3 min read

A Beginners Guide to Fuel Hedging - Call Options

This post is the third in a series where are addressing the fuel hedging strategies most utilized by commercial and industrial fuel consumers. The...

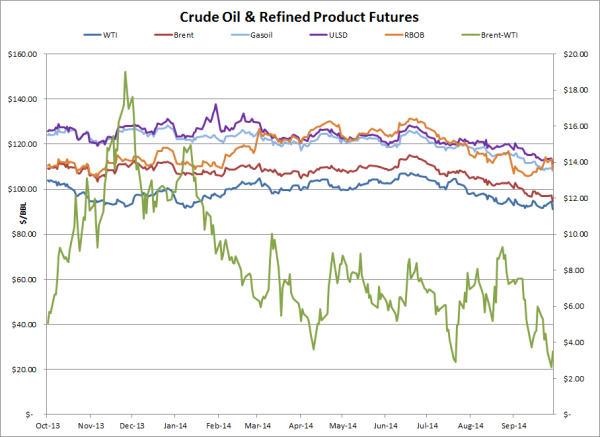

Given the roller coaster in the oil markets over the past month, during which crude oil futures have moved nearly $30/BBL from the high to the low and back, many large fuel consuming companies are searching for hedging strategies that will allow manage their exposure to volatile fuel (bunker, diesel, gasoline, jet, etc.) prices while also allowing them the potential to benefit from lower prices, should prices decline again.

In such an environment, one strategy which may deserve more consideration than it often receives is a four-way collar, which is the combination of a call option spread and a put option spread. The strategy can be attractive because it provides a hedge, albeit a limited one, against rising fuel prices, limits exposure to declining prices and requires minimal to no upfront premium cost.

While many might dismiss as the strategy due to it's "complex" nature, if it's broken down into it's individual parts, it's not nearly as complex as it might appear at first glance. To explain, a four-way collar is the combination of a call option spread and a put option spread. In the case of a fuel consuming company, this means purchasing a call option with a "lower" strike price and selling a second call option with a higher strike price than that of the the option with the lower strike price. The combination of the two call options, known as a call option spread, provides a hedge against rising fuel prices but only up to a certain price. In addition, to the call option spread, the four-way collar also includes a put option spread which is the sale of a put option with a "high" strike price and the purchase of a second put which has a strike price which is lower than the strike price of the option with the high strike price. The combination of the two put options, known as a put option spread, allows the company to offset the cost of the call option spread while limiting exposure to potentially declining fuel prices.

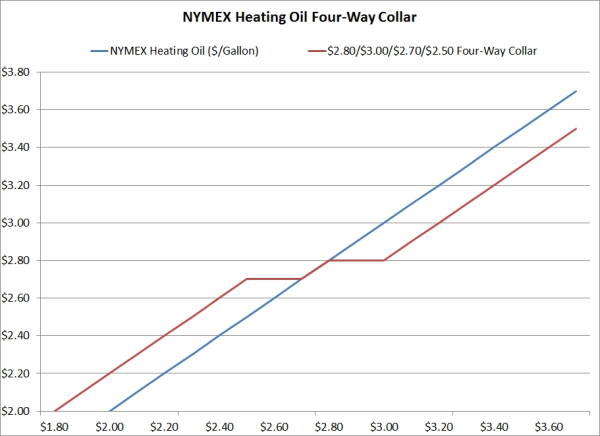

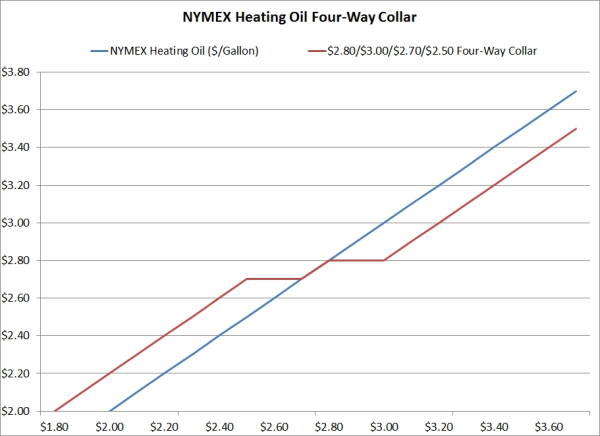

To explain in a numerical context, let's assume that a transportation company has decided to hedge their August fuel exposure with a four-way collar utilizing options based on NYMEX heating oil futures. Let's further assume that the company has determined that their most significant risk is between $2.80 and $3.00 per gallon. As a result, the company decides to purchase a $2.80 August NYMEX heating oil average price call option at the current price of $0.08/gallon. The company also sells a $3.00 August NYMEX heating oil average price call option at the current price of $0.025/gallon. As a result the company is long a $2.80 call option and short a $3.00 call option at a net cost of $.0550/gallon. The combination provides the company with protection against NYMEX heating oil prices averaging $2.80 or more up to a maximum of $3.00 or 20 cents per gallon.

To offset the $0.0550/gallon cost of the call option spread, the company also decides to sell a put option spread. As a result of their internal analysis, the company has determined to enter into an August heating oil put option spread with strike prices of $2.70/gallon and $2.50/gallon. As a result, they sell an August NYMEX heating oil average price put option with a strike price of $2.70/gallon for a premium of $.0650/gallon. In addition, to limit their downside price exposure, the company also purchases an August NYMEX heating oil average price put option with a strike price of $2.50/gallon for a premium of $.0200/gallon, which provides a net revenue of $0.0450/gallon ($0.650 - $0.0200). The combination of the two put options means that the company is at risk if NYMEX heating oil prices in August average less than $2.70 per gallon, to a maximum of $0.20/gallon, if prices average $2.50 or less.

Now, when we combine the call option spread which cost a net of $0.0550/gallon and the put option spread which resulted in a net revenue of $0.0450/gallon, the company's net cost for the four-way collar is $0.01/gallon.

As the following chart shows, the airline's net position is as follows:

While the four-way collar doesn't provide the company with an "unlimited" hedge against rising prices, it can be an attractive hedging strategy for a company which needs a "limited" hedge against rising prices. In addition, the strategy also limits exposure to declining prices, all while keeping the upfront premium cost to a bare minimum.

3 min read

This post is the third in a series where are addressing the fuel hedging strategies most utilized by commercial and industrial fuel consumers. The...

3 min read

As crude oil and refined products prices once again seem to be on an upward trend, we've received several requests for more information on the basics...

2 min read

After reaching 2014 highs in late June, crude and product prices have declined significantly over the past few months cumulating with the largest one...