3 min read

An Introduction to End-User Natural Gas Hedging - Part III - Basis Swaps

This post is the third in a series where we are exploring the various hedging strategies which are available to commercial and industrial natural...

3 min read

Mercatus Energy : Feb 22,2021

This post is the fifth in a series where we are addressing the various hedging strategies which are available to commercial and industrial natural gas consumers. The first and second posts can be found via the following links:

In the next post in this series we'll explore how commercial and industrial natural gas consumers can hedge with call option spreads.

While futures, swaps and call options are the most "vanilla" hedging strategies we see utilized by natural gas consumers, collars, often costless collars, are quite common as well. While the term can be confusing to those who are new to trading and hedging, a collar is really pretty simple, as it is simply the combination of buying one option (call/put) and selling another option (put/call), creating what we call the collar or ceiling and floor.

As an example, if a natural gas consumer desires to hedge their exposure to potentially higher natural gas prices, they could enter into a "consumer costless collar" which would involve buying a natural gas call option and selling a natural gas put option. Furthermore, if they wanted to make the option "costless" (meaning zero out of pocket cost), they could structure the trade such that the premiums of both option are the same.

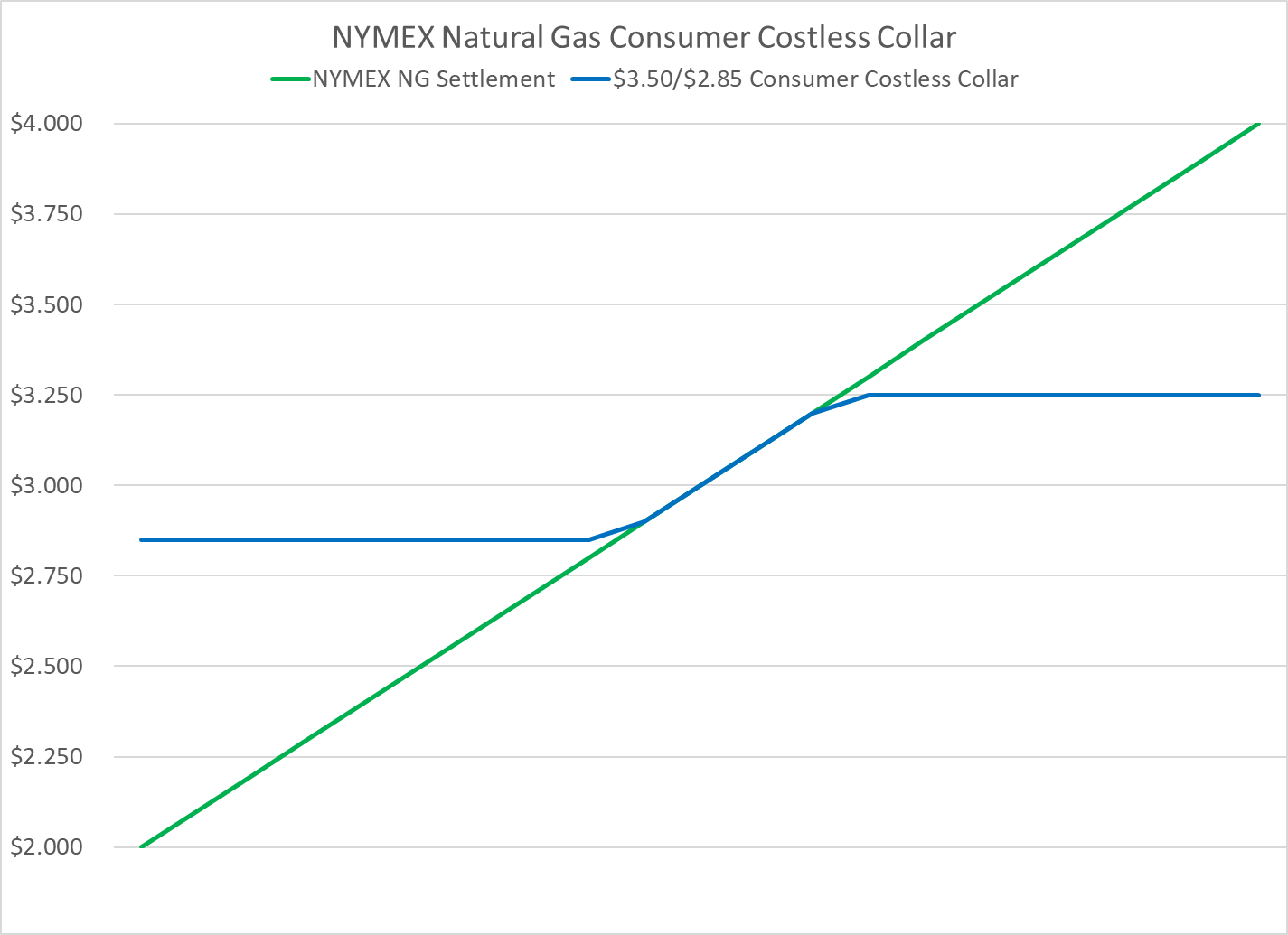

To put it into numerical context, let's assume that you are a natural gas consumer seeking to hedge your December natural gas price risk with a consumer costless collar. Let's further assume that based on the economics of your business, you determine that you need to be hedged against December NYMEX natural gas futures at no more than $3.75/MMBtu. In order to accomplish this you could purchase a $3.50/$2.85 consumer costless collar comprised of a long $3.50 call option and a short $2.85 put option. The option is costless because the cost of buying the $3.50 call option (a premium of $0.2297/MMBtu is offset by the revenue received from selling the $2.85 put option (also a premium of $0.2297/MMBtu)

By hedging with a $3.50/$2.85 consumer costless collar, you have ensured that your maximum cost in December will be $3.50. However, if natural gas prices decline below $2.85 you will incur a hedging loss equal to $2.85 minus the settlement price. In addition, if December NYMEX natural gas futures settle between $2.85 and $3.50 (between the floor and ceiling) you will not incur a gain or loss on your hedge, you would simply be exposed to the market price.

To expand, if December NYMEX natural gas futures were to settle at $4.00, you would have a hedge gain of $0.50/MMBtu. On the other hand, if December NYMEX natural gas futures were to settle at $2.25, you would have a hedging loss of $0.60/MMBtu. That being said, it should be noted that the hedging gains and losses are offset by opposing losses or gains in the physical market. For example, if December NYMEX natural gas futures were to settle at $4.00, the $0.50 gain on your collar would offset your higher cost incurred in the physical market. Perhaps better said, if the settlement price is $4.00, your physical cost would be $4.00 (excluding basis, transmission, distribution and taxes, if applicable) but your net cost would be $3.50 due to the $0.50 gain on the costless collar.

As the example indicates, costless collars can be an effective natural gas hedging strategy but due to the fact that one "leg" of a costless collar involves selling an option, and selling options means taking on risk, one must fully understand the potential consequences of being short an option (in this scenario, selling the put option) before entering into a costless collar.

UPDATE: The previous and subsequent posts in this series can be accessed via the following links:

3 min read

This post is the third in a series where we are exploring the various hedging strategies which are available to commercial and industrial natural...

3 min read

In industries that consume large volumes of natural gas, such as manufacturing and processing, as well as companies that simply use large volumes of...

3 min read

This post is is a continuation of A Primer on Hedging Natural Gas Costs - Part I, which provides a basic introduction to natural gas hedging for...