2 min read

How to Reduce Basis Risk by Hedging with Options - Part II

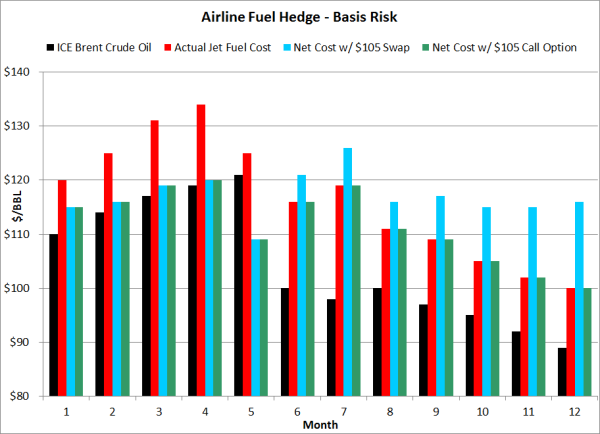

A few weeks ago, in a post titled How to Reduce Basis Risk by Hedging with Options - Part I, we looked at how a large fuel consumer, such as an...

1 min read

Mercatus Energy : Feb 16,2010

Here's your scorecard:

9 Out of 9: Perfectly suited as a Chief Energy Hedging Officer. Now, go execute.

8 Out of 9: Ready to take the reins but be sure you have the right team to help you deliver winning results.

7 Out of 9: One more skill-set and you'll be ready to lead.

6 Out of 9: On the right track. Close your skill gaps (i.e. attend an energy hedging seminars) then, apply them.

Less than 6: It's time to bring in an energy hedging expert.

What's your score? What are you doing to improve your hedging expertise?

2 min read

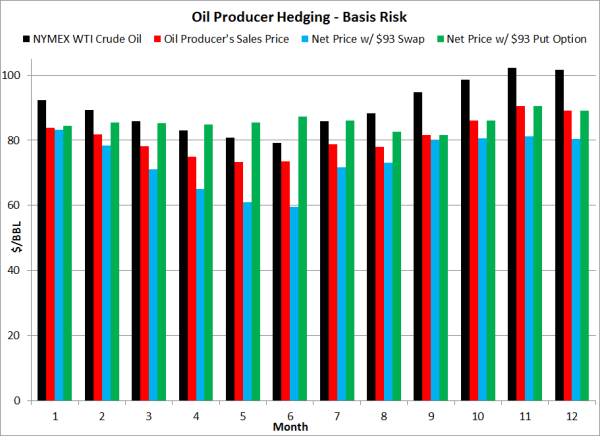

A few weeks ago, in a post titled How to Reduce Basis Risk by Hedging with Options - Part I, we looked at how a large fuel consumer, such as an...

3 min read

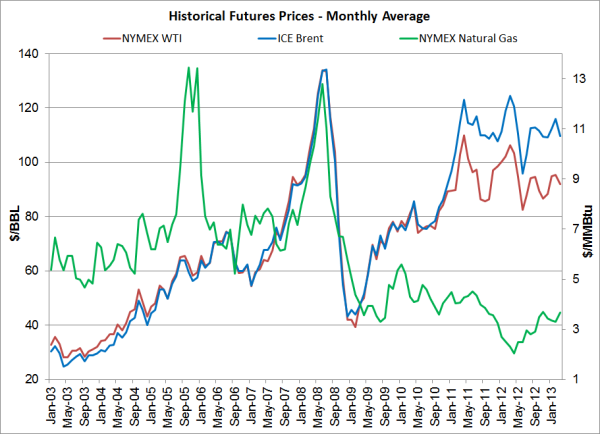

As readers of our blog are well aware, we spend a lot of time analyzing and discussing basis relationships and the accompanying risk. While it's...

3 min read

In our role as energy hedging advisors, we regularly receive inquires from companies who have had a difficult time, if not worse, in producing...