3 min read

A Primer on Hedging Natural Gas Costs - Part II

This post is is a continuation of A Primer on Hedging Natural Gas Costs - Part I, which provides a basic introduction to natural gas hedging for...

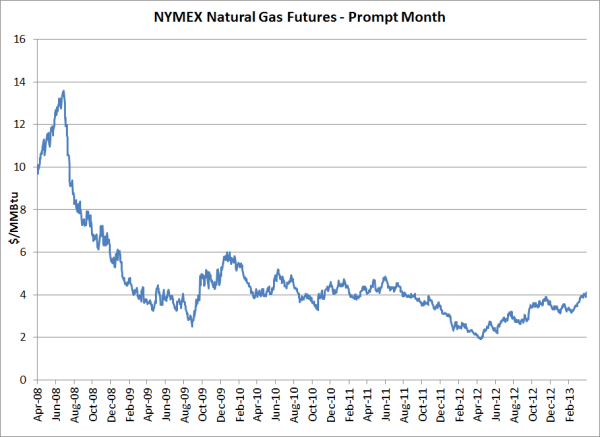

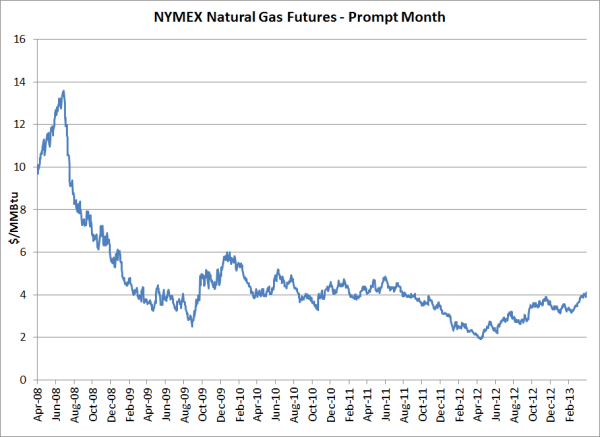

Over the course of the past year, the price of prompt month NYMEX natural gas futures have doubled since bottoming just below $2/MMBtu. The reasons are many (weather, coal to natural gas fuel switching, declining rig counts, etc.) and are prompting many commercial and industrial gas consumers, who thought they would long enjoy lower natural gas prices due ever increasing production, wondering how they should hedge in the current environment.

In our opinion, prices alone shouldn't drive hedging decisions, rather hedging decisions should be driven by significant business decisions. Better said, if you hedge your anticipated natural gas consumption for the period of in quiestion, how will the price impact your bottom line? What does it mean in terms of reward vs. risk? Is the potential benefit of declining prices so significant that you are willing to face higher prices in the interim?

Given the current environment, in recent weeks we've received several inquires as to how natural gas consumers can implement conservative, short-term hedging strategies.

So what strategies are available to companies looking for short-term, conservative strategies to hedge against higher natural gas prices? Beyond traditional futures, swaps and call options, one such strategy is a bull call spread. A bull call spread is the combination of buying one call option, with a "low" strike price, and selling another call option, with a higher strike price.

As an example, let's assume that you are looking to hedge your June 2013 natural gas consumption. If we look at the forward market for June natural gas futures, we see that they are currently trading in the $4.117/MMBtu range. In addition, let's assume that your analysis indicates that you want to be hedged against natural gas prices prices rising above $4.50/MMBtu. Last but not least, let's further assume that the maximum "out of pocket" cost you are willing to pay for such a hedge is $0.15/MMBtu.

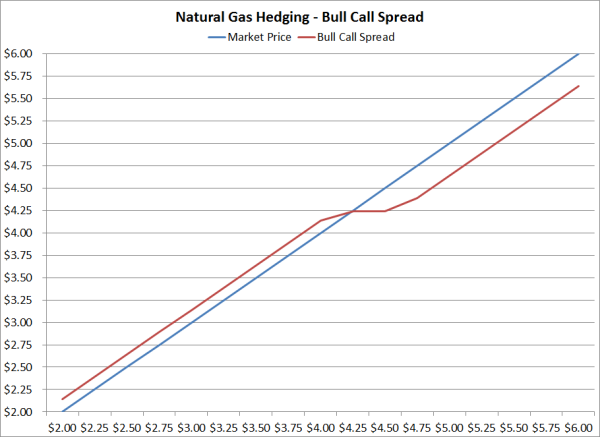

Based on your needs, one potential strategy to consider a June $4.100/$4.600 bull call spread. This transaction would entail the combination of purchasing a $4.100 call option and selling a $4.600 call option. The net cost would be approximately $0.1400/MMBtu as the current prices for the $4.100 and $4.600 June natural gas call options are approximately $0.18/MMBtu and $0.04/MMBtu, respectively.

As the chart above indicates, by hedging with a $4.100/$4.600 bull call spread, you are hedged against prices rising above $4.100 up to a maximum of $4.600, at which point your maximum gain on the position would be $0.50/MMBtu. In addition, this position is a low risk hedging strategy as the position would not expose you to losses should natural gas prices decline. In fact, by hedging with a bull call spread, you would be well positioned to benefit from lower prices such that your net cost would simply be the settlement price of the June natural gas futures plus the $0.140/MMBtu premium paid for the call option spread.

The "downside" to hedging with spreads on options is that your maximum potential gains are limited. As mentioned above, in this example, if the June natural gas futures contract settles above $4.600, your gain would be limited to $0.50/MMBtu. In addition, when you include the premium cost, your maximum net gain would be $0.36/MMBtu.

In closing, for commercial and industrial natural gas consumers seeking conservative, short-term hedging strategies against rising prices, bull call spreads are one strategy to consider.

Similarly, natural gas producers seeking a conservative, short-term hedging strategy against declining natural gas prices, can consider a bear put spread, a strategy we highlighted last November in a post titled A Low Cost Natural Gas Hedging Strategy For E&P Companies.

3 min read

This post is is a continuation of A Primer on Hedging Natural Gas Costs - Part I, which provides a basic introduction to natural gas hedging for...

2 min read

The following are our answers to your April energy hedging questions. If you're interested in reading our previous energy hedging questions and...

2 min read

This post is the sixth in a series where we are exploring many of the hedging strategies which are available to commercial and industrial natural...