2 min read

Is Brent Now the Global Benchmark for Crude Oil Hedging?

In early December the EIA announced that beginning with its 2013 Annual Energy Outlook, which will be published in the spring, the agency is going to...

As the Gulf Coast continues to becoming an ever more active crude oil trading hub, the interest in hedging Gulf Coast crude oil is increasing as well. While much of the hedging activity is taking place in the bi-lateral OTC (over-the-counter) market, we can also see evidence of the increasing activity in the exchange cleared products such as the NYMEX's LLS-WTI basis swap. Since early 2012, the open interest in the NYMEX cleared LLS-WTI basis swap has increased from approximately 20,000 contracts to just shy of 42,000 contracts as of the close of business yesterday.

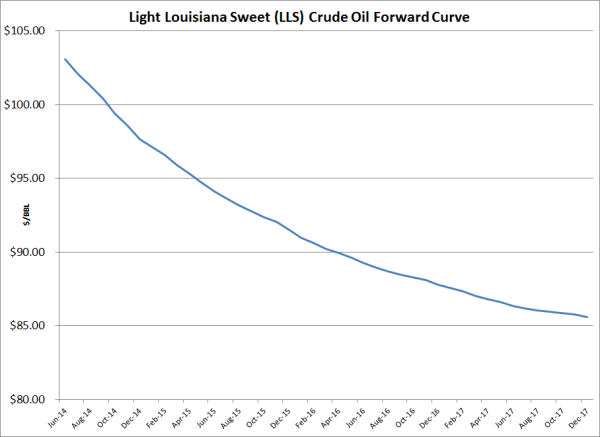

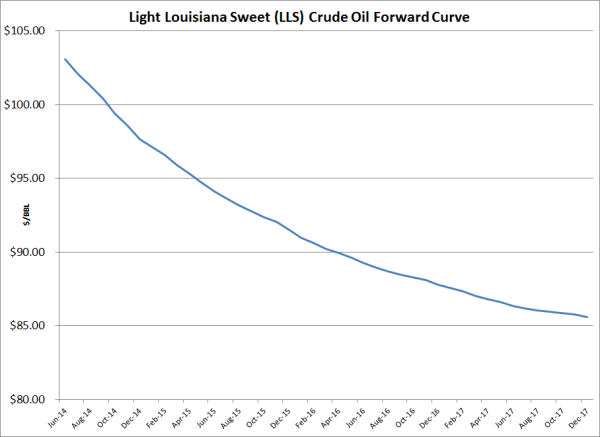

So, how can a crude oil producer hedge their exposure to Gulf Coast crude oil prices? As an example, let's assume a Gulf Coast crude oil producer is looking to hedge their July 2014 LLS (Light Louisiana Sweet) crude oil production. As of the close of business yesterday, the forward market for July 2014 Argus LLS crude oil was trading around $2.25/BBL while the July 2014 NYMEX WTI crude oil swap was trading around $99.75/BBL. The combination of these two data points tells us that a crude oil producer should be able to hedge their July 2014 LLS crude oil production at approximately $102/BBL (excluding the bid/ask spreads) by selling an LLS crude oil swap.

Now, how would a July $2.25 LLS-WTI basis swap and a $99.75 WTI swap perform if both LLS-WTI basis and WTI average more and less than their current, respective forward prices?

In the first instance, let's assume that during the month of July, the LLS-WTI crude oil basis averages $1.00/BBL and WTI crude oil averages $90/BBL. On the LLS-WTI basis swap leg of the trade, the producer realizes a hedging gain of $1.25/BBL ($2.25-$1.00=$1.25). On the NYMEX WTI crude oil swap leg of the trade, the producer realizes a hedging gain of $9.75/BBL ($99.75-$90.00=$9.75). As a result, in this first instance, the producer realizes a net hedging gain of $11/BBL ($1.25+$9.75=$11.00). However, since the producer would have also sold their July 2014 production for approximately $91/BBL their net, including the hedging gains, would have been be $102/BBL ($91+$11=$102).

In the second instance, let's assume that during the month of July, the LLS-WTI crude oil basis averages $4.25/BBL and WTI crude oil averages $105/BBL. On the LLS-WTI basis swap leg of the trade, the producer realizes a hedging loss of $1.25/BBL ($4.25-$2.25=$2.00). On the NYMEX WTI crude oil swap leg of the trade, the producer realizes a hedging loss of $5.25/BBL ($105-$99.75=$5.25). As a result, in the second instance, the producer realizes a net hedging loss of $7.25/BBL ($2.00+$5.25=$7.25). However, since the producer would have also sold their July 2014 production for about $109.25/BBL their net, including the hedging losses, would have been be $102/BBL ($91+$11=$102).

While this example focused on hedging LLS crude oil production, the same methodology is also applicable to other Gulf Coast crude oils. In a future post(s) we will look at crude oil basis hedging in other producing regions. If you would like to us to address a specific region please let us know in the comment section below.

2 min read

In early December the EIA announced that beginning with its 2013 Annual Energy Outlook, which will be published in the spring, the agency is going to...

2 min read

As we discussed A Beginner's Guide to Crude Oil Options - Part I & Part II, there are four primary factors that determine the price of crude oil, as...

3 min read

In a recent Bloomberg article, “In a Risky World, Oil Traders Bet on $100 a Barrel” the author explored how, “Some oil traders have started to gear...