2 min read

January Energy Hedging Q&A - Natural Gas, Diesel Fuel & Propane

Once again, it's time for the monthly energy hedging Q&A. If you would like to pose a question for next month's Q&A, please contact us or leave a...

3 min read

Mercatus Energy : Apr 3,2020

A lot of time and attention is paid to the upstream (producers) in the energy commodity supply chain. While there are many, good reasons for this, what about the other end of the supply chain? Commercial and industrial energy consumers are equally affected by drastic shifts in market prices. When a market reprices so aggressively, as the crude oil and refined products markets have done in recent weeks, many fuel consumers find themselves with large mark to market (interim accounting) hedging losses. This post explores one way a consumer might ease the pain, blending their current hedging losses with additional positions across a longer duration.

While it's impossible to eliminate the current loss without consequence, many consumers with otherwise stable, even strong, balance sheets, can stretch the loss over a longer duration. This has at least two benefits. First, the total mark to market doesn’t change, but the monthly exposure is reduced. This may have a positive impact on credit and, at the very least, reduces the realized loss that is almost certain to occur at the end of the month. Second, extending the hedge positions across a longer period of time, while still underwater, likely allows the consumer to achieve a hedge for forward months at prices that are lower today compared to when the original hedge was put in place.

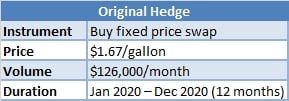

For purposes of this post, assume we are a commercial or industrial consumer of gasoline, say a fleet of delivery vehicles, which hedges its gasoline price exposure via NYMEX RBOB gasoline swaps. On November 1, 2019 this hypothetical consumer had just finished budgeting for 2020 and decided to hedge its gasoline price risk via a fixed price swap for the entire calendar year at a price of $1.67/gal on volume of 126,000 gallons per month.

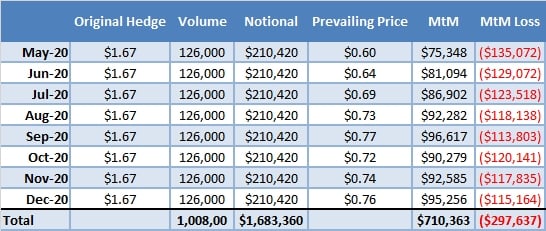

Much has changed since November 2019 in the global oil markets. Toward the end of March, gasoline prices fell to multi-decade lows in response to what is expected to be the largest oil demand destruction event in a generation or more. The average price of RBOB gasoline for the balance of 2020 (May-December) has fallen to an average of about $0.70/gallon in response. Consequently, our example consumer has a mark to market loss of about $0.97/gallon or a total of $297,637 as of March 26, 2020.

A mark to market loss like this can be frustrating, especially when coupled with the major changes we’ve observed. These changes compound the price losses if the new economic environment mean the consumer has lowered his expectations for his actually need for fuel. One way to ease the pain is to spread the loss (blend) and stretch it cross a longer duration (extend).

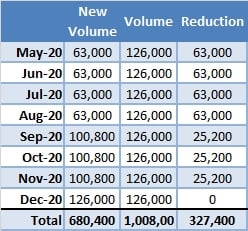

The remaining months of this example hedge, May-December, contain 1,008,000 gallons of hedged fuel at 126,000 gallons per month. Our expectation for volume is reduced in response due to an expectation of lower fuel demand within the business:

This means the portfolio is over hedged by 327,400, on top of being underwater $297,637.

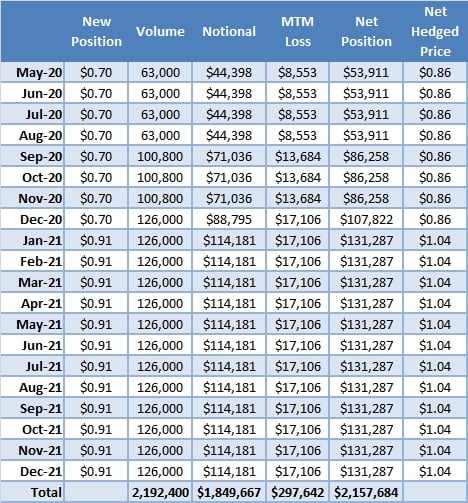

Assume this consumer plans to be back at full capacity for 2021 and intends to hedge that budget year. This twelve-month period can be used to extend the hedge at prevailing prices, while spreading the current loss proportionately over the 20 months of 2020 and 2021, combined.

The new position is immediately underwater, with the balance of 2020 at $0.86 v. a market price of $0.70 and calendar year 2021 at $1.04 v. a market of $0.91. The total loss has not gone away. Rather, it has been spread across the upcoming 20 months, so the position shows a MtM loss of $0.17 in 2020 instead of $0.97, the balance being reflected in 2021’s MtM loss of $0.13. For many, this represents a more manageable potential loss when/if realized. May, for example, is currently trading around $0.60. If the contract were to settle at $0.60, the new position would realize a monthly loss of ($0.60 - $0.86) x 63,000 gallons = $16,380. Compare this to the original hedge, which would have realized a loss of ($0.60 - $1.67) x 126,000 gallons = $134,820.

The exercise also lowered the total volume hedged for May-December 2020 from 1,008,000 to 680,400, to reflect the lower expected fuel use. Hedge volumes for 2021 reflect expected consumption for that budget year.

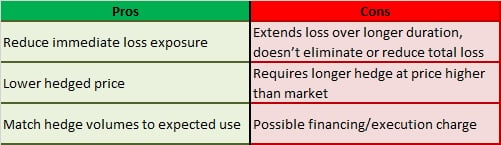

Pros and Cons

The trade-offs of such a maneuver are important to understand.

A consumer who is looking at their current hedge relative to their new, revised needs may benefit from taking a longer view of the market and considering the upcoming year’s budget. By blending and extending the MtM hedging loss in this manner, the consumer gets some relief when it comes to to settle their hedge positions. In exchange, the hedge is extended through next year, which begins in an "underwater" state. While the total loss isn’t eliminated, it is more manageable and more inline with the businesses current and expected future operations and cash flow. The price at which the balance of 2020 and the year 2021 are hedged also provide budget certainty at a much lower price than was imaginable when the original hedge was placed in November of 2019.

One last thing to consider, the consumer would likely pursue this with their original counterparty. It may take a bit more work than the original hedge and may even require approval. Some counterparties may refuse to restructure a hedge, while others may require a portion of the loss be realized and paid before the new strategy(s) can be executed, each case will be unique and based on the counterparty, their risk tolerance, size and scale of the positions being restructured and the current and future expected credit position of the business.

Despite the nuance, we still see hedgers benefit from approaching this kind of restructuring thoughtfully.

2 min read

Once again, it's time for the monthly energy hedging Q&A. If you would like to pose a question for next month's Q&A, please contact us or leave a...

2 min read

Once again it's time for our monthly energy hedging Q&A. If you would like to pose a question for one of our future Q&A posts feel free to contacts...

1 min read

We're thrilled to announce that Energy Risk has awarded us Hedging Advisory Firm of the Year. Regarded as the benchmark awards for the global energy...