2 min read

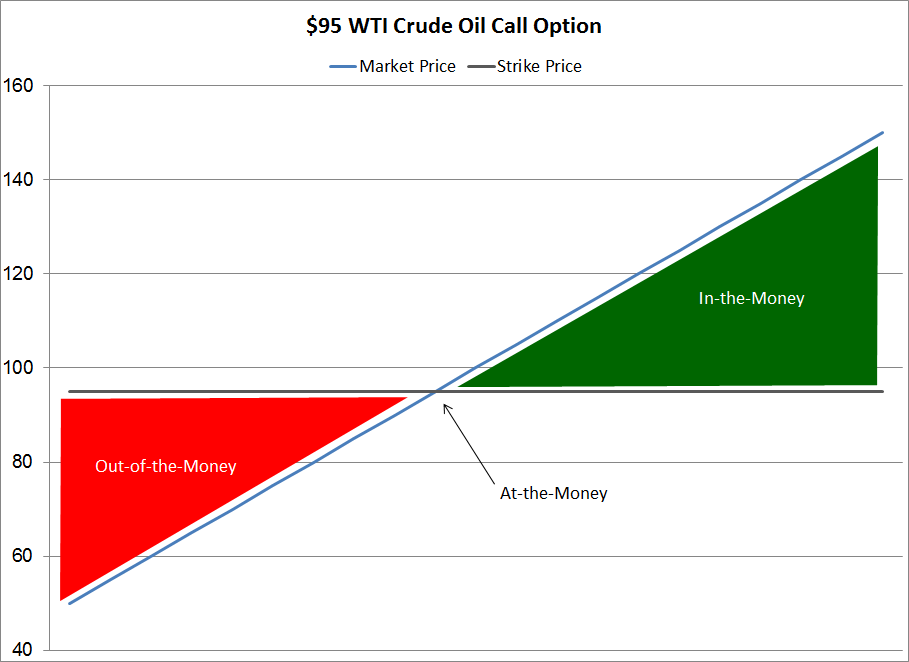

A Beginner's Guide to Crude Oil Options - Part I - Strike Price

We're often asked to explain what determines the price of crude oil (as well as bunker fuel, diesel fuel, gasoil, gasoline and jet fuel) options....

In an attempt to put things a few things in perspective, while noting that it's Friday and most are already enjoying the weekend, we've compiled a few charts which examine oil and fuel (gasoline as well, distillates i.e. diesel fuel and jet fuel) supply, demand and prices over the past ten years, with "snapshots" taken at the beginning of August for each respective year. While the charts are limited to early August of each year, when time allows we'll be providing in depth charts showing all months. Most descrptions should be self-explanatory save crude oil demand which may be a bit confusing as demand is measured in terms of "total product demand". In short, total product demand (total domestic refined product demand, which is product supplied in EIA terminology) is one of the benchmarks that the industry uses as a proxy for crude oil demand. In addition, while we're not "gold bugs,"we've included a chart which shows NYMEX crude oil vs. spot gold prices over the same time period as it's quite telling.

2 min read

We're often asked to explain what determines the price of crude oil (as well as bunker fuel, diesel fuel, gasoil, gasoline and jet fuel) options....

3 min read

The prompt month NYMEX WTI contract settled at $107.26/bbl on June 20, 2014. That day would prove to be a major inflection point in the market. The...

3 min read

In a recent Bloomberg article, “In a Risky World, Oil Traders Bet on $100 a Barrel” the author explored how, “Some oil traders have started to gear...