3 min read

The Basic Building Blocks of A De Novo Fuel Hedging Program

As we're often asked to help companies develop de novo fuel hedging initiatives, we thought we would highlight the primary building blocks of a fuel...

What is a deferred premium option? Essentially, it is identical to a standard call or put option, except that the premium isn't paid until the expiration of the option. The seller of a deferred premium option is simply financing the cost of the option to the buyer of the option.

As an example, assume that an airline is looking to hedge their exposure to fuel prices by purchasing average price (also known as Asian), call options on heating oil (airlines often hedge jet fuel via heating oil as the market for heating oil swaps and options is more liquid than the market for jet fuel swaps and options). Hedging jet fuel with heating oil does subject the airline to basis risk but basis risk is beyond the scope of this discussion. We previously discussed basis risk in this post). The airline's is lacking adequate cash to purchase the call options so their CFO is seeking a way to reduce or eliminate the amount of cash require to purchase the options. Enter the deferred premium option.

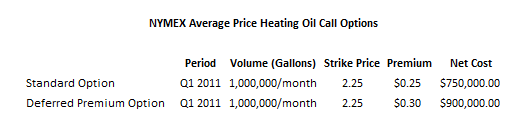

Let's assume that the airline is looking to hedge a portion of their fuel exposure in the first quarter of 2011. Based on current market prices, a Q1 heating oil call option with a strike of $2.25 is $0.25. As previously mentioned, the CFO wants to use deferred premium options so he obtains a quote from the airline's counterparty for a the $2.25 call option. The counterparty quotes the CFO a premium of $0.30 for a deferred premium Q1 $2.25 average price, heating oil call option, which the CFO agrees to buy, for a volume of 1,000,000 gallons per month.

Fast forward to March 31st, the end of Q1. NYMEX heating oil futures averaged $3.00/gallon during the quarter and as such the airlines fuel hedges are $0.75 in the money, meaning the airline's counterparty owes the airline $0.75/gallon or $2.25MM ($0.75/gallon X 3MM gallons). However, because the airline purchased deferred premium options, with a premium of $0.30/gallon, the net payment due to the airline is $0.45/gallon or $1.35MM.

While the airline could have saved $0.05/gallon or $150,000 by paying for the premium upfront, paying their counterparty an extra $0.05/gallon for the deferred premium option allowed them to defer the paying the option premium until Q1. A small price to pay for a cash-strapped airline that is required to hedge their exposure to fuel prices.

While the focus of this discussion has been on fuel hedging, via heating oil, deferred premium options are also available on gasoline, crude oil and natural gas.

If you would like to discuss how we can help your company hedge via deferred premium options, please don't hesitate to contact us.

3 min read

As we're often asked to help companies develop de novo fuel hedging initiatives, we thought we would highlight the primary building blocks of a fuel...

2 min read

In what has become a monthly feature of our blog, here is the November energy hedging Q&A. As always, if you would like us to provide a more in...

3 min read

As a continuation of our September and August Energy Hedging Q&A posts, here are the questions and our answers to this months Energy Hedging Q&A. As...