4 min read

An Introduction To Crack Spread (Refiner) Hedging

Over the course of the past year, refining profit margins have been all over the map. As an example, over the course of the past year, the WTI-NY...

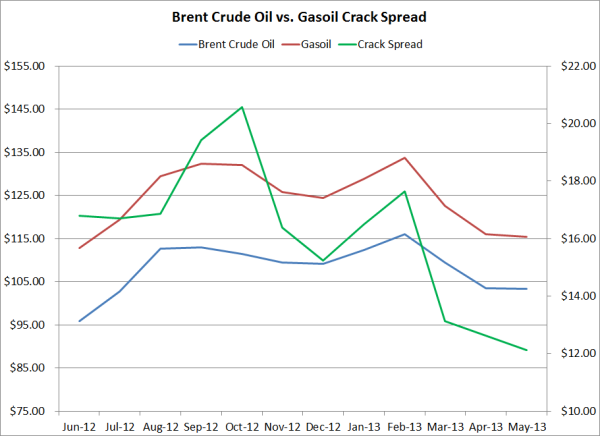

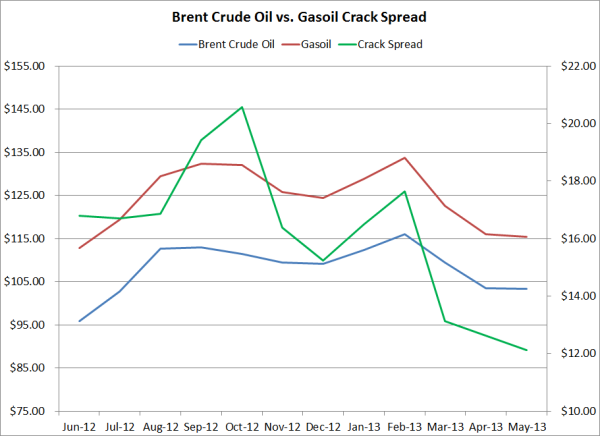

Over the past year, refining profit margins have been quite volatile. As an example, Brent crude oil/gasoil calendar swap crack spreads have traded as high as $20.56/BBL and as low as $12.12/BBL, averaging $16.17/BBL. Crack spreads on other crude oils (Dubai, WTI, Light Louisiana Sweet, etc.) and various refined products (diesel, gasoline, jet fuel, etc.) have been similarly volatile.

While our posts often focus on hedging from the consumer and producer perspective, refiners arguably face an even greater need to hedge their exposures as their profit margins are based on the price of not one commodity, but several: the price of their input (crude oil) as well as their outputs (gasoil, gasoline, diesel fuel, gasoil, jet fuel, fuel oil, etc). As an example, in the past four months alone, the Brent crude oil/gasoil calendar swap crack spread has declined from a high of $17.65/BBL to a current level of $12.12/BBL.

So how can a European refiner hedge their crack spread risk? While we've previously looked at how refiners can hedge the crack spread via fixed price swaps (see An Introduction to Crack Spread Hedging), today we're going to look at how refiners can hedge with options.

For those of you who aren't well versed in refining economics, calculating a refiner's profit margin is actually quite simple. As an example, to calculate the Brent crude oil/gasoil crack spread, you take the current price of gasoil futures, $869.25/MT, and divide it by 7.45 (there are approximately 7.45 barrels in a metric ton of gasoil) which equates to $116.68/BBL. You then subtract the current price of Brent crude oil, which is $103.95/BBL, from the gasoil price, which produces a refining profit margin (crack spread) of $11.73/BBL.

Back to the question at hand, let's assume that the refiner is interested in hedging their July 2013 gasoil oil profit margin as they need a gasoil crack spread of at least $12/BBL to meet budget. As of the close of business yesterday, the July 2013 Brent crude oil/gasoil crack spread was trading at $13/BBL based on a gasoil calendar swap at $869.72/MT ($116.75/BBL) and Brent crude oil calendar swap at $103.74/BBL.

To hedge or lock in the July Brent/gasoil crack spread of $13/BBL, the refiner could buy a July Brent crude oil swap at $103.74/BBL and sell a gasoil swap at $869.72/MT ($116.74/BBL). However, the refiner wants to retain the ability to participate in a favorable price move so rather than hedging with swaps, it has decided to hedge with an option.

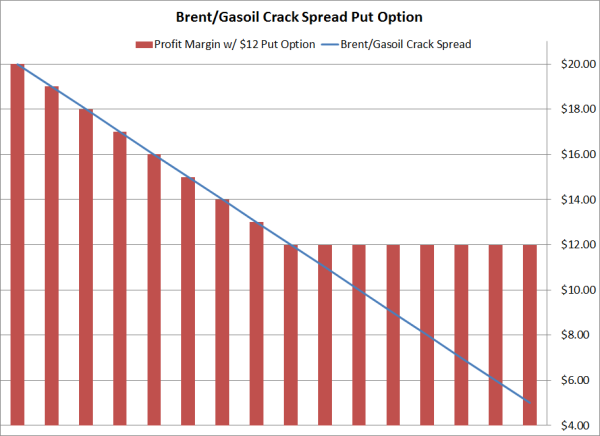

As an example, let's assume that the refiner has decided to hedge it's crack spread risk by purchasing a July 2013 $12.00 Brent/gasoil crack spread put option. Crack spread options provide refiners with a great tool to hedge (or capture) refining margins as they allow the refiner to hedge two independent risks with one trade. By purchasing the July 2013 $12.00 Brent/gasoil crack spread put option, the refiner has effectively hedged both the cost of purchasing Brent crude oil and the revenue from the sale of gasoil.

Let's fast forward to July 31 (the final trading day of July) and take a look at how this hedge would perform in a few different price environments. For starters, let's look at the impact of the crack spread put option, if during the month of July, Brent crude oil averages $100/BBL while gasoil averages $825/MT ($110.74/BBL). In this case, the refiner will experience a hedging gain of $1.26/BBL ($12.00-$10.74).

What if July Brent crude oil increases a modest amount, averaging $110/BBL, while gasoil jumps to an average $925/MT ($124.16/BBL), which equates to a crack spread of $14.16/BBL? In this case, the refiner will not experience a gain on the put option as the crack spread settled above the strike price of $12/BBL. However, because the refiner hedged with the put option, rather than the swap which would have locked in the $13.00 crack spread, it was able to participate in the favorable price move by capturing an additional $1.16/BBL ($14.16-$13.00).

While this post looked at hedging the Brent crude oil/gasoil crack spread, the same methodology can be applied to hedging other crack spreads (i.e. WTI crude oil, diesel fuel, gasoline, jet fuel, fuel oil, etc.) as well.

4 min read

Over the course of the past year, refining profit margins have been all over the map. As an example, over the course of the past year, the WTI-NY...

1 min read

Over the course of the past few days we've received several reports that Mexico has begun to execute it's 2014 oil hedging program, so we're going to...

2 min read

Last April, in a post titled The Ultimate Airline Fuel Hedge: Buy A Refinery, we highlighted Delta Airlines acquisition of the Trainer refinery from...