3 min read

The Layman's Guide to Gasoil Hedging with Futures

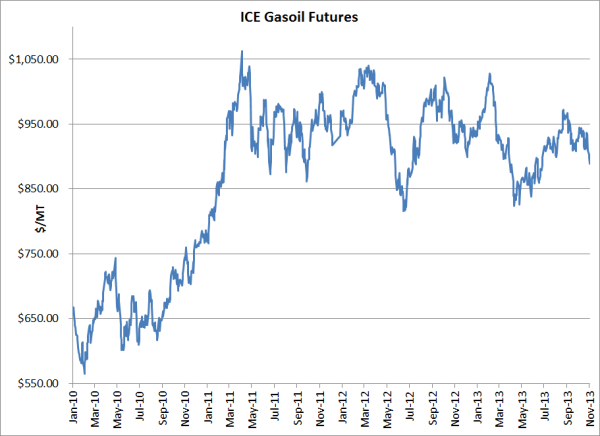

As many companies are beginning to plan for 2014, we have received quite a few inquiries from companies who are looking into hedging their gasoil...

2 min read

Mercatus Energy : Jul 12,2016

Many companies today are faced with an unprecedented combination of economic, political and regulatory uncertainty. Exposure to energy price volatility adds another layer of risk to an already difficult environment and to succeed companies clearly have to to find ways to mitigate this risk. Hedging remains one of the best ways that companies can mitigate energy price risk and the subsequent budget uncertainty.

While the reasons for hedging are, or should be, clear to the companies that engage in hedging, this isn't often the case when it comes to shareholders, rating agencies, equity analysts, regulators, etc. Changes to financial reporting requirements and more demanding investors are creating an increasing need for better hedging related disclosures and transparency. As an example, many companies are now required to disclose how and why they utilize derivatives. Companies who are not paying close attention to these new requirements would be well served to study the negative repercussions of poorly communicated hedging programs. To this point, many publicly traded companies (energy consumers, producers, processor and refiners) are actively hedging their exposure to energy prices, yet they provided their investors with minimal transparency into their hedging programs. As a result, most of these companies aren't "rewarded" (in the equity markets) when their hedges produced gains and punished when their hedges produced losses.

As such, we would suggest that companies who are actively engaged in energy hedging consider the following three fundamentals with respect to hedging disclosures and transparency:

An effective hedging program can help prevent significant losses, budget uncertainty, declining profit margins, and, in extreme cases, bankruptcy. However, hedging is rarely successful without proper communications. In too many cases, companies hesitate to engage in hedging for fear that they will be second-guessed by shareholders, analysts, rating agencies or regulators. In other cases, some companies resist hedging because of concerns that stakeholders may punish them if they depart from perceived industry standards, even if their reason for doing so is sound and is executed properly.

Successful hedging programs are based upon a thorough understanding and communication of underlying the risks that need to be mitigated, sound hedging strategies and proper risk management policies, procedures and systems.

Traditionally, the focus of most hedging programs has been to ensure that the "best" strategies are employed at any given time. While this is certainly still true today, proper communications are increasingly becoming a key element in the success of a hedging program. It is no longer sufficient to have a hedging program that is supposedly working as designed, companies need to explain their hedging goals, whether they are meeting their goals and how their goals contribute to the value of the firm. In addition to meeting financial reporting and regulatory requirements, timely and transparent communications with stakeholders can help shape a company’s reputation as either a responsible fiduciary or as an irresponsible speculator.

Faced with heightened volatility in markets, corporate stakeholders are paying greater attention to hedging related decisions. At the same time, financial reporting requirements now require greater hedge program transparency and regulators are increasing their oversight via Dodd-Frank, EMIR, etc. As a result, poorly supported and communicated hedging programs are now becoming more visible and their impact on companies is becoming more pronounced than in the past.

In conclusion, the time is nigh for companies to ensure that their hedging programs are well aligned with the company goals and objectives and that these programs are properly disclosed, transparent and well communicated with all company stakeholders, both internal and external.

3 min read

As many companies are beginning to plan for 2014, we have received quite a few inquiries from companies who are looking into hedging their gasoil...

2 min read

As we discussed yesterday in The Layman's Guide to Natural Gas Options - Part II, there are four primary variables that affect the premium or price...

1 min read

As we discussed in our last post, The Layman's Guide to Natural Gas Options - Part III, there are four primary variables that affect the premium or...