1 min read

The Case For Developing An Effective Energy Hedging Program

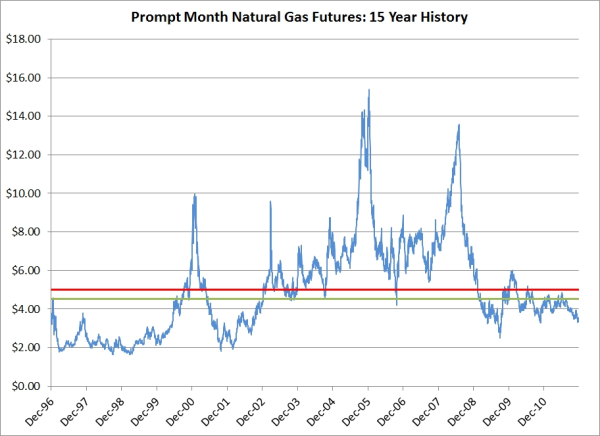

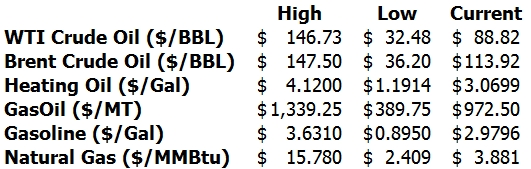

The argument for developing an effective energy hedging program has never been more compelling. As the following data shows (NYMEX and ICE futures),...

2 min read

Mercatus Energy : Dec 5,2011

As energy hedging advisors we're asked on nearly a daily a basis whether now is a good time to begin hedging crude oil, electricity, gasoline, diesel fuel, jet fuel, natural gas, NGLs, etc. The short answer is that you can always make a bad hedging decision but there's never a bad time to develop (if you're starting from scratch) or evaluate (if you're already an active hedger) your energy hedging strategy. While many might see this as a cop out, it's simply the truth. How many teams win big games without a sound game plan? It's the same when it comes to hedging.

A successful hedging strategy doesn't require a magic eight ball or the best energy market analyst that money can buy. Success in energy hedging isn't the result of being able to successfully forecast future market prices. It can certainly help but it's really only a minor part of the equation. Hedging success is the product of proper analysis, planning, execution and optimization.

A year ago today the 2011 and 2012 NYMEX natural gas forward curves were trading at $4.40/MMbtu and $5.045, respectively. Year to date, NYMEX natural gas has settled at an average of $4.11/MMbtu and the 2012 strip is currently trading at $3.843. Does this mean that a large natural gas consumer who entered into a two year fixed price deal a year ago made a poor hedging decision? It all depends on what they were trying to accomplish when they executed the deal. If they were simply speculating that natural gas prices were going to increase, sure, it was a poor decision. But what if $4.723 (the average of $4.40 and $5.045) allowed them to lock in a profit margin that was 20% larger than normal? While it may seem outrageous, for industries whose profit margins are highly dependent on the price of natural gas, this isn't an exaggeration.

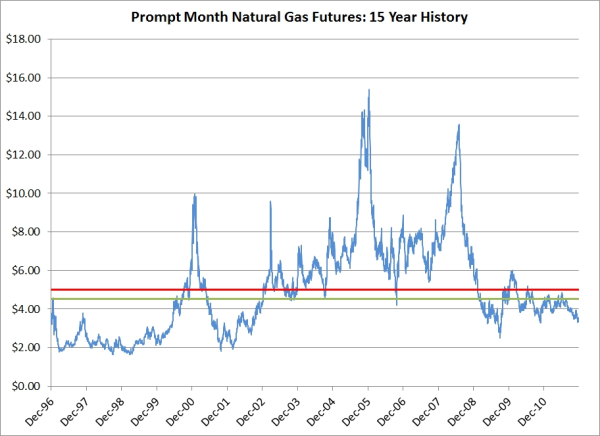

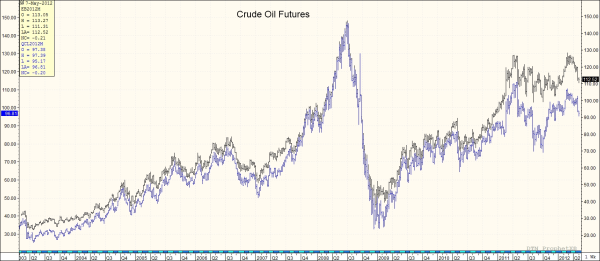

The chart below displays the NYMEX prompt month natural gas settlement prices over the past fifteen years, including a mean of $5.00/MMbtu and median of $4.51/MMbtu.

Excluding the drastic decline during the summer of 2009, during which time we saw natural gas prices trade for less than $3/MMbtu, front month natural gas prices are currently trading at their lowest level since 2002. It was only the summer of 2008 that natural gas prices traded just shy of $14/MMbtu and December of 2005 when they neared $16/MMbtu. We've since heard stories from many natural gas producers that didn't want to hedge when the market was trading at $14, or even $16, because they didn't want to miss out if prices increased to $20, or more. In both instances, it took less than 90 days for prices to collapse by more than 50%. Call it what you will, but sound hedging those decisions weren't.

Success in energy hedging comes down to the four primary factors we previously mentioned: analysis, planning, execution and optimization. If you're willing to allocate the proper time and attention to each, and your expectations are reasonable, your hedging program will be successful the vast majority of the time, regardless of whether prices increase, decrease or trade within a narrow range.

1 min read

The argument for developing an effective energy hedging program has never been more compelling. As the following data shows (NYMEX and ICE futures),...

1 min read

As we discussed yesterday in The Layman's Guide to Natural Gas Options - Part I, there are four primary variables that affect the premium or price...

2 min read

It was only a few weeks ago that many analysts were calling for crude oil to continue to trend towards $150 per barrel. Today many are saying that...