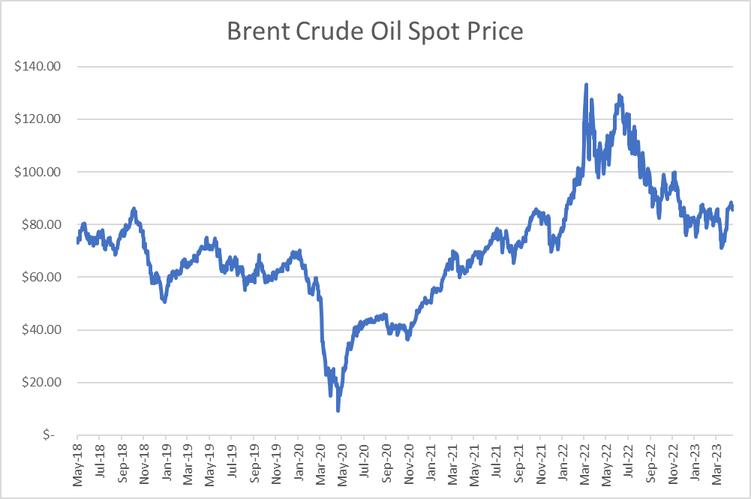

As a result of rising geopolitical tensions across the world – with many countries also facing key elections in the coming months- and fundamentals which have pushed crude and refined products significantly higher in the past few weeks, we have received numerous inquiries regarding potential hedging strategies which can provide short term protection against rising crude oil and refined product prices spike in the coming days and weeks.

As we've addressed in previous posts, call options, and to a lesser extent, call options spreads are often the best short-term hedging strategies for market participants seeking a hedge against a short-term price move. Given the volatile environment, call option premiums are rarely cheap, even more so in a bullish environment fueled by geopolitical concerns and interest rates which are much higher than they have been in recent years.

As an example, an at-the-money (at-the-money refers to an option whose strike price is the same as the current, respective forward price) $80.678 July 2023 Brent average price call option is currently trading for approximately $5.293/BBL. Similarly, a $90 July 2023 Brent average price call option is currently valued at about 1.87/BBL.

If you need a refresher on hedging with call options, see Hedging Bunker Fuel Price Risk With Call Options (while the focus is on bunker fuel, the methodology is essentially the same for crude oil, diesel fuel, gasoline, jet fuel, etc). Similarly, we provided an example of how you can hedge with call option spreads in the post titled Bunker Fuel Hedging With Call Option Spreads. In addition, for those of you who are long fixed price swaps which are in-the-money, the current environment might provide an ideal opportunity to reduce your risk by converting your swaps into synthetic call options (see Optimizing "In-The-Money" Fuel Hedging Strategies). Also, for those of you who have hedged with consumer costless collars which are in-the-money, now might be an ideal time to reduce your risk by eliminating or reducing your short put positions (see The Case For Employing A Dynamic Fuel Hedging Program).

On the other hand, for producers who are seeking to take advantage of the current price environment, there are also numerous potential strategies which may be of interest, not only in the short term but longer tenors as well. Put options with a relatively high strike price are more affordable than they have been in quite some time. As an example, a $75 July 2023 Brent average price put option is currently trading for approximately $3.061/BBL.

For a refresher on how producers can utilize put options, see The Fundamentals of Oil & Gas Hedging with Put Options. In addition, now could be a opportune time for producers to utilize what we like to call a conservative, three-way producer collar (see An Alternative Oil Hedging Strategy Using Three Way Collars). As opposed to a traditional, producer three-way collar (see Hedging Oil & Gas With Three Way Collars) which generally involve the producer buying a put option, selling a call option and selling a further out-of-the-money put option, a conservative, three-way producer collar involves buying a put option, selling a call option and buying a further out of the month call option. While the premium cost of the conservative strategy is higher than that of the traditional strategy three-way collar, it's a sound low risk strategy which can be put in place for a relatively low cost in a high price environment.

In summary, in a volatile geopolitical environment such as the current one, sound, low risk hedging strategies remain very available to market participants on both sides of the barrel. Lastly, the keys to successfully hedging in such an environment are really no different than any other environment. Utilize hedging strategies that you understand and are well aligned with both your goals and tolerance for risk. Doing otherwise could put you in the less than desirable situation which all too many hedgers, both consumers and producers, faced during the global financial crisis (see Will Your Hedging Strategies Sustain Another 2008-Like Crisis) as well as during the peak of the pandemic in 2020.

3 min read

This post was originally written many years ago but has been updated many times since as it is regularly referenced by various publications and...

3 min read

We've previously explored how both energy producers (see Hedging Oil Gas With Three Way Collars) and consumers (see Fuel Hedging With Three Way...

1 min read

While the basic fundamentals of energy hedging and risk management don't change very often, the prices at which one can hedge clearly do. As such,...