3 min read

The Layman's Guide to Gasoil Hedging with Swaps

This post is second in a series we are publishing on gasoil hedging from the perspective of a gasoil consumer. The first post in the series, which...

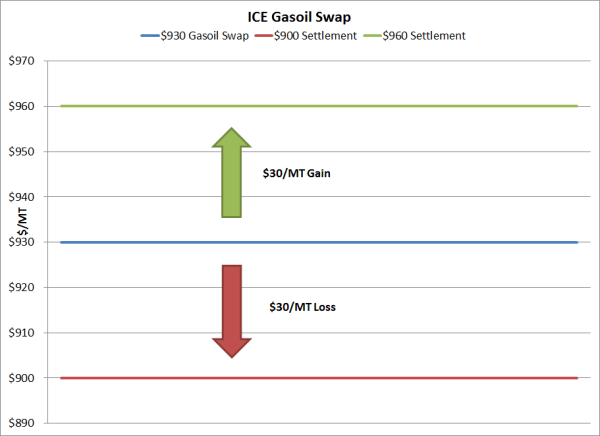

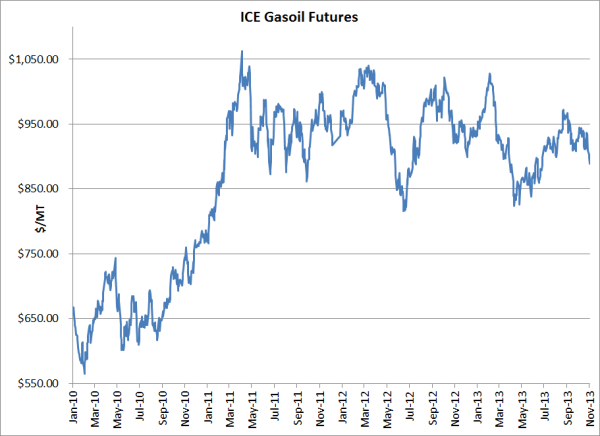

In recent weeks we've explored how gasoil consumers can hedge their exposure to gasoil price with futures The Layman's Guide to Gasoil Hedging with Futures) and swaps (The Layman's Guide to Gasoil Hedging with Swaps).

While futures and swaps are both viable hedging instruments, many gasoil consumers are interested in hedging with an instrument that provides them with a hedge against rising prices but does not expose them to hedging losses, should gasoil prices decline. For companies in this situation, call options (also known as caps) are often the hedging instrument of choice. In simplest form, call options can provide gasoil consumers with "price insurance" against rising gasoil prices while also allowing them to benefit if/when gasoil prices decline.

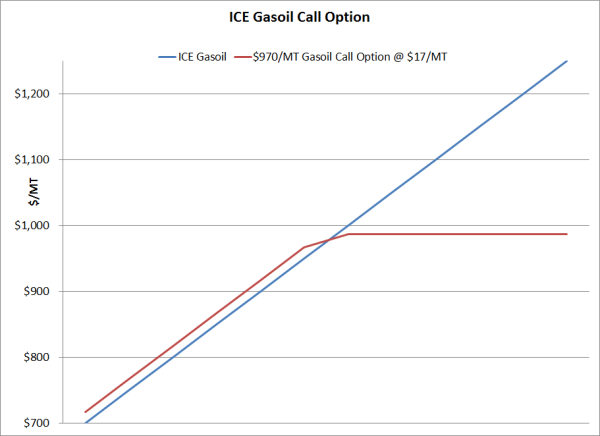

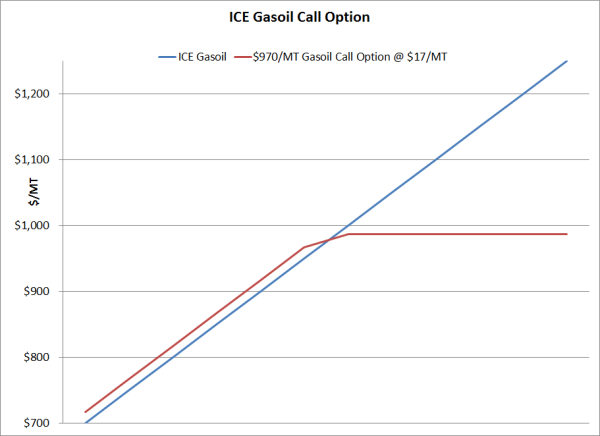

As an example, let's assume that you are a gasoil consumer in Europe who wants to hedge your February gasoil price risk of 1,000 MT at or below $1,000/MT. Based on current market prices, you could accomplish this by purchasing a $970.00 February, average price, call option on ICE gasoil from one of your counter-parties for a premium (upfront cost) of approximately $17/MT or a total of $17,000 ($17 X 1,000 MT). By doing so, you will have ensured that your maximum gasoil cost for February is capped at $987/MT ($970 + $17 = $987).

Now let's address how the $970 gasoil call option would impact your February gasoil costs if ICE gasoil prices average both above and below $970/MT in February.

In the former situation, let's assume that gasoil prices are higher and that the average settlement price for ICE gasoil in February is $1050/MT. In this scenario, your call option would provide you with a hedging gain of $80/MT ($1,050 - $970 = $80) or $80,000 ($80 X 1,000 MT). As a result, you would receive a payment of $80,000 from your counter-party, which would offset the increase in your gasoil costs by $80/MT. However, given that you paid $17/MT for the option, your net gain would be $63/MT or $63,000.

In the latter situation, let's assume that gasoil prices are lower and that the average settlement price for ICE gasoil in February is $900/MT. In this scenario, your call option would be "out-of-the-money" and you would not receive a payment from your counter-party. However, given that the option is out-of-the-money, your actual gasoil costs will be lower than the price at which you purchased the call option. More specifically, your net cost would be $917/MT ($900/MT plus the option premium cost of $17/MT).

As the above chart indicates, when ICE gasoil settlement prices average more than $970/MT, if you have hedged with a $970 call option at a premium cost of $17/MT, your cost is capped at $987/MT. On the other hand, when ICE gasoil settlement prices average less than $970/MT, your cost is the ICE gasoil average settlement price plus the option premium cost of $17/MT.

As indicated in this example, hedging with call options allows gasoil consumers to be protected against higher gasoil prices while also retaining the ablility to benefit from lower gasoil prices as well.

As we mentioned earlier, while futures and swaps are certainly viable hedging strategies, many companies who are looking to cap, rather than fix, their gasoil costs would be well served to consider hedging with gasoil call options.

UPDATE: This article is the third in a series on hedging gasoil prices. The previous articles can be viewed via the following links:

The Layman's Guide to Gasoil Hedging with Futures

The Layman's Guide to Gasoil Hedging with Swaps

If you would like to discuss how we can help your company hedge your gasoil price risk, please contact us.

3 min read

This post is second in a series we are publishing on gasoil hedging from the perspective of a gasoil consumer. The first post in the series, which...

3 min read

As many companies are beginning to plan for 2014, we have received quite a few inquiries from companies who are looking into hedging their gasoil...

3 min read

As crude oil and refined products prices once again seem to be on an upward trend, we've received several requests for more information on the basics...