2 min read

A Practical Guide to Developing an Energy Hedging Policy

As more and more companies are looking at hedging their exposure to volatile energy prices, many for the first time, we thought it would be prudent...

As always, if you'd like to discuss these topics or anything else with us, please send us an email or give us a call.

2 min read

As more and more companies are looking at hedging their exposure to volatile energy prices, many for the first time, we thought it would be prudent...

2 min read

Since the NYMEX introduced the heating oil futures contract in 1978, energy consumers, producers, marketers, refiners and processors have had the...

2 min read

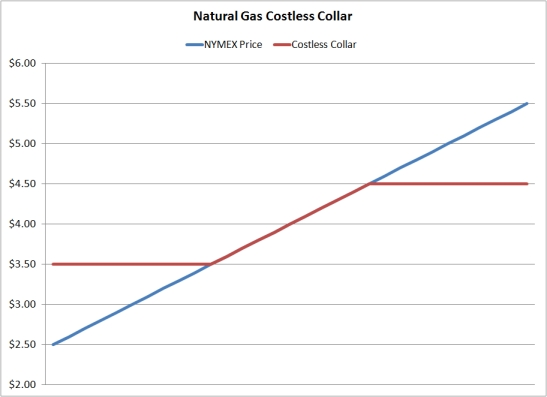

This post is the fifth, in a series, covering the basics of energy hedging. The first four posts in the series explained futures, swaps, options and...