2 min read

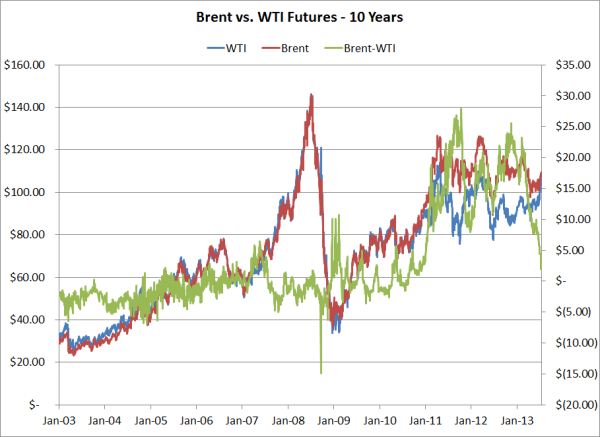

Caveat Emptor - Hedging Brent vs. WTI & Crack Spreads

As the Brent-WTI spread is trading at it's lowest level since November 2010 and crack spreads shifting as a result, it's time that we take another...

Given the recent increase in global fuel prices we thought it would be beneficial to explore how companies can optimize their existing fuel hedging positions. While the term optimize can mean many different things, in terms of fuel price risk management, we tend to think of it in the sense of improving your existing positions by reducing your risk and improving your liquidity.

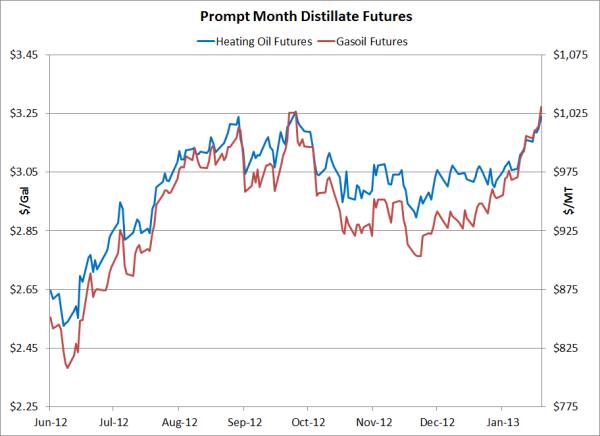

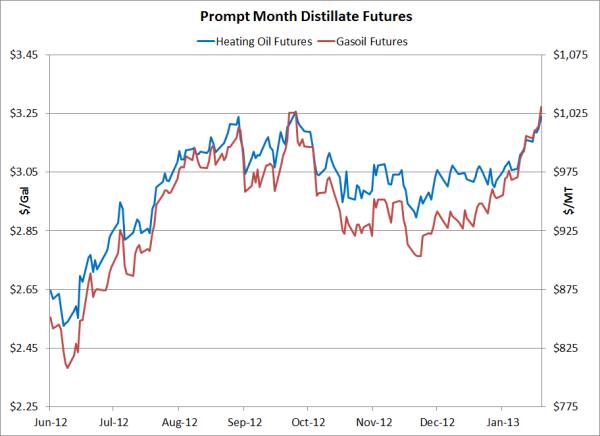

To put things in perspective, prompt month heating oil and gasoil futures, the global benchmarks for distillate fuels (diesel fuel, jet fuel, etc.) have increased by ~21% over the past eight months, rising from approximately $2.65/gallon and $850/MT to $3.35/gallon and $1,030/MT, respectively.

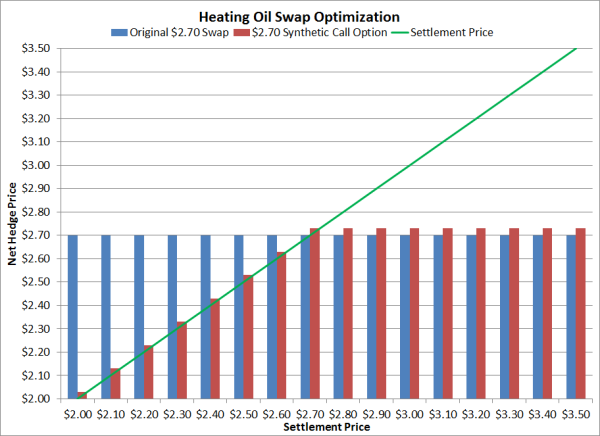

If a company entered into long-term hedges during the summer, when prices were lower, the subsequent price increase is providing a great opportunity to optimize said positions. As an example, let's consider the case of a transportation company who executed a 2013 heating oil swap in mid June at the prevailing market price of approximately $2.70/gallon. The remaining months of the swap (for simplicity let's consider March - December as the remaining months) are currently trading for approximately $3.15, a $0.45/gallon increase over the swap price of $2.70.

While it's safe to say the company should be satisfied with the current results of their swap, the price increase has provided them with a good opportunity to reduce their risk by optimizing their swap position. While this could easily be accomplished by selling their swap and pocketing the gain, or selling the swap and utilizing the gain to purchase a call option, there is a more effective strategy which results in better hedge at a lower cost. In trading lingo it's referred to as a synthetic call option. In practice, it is the combination of a swap and a put option, which when combined, creates a risk profile which is the same as a call option.

As an example, one way the company can optimize the $2.70 swap is by converting the swap into a $2.70 synthetic call option is by purchasing a $2.70 put option for a premium of $0.03/gallon. While the company's original swap protected them against heating oil prices settling above $2.70, they were also at risk should heating oil prices settle below $2.70. By converting their $2.70 swap into a $2.70 synthetic call option the company will retain their hedge at $2.70 while eliminating their risk below $2.70, at a cost of $0.03/gallon. In addition, by converting the swap into a synthetic call option, they will have eliminated their need to support the swap with cash, collateral or a credit facility, which improves their liquidity.

In summary, by paying a premium of $0.03/gallon to convert their $2.70 swap into a synthetic call option, the company can guarantee itself a "win-win" situation, regardless of whether heating oil prices trade higher or lower between now and the end of December.

While many companies approach hedging with a "hedge it and forget it" mentality (see The Case For Employing A Dynamic Fuel Hedging Program for more on this topic), this example shows how and why companies should seek opportunities to optimize their "in-the-money" hedges. If the cost is low, why would a company not want to improve their position while reducing risk and improving liquidity?

2 min read

As the Brent-WTI spread is trading at it's lowest level since November 2010 and crack spreads shifting as a result, it's time that we take another...

1 min read

As has been well reported elsewhere, Delta Airlines is rumored to be in negotiations to buy ConocoPhillips' Trainer, Pennsylvania refinery in order...

4 min read

Over the course of the past year, refining profit margins have been all over the map. As an example, over the course of the past year, the WTI-NY...