2 min read

A "Zero Cost" Gasoline Hedging Strategy For End-Users

Given that more and more organizations with large fleets are seeking "low" or "zero" cost gasoline hedging strategies, which won't leave them...

As we're often asked to help companies develop de novo fuel hedging initiatives, we thought we would highlight the primary building blocks of a fuel hedging program.

1. Identifiy, Analyze and Quantify Your Fuel Related Risks

Identify all fuel related risks including price, basis, credit, operational and regulatory risks. Once all of the risks have been identified, they can be analyzed, categorized and prioritized. Many risks can be rigorously analyzed via quantitative and statistical analysis, while some risks have to be evaluated through a qualitative approach. Risks that are not identified and analyzed cannot be properly managed, mitigated or hedged.

2. Determine Tolerance for Risk and Develop An Official Fuel Hedging Policy

All risks should be addressed through a process that establishes risk management goals and objectives as well as risk tolerance. A fuel hedging policy can then be developed to formalize the goals, objectives and risk tolerance, and to clearly define the decision-making process and determine who (individuals and/or committees) executes fuel hedging and related activities.

3. Develop Fuel Hedging and Implementation Strategies

All potential execution strategies should be approved and documented. While the fuel hedging policy addresses the pre-approved boundaries for managing risk, hedging and implementation strategies are the detailed steps for implementing the strategies and complying with the fuel hedging policy.

As an example, an airline's fuel hedging policy may state that between 50% and 75% of anticiatped fuel consumption should be hedged on a continuous basis, for the next twelve months, and between 25% and 50% for months 13-24, also on a continuous basis. The implementation strategies based on this policy will determine the company's official stance on the appropriate conditions for hedging 50% versus 75% as well as inbetween, which fuel hedging instruments (futures, swaps, call options, costless collars, basis swaps, etc) and as well as the appropriate indices (WTI crude oil, Brent crude oil, NYMEX heating oil, Singapore jet fuel, etc.) should be used to meet the targeted hedge objectives. Policies and strategies may need to be adjusted because of a change in risk management objectives, general business conditions and in some cases, changing market conditions such as a lack of liquidity. Regardless, it is important to have written policies, stated objectives and a defined risk tolerance in place.

4. Controls and Procedures

A fuel hedging policy needs to be supported by controls and procedures that ensure hedging and activities receive an appropriate level of oversight, such as the implementation and reporting of trades. Controls and formal procedures can provide transparency that show how risks are being managed, on both a macro and micro level. The controls and procedures can include everything from written procedures to separating front, middle and back office activities to utilizing a fuel trading and risk management software system.

5. Implementation of Fuel Hedging Strategies

Once the previous steps are in place, the implementation of the intial fuel hedging positions can begin. For most companies, implementation and management of fuel hedging program should be a constant, dynamic process, as opposed to a static process. As such, fuel hedges should be constantly analyzed and if fits within the company's goals and of course the fuel hedging policy, the positions should be optimized if and/or when market conditions allow.

6. Monitoring, Analyzing and Reporting Risk

All risks related to fuel hedging, including price, basis, credit, operational and regulatory risks, need to be continuously monitored, measured and reported through the company's fuel hedging framework. As the company's risk exposure changes, there should be a systematic process for reporting and determining if the fuel hedging policy or strategies need to change or if the existing policy and strategies are sound. Regarding this last point, fuel heding policies or strategies should not be changed simply because someone in upper management has an opinion about fuel prices. If a change in policy or strategy is to be made, the chance should be proceeded by proper analysis and discussion.

7. Repeat

While we've identified the six basic building blocks for the development of de novo fuel hedging program, the "last" step is the most important: repeating the entire process as often as is necessary, regardless of whether it's as frequent as once a month or as infrequent as once a year. While the formal fuel hedging policy may only materially change once every few years, the other six steps should become a consistent process, even if said process moves slower than molasses in January.

2 min read

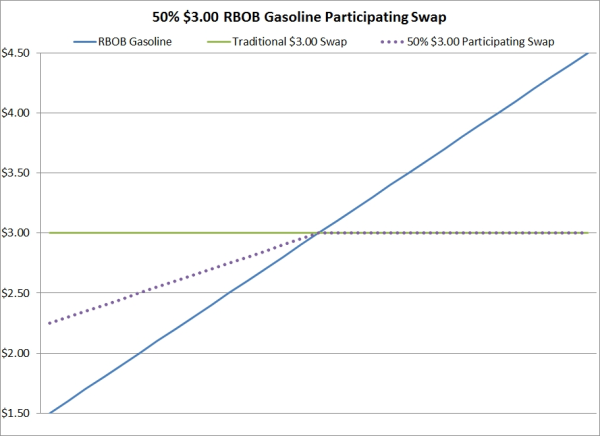

Given that more and more organizations with large fleets are seeking "low" or "zero" cost gasoline hedging strategies, which won't leave them...

2 min read

What is a deferred premium option? Essentially, it is identical to a standard call or put option, except that the premium isn't paid until the...

3 min read

As a continuation of our September and August Energy Hedging Q&A posts, here are the questions and our answers to this months Energy Hedging Q&A. As...