2 min read

Airlines Alter Fuel Hedging Strategies for Low Price Environment

As crude oil and jet fuel prices continue to decline, many airlines are adapting their fuel hedging strategies to account for the current, lower...

Historically, many large fuel consuming companies have utilized passive fuel hedging strategies but, companies who "hedge and forget it" often accept unnecessary risks and leave money on the table. As such, due to their failure to actively manage their hedge positions, many companies are not obtaining the optimal or maximum value from their hedge portfolios. A dynamic fuel hedging portfolio can mitigate price, credit and cash flow risk while increasing the ability to benefit should fuel prices decline.

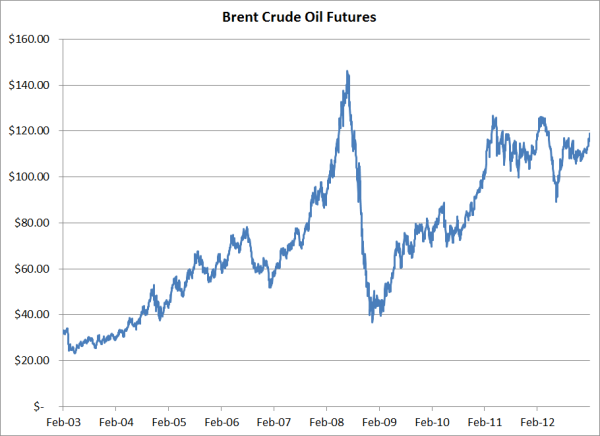

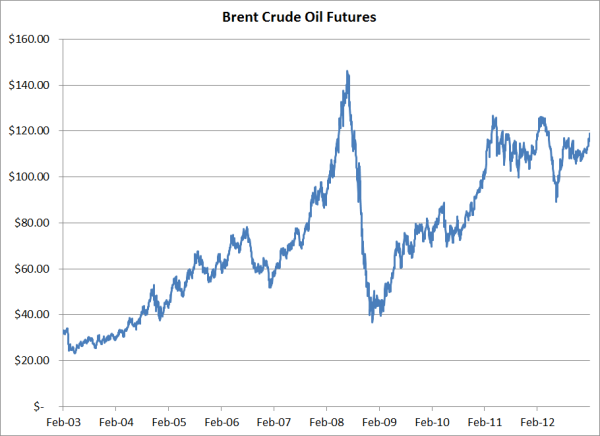

The more traditional, passive approach to fuel hedging, whereby a company buys a swap or enters into a costless collar and holds the position until expiration limits the company's ability to benefit from favorable price moves. Due to the fact that most companies are required to post cash or collateral or utilize a credit facility to buy a swap or collar, passive hedging strategies can also present an inefficient use of capital, not to mention cash flow and credit challenges. As an example, when oil prices collapsed in 2008-2009, many companies who were hedging with swaps and collars were forced to post additional cash or collateral to support their fuel hedges. In other cases, their mark-to-market losses were so large that their credit facilities weren't large enough to support their hedge positions. Making matters worse, due to the state of the global economy during this time, most companies needed to use their cash, collateral and credit facilities to fund their day-to-day operations.

So how can companies employ fuel hedging strategies that provide them with opportunities to further reduce risk, lower costs and improve liquidity? One answer is to transition from a static ("hedge it and forget it") hedging program to a dynamic (opportunistic) hedging program.

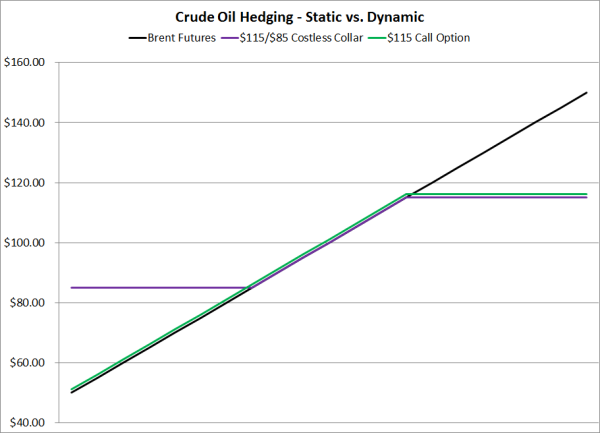

As an example, consider the case of an airline who in early August 2012 entered into a July 2013 - December 2013 Brent crude oil costless collar, comprised of an $115 call option and $85 put option, to hedge their Q3 and Q4 fuel price risk. In this example, the airline would be hedged against prices rising above $115/BBL and exposed (at risk) to prices declining below $85/BBL. When this transaction was executed, the July 2013 - December 2013 Brent crude oil forward curve was trading in the $100.50 range and has since risen significantly, closing near $112 on Friday.

When the airline entered into the costless collar, the premiums for both the $115 call and $85 put options were both about $5.90/BBL. As of the close of business on Friday, due to the increase in the Brent forward curve in recent months, the price of the $85 put option has declined to approximately $1.10/BBL. And this is where the "dynamic" aspect comes into play. If the airline does nothing and allows both the calls and puts to remain as they are until expiration ("hedge it and forget it"), they will continue to be hedged against above prices rising above $115/BBL and exposed to prices declining below $85/BBL.

However, if they decide to take advantage of current market prices, they can buy back the $85 put option for approximately $1.10/BBL. As a result of buying back the $85 put option, they will no longer be exposed (at risk) to Brent crude oil trading below $85/BBL, which also means they will no longer be required to post cash or collateral or utilize a credit facility to support the $85 put option. Perhaps better said, by paying $1.10/BBL to buy back the $85 put option, the airline will remain hedged against prices rising above $115/BBL and be positioned to benefit should Brent crude oil prices decline, as shown on the following graph.

Hedge it and forget it may have worked well in the past but the due to the ongoing changes in the commodity markets, passive hedging strategies are now far from ideal, in fact they are often problematic. For most companies, utilizing dynamic hedging strategies, rather than passive hedging strategies, is one of the key factors to developing a successful, sustainable fuel hedging program. A dynamic fuel hedging portfolio will not only provide protection against rising fuel prices but, will also provide the ability to benefit from declining prices and reduce credit and cash flow exposures.

2 min read

As crude oil and jet fuel prices continue to decline, many airlines are adapting their fuel hedging strategies to account for the current, lower...

2 min read

One of the most common questions we receive from prospective clients is, "What's the best fuel hedging strategy?" The short answer is that the best...

2 min read

Given the recent increase in global fuel prices we thought it would be beneficial to explore how companies can optimize their existing fuel hedging...