1 min read

Sell Crude Oil - Buy Natural Gas - Hedge or Widowmaker?

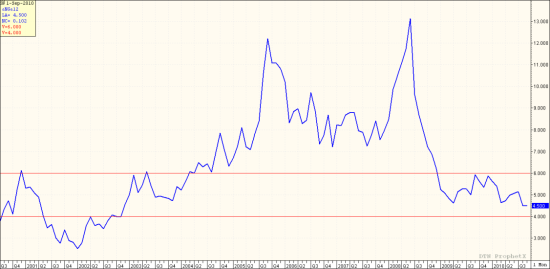

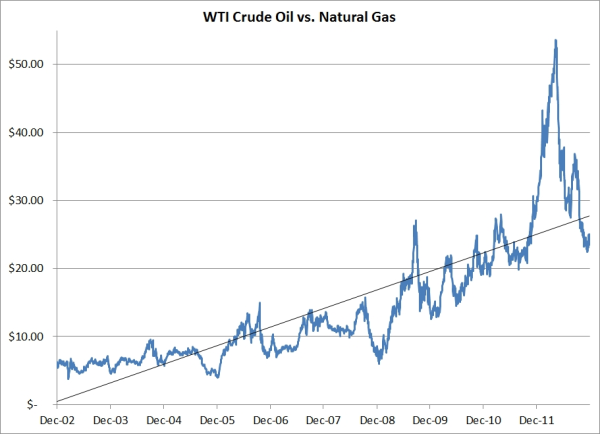

In June of 2011, in a post titled Energy Hedging Myths Demystified - Part I, we took addressed the age old theory that crude oil and natural gas...

Before we head out for the long weekend we thought we should address the current state of the natural gas market as it relates to hedging, for both producers and consumers, as we received several calls today asking for our two cents.

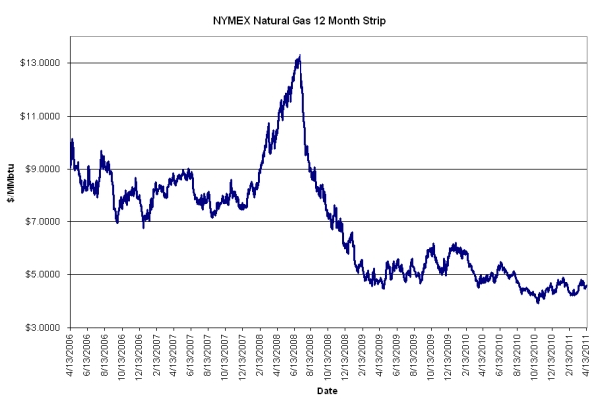

As many of you are aware, the one year forward strip (which is the average price of the first 12 months of NYMEX natural gas futures contracts) is currently trading around $4.50/MMBtu, near an eight year low. To find the last time the one year strip traded near or below the current level, you'll need to get in your time machine and travel back to 2002.

So, what's an unhedged or underhedged natural gas producer or consumer to do with prices at the current level?

If you're a natural gas consumer that is currently unhedged or underhedged, we would suggest that you strongly consider hedging at least a portion of your expected demand in the not too distant future. Sure, natural gas prices could very well continue to decline, but most commercial and industrial consumers would do very well with $4.50 gas over the coming year. As always, you need to determine your company's hedging goals and objectives as well as your budgetary needs before entering into any hedging transactions.

If you're a natural gas producer, you're obviously not thrilled with the current state of the forward curve. While the 12 month strip is near $4.50, the 24 and 36 month strips aren't significantly more attractive at $4.80 and $5.05, respectively. Which begs the question, will prices improve in the near future? Unless we experience an unanticipated event (a hurricane hitting the Gulf Coast, an extremely cold winter, etc.) it's difficult to have an educated, bullish opinion.

If one takes a quick glance at the fundamentals, all signs point towards flat or declining natural gas prices for the foreseeable future.

Perhaps all of the above will prompt producers to slow drilling which should, in turn, push gas prices higher but given that the rest of the fundamentals are what they are, we wouldn't bet on it.

Enjoy the long weekend.

1 min read

In June of 2011, in a post titled Energy Hedging Myths Demystified - Part I, we took addressed the age old theory that crude oil and natural gas...

2 min read

One of the questions we quite often from both current and prospective clients is, "Is now a good time to be hedging natural gas"? For starters, the...

3 min read

This article is the first in a series of several where we are exploring the various hedging strategies which are available to commercial and...