2 min read

The Layman's Guide to Gasoil Hedging with Call Options

In recent weeks we've explored how gasoil consumers can hedge their exposure to gasoil price with futures The Layman's Guide to Gasoil Hedging with...

This post is second in a series we are publishing on gasoil hedging from the perspective of a gasoil consumer. The first post in the series, which focused on gasoil hedging with futures, can be accessed via the following link: The Layman's Guide to Gasoil Hedging with Futures. In future posts, we will also explore how gasoil consumers can hedge their gasoil price risk with call options, collars and spreads options.

So what is a gasoil swap? In short, a gasoil swap is an agreement whereby one party exchanges their exposure to a variable (often referred to as spot, index floating, or market) gasoil price for a fixed gasoil price, over a specified period(s) of time. In addition to gasoil, swaps are available for nearly all types of fuel including bunker fuel, diesel fuel, gasoline, heating oil, jet fuel, fuel oil, etc. The agreements are referred to as swaps as the buyers and sellers of swaps are “swapping” the cash flows (variable vs. fixed) associated with the purchase or sale of physical gasoil (or a related product such as diesel fuel or jet fuel).

Energy consumers in numerous industries (manufacturing, mining and transportation, to name a few) utilize swaps in order to hedge their energy price risk as doing so allows them to obtain a fixed price for what is often a rather volatile, unknown cost. Similarly, many energy producers (crude oil, natural gas, electricity, etc.) also utilize swaps in order to obtain a fixed price for their revenue from their production. In addition, many energy marketers and refiners also use swaps to hedge the risk associated with their inventory (stocks). Furthermore, swaps are not only used to hedge energy price risk but also market prices of all sorts i.e. foreign exchange, interest rates and agricultural commodities as well.

As an example of how a gasoil consumer can utilize a fixed price swap to hedge their exposure to fluctuating gasoil prices, let's assume that you are a European manufacturing company who consumes are large amount of gasoil in your manufacturing process. Let' also assume that your gasoil costs are a large percentage of your operating costs and as such you need to be able to predict your gasoil costs for budgeting purposes.

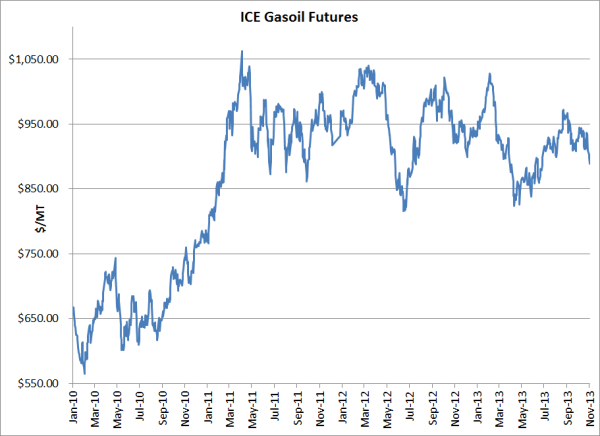

For sake of simplicity, let's assume that you have determined that you need to hedge 500 MT of gasoil which you anticipate consuming in February 2014. In order to implement this hedge, you could purchase an February ICE gasoil swap from one of your counter-parties (often a financial institution or energy trading company). If you had purchased this swap earlier this week at the prevailing market price, the price of your swap would have been approximately $930 per MT.

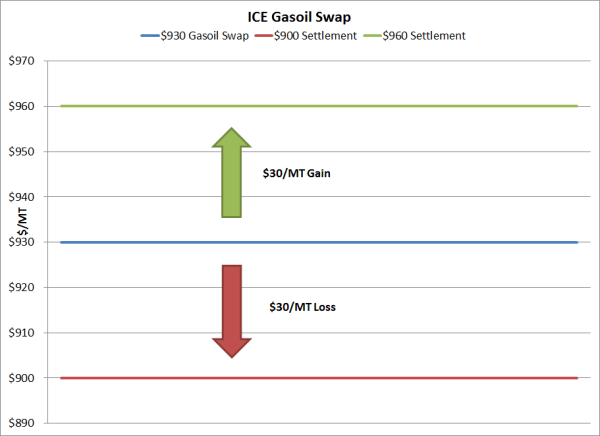

Now let’s examine how the gasoil swap will impact your February gasoil costs if ICE gasoil prices during February average both higher and lower than the price you paid for the swap, $930/MT.

In the first case, let's assume that ICE gasoil prices in February are higher than the price at which you bought the swap and that the average price for ICE gasoil futures each business day in February is $960/MT. In this case, your $930 gasoil swap would result in a gain of $30/MT ($960 – $930 = $30) or $15,000 ($30/MT X 500 MT = $15,000). As a result, you would receive a payment of $15,000 from your counter-party, which would decrease your actual February gasoil expense by $30/MT.

In the second case, let's assume ICE gasoil prices in February are higher than the price a which you bought the swap and that the average price for ICE gasoil futures each business day in February is $900/MT. In this case, your $930 gasoil swap would result in a loss of $30/MT ($930 – $900 = $30) or $15,000 ($30/MT X 500 MT = $15,000). As a result, you would owe your counter-party a payment of $15,000, which would increase your actual February gasoil expense by $30/MT.

As this example indicates, purchasing a gasoil swap allows the manufacturing company to hedge their exposure to unpredictable gasoil prices. If the price of gasoil during the month is higher than the price at which the company purchased the swap, the gain on the swap will offset the higher price they pay for physical gasoil. Similarly, if the price of gasoil during the month is lower than the price at which the company purchased the swap, the loss on the swap will offset the lower price they pay for physical gasoil. As a result, regardless of whether gasoil prices increase or decrease, the company will have fixed their gasoil cost by hedging with the swap.

While this example addressed how a manufacturing company can utilize gasoil swaps to hedge their exposure to fluctuating gasoil prices, the same methodology can be used to hedge bunker fuel, diesel fuel, gasoline, heating oil, fuel oil and many other commodities.

As previously mentioned, other market participants can also utilize swaps to hedge their exposure to fluctuating commodity prices. As an example, a refiner who needs to hedge their inventories as they are exposed to potentially declining gasoil prices, could hedge said risk by selling a gasoil swap.

UPDATE: This article is the second in the series on hedging gasoil prices. The first and subsequent posts in the series can be viewed via the following links:

The Layman's Guide to Gasoil Hedging with Futures

2 min read

In recent weeks we've explored how gasoil consumers can hedge their exposure to gasoil price with futures The Layman's Guide to Gasoil Hedging with...

3 min read

As many companies are beginning to plan for 2014, we have received quite a few inquiries from companies who are looking into hedging their gasoil...

3 min read

As crude oil and refined products prices once again seem to be on an upward trend, we've received several requests for more information on the basics...