2 min read

CME to List Heating Oil Futures Beyond April 2013

On Friday the CME announced that it is no longer going to de-list heating oil futures and options, which was set to occur at the expiration of the...

2 min read

Mercatus Energy : Apr 1,2013

As of yesterday, NYMEX heating oil futures and options are now ultra low sulfur diesel fuel (ULSD) futures and options. The transition is a long time in the making as the CME first announced the transition back in June of 2011. At that time, the exchange planned to delist heating oil futures and options and to replace them with ULSD futures and options. However, last May, the exchange announced that rather than delisting the heating oil contracts, they would transition the existing heating oil contracts to ULSD contracts.

With the expiration of the March heating oil contract last week, heating oil futures and options are now extinct and have been replaced by ULSD futures and options. Most of the contract specifications remain the same except that ULSD futures must meet the "Delivery specifications of Colonial Pipeline's Fungible Grade 62 Ultra Low Sulfur Diesel, and being properly designated for sale in New York Harbor in accordance with U.S. Environmental Protection Agency (EPA) regulations." In practice, this means that the futures are now based on 15 PPM (sulfur content) ULSD rather than 2,000 PPM heating oil.

Why the transition? In essence, the change was necessary to reflect the changes occurring in the physical market, as a result of federal (EPA) and state regulations which require lower sulfur content in distillate fuels.

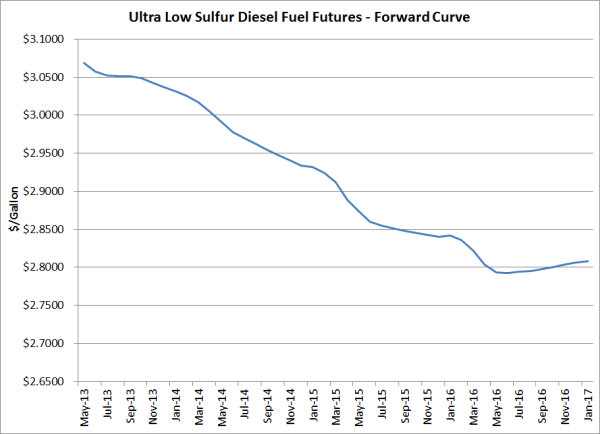

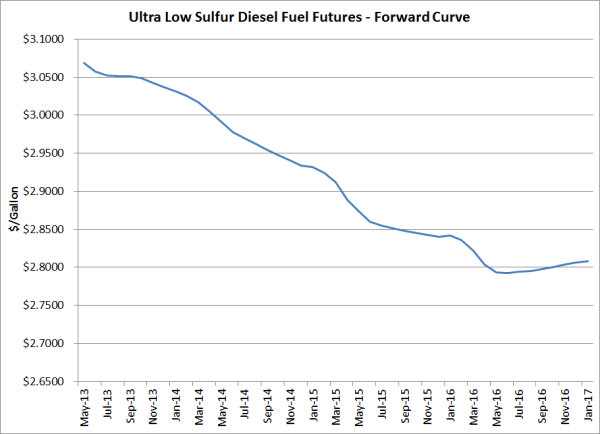

So what does the transition mean as it relates to pricing and hedging? In essence, ULSD futures are now the "Americas" benchmark for distillate fuel prices and as such, the rest of the "Americas" distillate fuels complex will now trade at a premium or discount to the ULSD futures, rather than heating oil futures.

Excluding those who consume, market, trade or refine traditional heating oil, the transition should be welcomed by most market participants as the transition to a lower sulfur benchmark reduces "quality" basis risk for those who have traditionally hedged lower sulfur products with (higher sulfur) heating oil futures, swaps and options. In addition, the market has been anticipating this change for quite some time, and has reflected the pending transition via the spreads between heating oil futures, swaps and options, ULSD futures, swaps and options and the rest of the distillate fuel complex. That being said, for those who do need to trade or hedge heating oil itself, you can still do so by trading the spread between heating oil (in the spot market as well as swaps and options on heating oil) and ULSD futures, swaps and/or options, so long as there remains a viable market for heating oil and/or financial derivatives on heating oil.

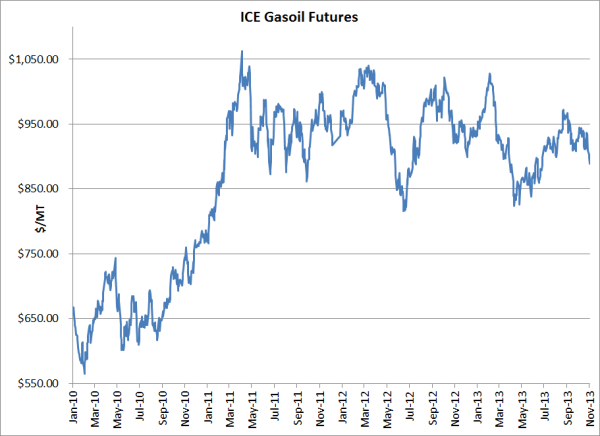

A similar transition is also underway in Europe. In August of 2011, ICE introduced numerous low sulfur distillate contracts including a low sulphur gasoil futures contract (10 PPM), which will ultimately replace ICE's traditional (1,000 PPM) gasoil futures and options. However, ICE is giving the traditional gasoil futures and options a longer life than than the CME gave to heating oil futures and options. Based on their current plans, ICE will continue to list gasoil futures and options through the January 2015 contract, at which time the low sulphur gasoil futures and options will become the default, not only for gasoil but also as the European benchmark for other European distillate fuels. In the meantime, both the traditional gasoil futures and options and the low sulphur gasoil futures are trading side by side.

As an aside, for those of you interested in the history of commodity markets, heating oil futures were the first, successful energy futures contract to be traded anywhere in the world, having made their debut on the NYMEX in 1978.

Last but not least, if you're wondering why the NYMEX contracts are spelled sulfur and the ICE contracts are spelled sulphur, it's simply due to difference in the American and British spellings of the word.

2 min read

On Friday the CME announced that it is no longer going to de-list heating oil futures and options, which was set to occur at the expiration of the...

3 min read

As many companies are beginning to plan for 2014, we have received quite a few inquiries from companies who are looking into hedging their gasoil...

2 min read

We're often asked to explain what determines the price of a natural gas (as well as crude oil, heating oil, gasoline, etc) option. In short, in...