2 min read

Are You Hedging or Speculating When Managing Your Energy Price Risk?

While most companies approach energy price risk management with the best of intentions, human nature often leads far too many down the wrong path,...

1 min read

Mercatus Energy : Jul 21,2016

As many companies are currently planning for 2017 and beyond, now is an ideal time to review your energy risk management program, including whether your team is prepared for the challenges of the upcoming year. Regardless of whether you're a Fortune 500 company or a small, family owned business, you need to determine whether or not your team your team is well prepared to do all of the following:

Wondering how you rank? Here's your scorecard:

10 out of 10: Excellent, keep up the good work.

9 out of 10: You're almost there, do what you need to do to bridge the gap.

8 out of 10: A couple more and you're all set.

7 out of 10: You're on the right track but you need to close the gaps. You should consider attending an energy hedging and risk management seminar.

6 out of 10 or less: It's probably time to contact us.

2 min read

While most companies approach energy price risk management with the best of intentions, human nature often leads far too many down the wrong path,...

2 min read

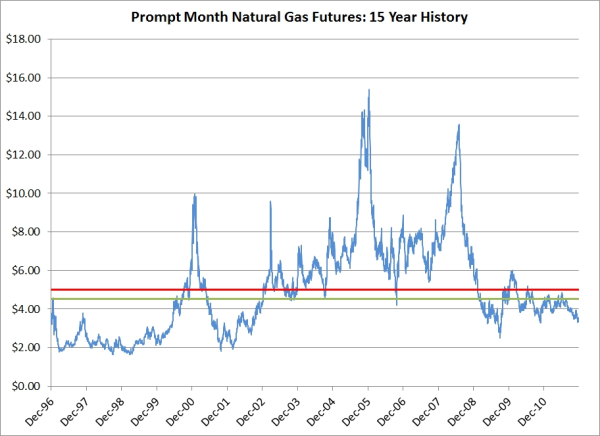

As energy hedging advisors we're asked on nearly a daily a basis whether now is a good time to begin hedging crude oil, electricity, gasoline, diesel...

2 min read

Managing an energy budget can be a difficult task to say the least. Natural gas, fuel and electricity markets are complex and volatile. Not to...